A Wall Around Your Wealth: The Importance of Asset Protection

Submitted by The Blakeley Group, Inc. on January 24th, 2022

Success can come with a major downside: It can make you a potential magnet for lawsuits – including frivolous and unfounded ones – and other attacks that can wreak havoc on your financial health and stability.

Indeed, you may very well know someone in your life who has been sued. Maybe it was you!

Why You Need Asset Protection

Asset protection planning as we define it is pre-litigation planning that is designed to deter lawsuits if possible – and if not, to encourage favorable settlements.

The logic of asset protection planning is clear: You build a wall around your wealth that is as difficult as legally possible for litigators, creditors, and others to scale. Instead of trying to fight it out with you in court for months or years and risk losing, the litigant sees that the only reasonable option from a legal standpoint is to settle for pennies on the dollar—or, ideally, to leave empty-handed.

Important: Asset protection isn’t about “hiding money” from the world – quite the opposite, in fact. You want anyone who might come after your assets to clearly see what you have done to build a wall around your wealth. Why? It shows them the difficult legal path they’d have to take to get at that wealth – which, hopefully, will cause them to settle, negotiate or (ideally) throw up their hands and walk away.

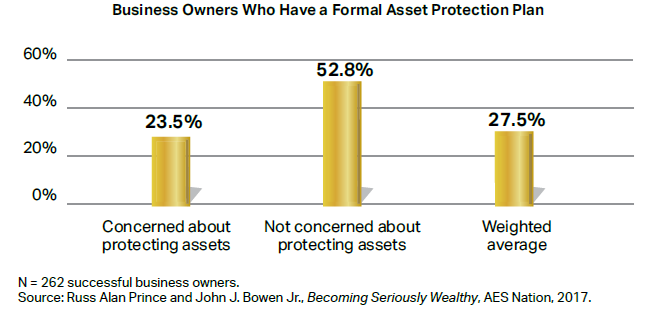

The good news is that the threats to your wealth from other people and entities may be on your radar screen. Take successful business owners, for example. More than 85 percent of successful business owners say they are concerned about becoming the object of unjust lawsuits or being victimized in divorce proceedings. The bad news: Only about a quarter (27.5 percent) of them actually have a formal asset protection plan in place (see the exhibit below). The percentage is even lower among those business owners who say they are concerned about protecting assets. Given the risks that our litigious culture presents, these numbers are likely far too low.

FOUR ASSET PROTECTION ACTIONS STEPS TO CONSIDER

If you’re among the many types of successful people out there who lack an asset protection plan – or if you’re simply serious whether your existing plan is still as strong as it needs to be – consider taking a few key actions.

1. Get protected before a claim against you is made. You can do a lot to protect your wealth before a liability arises – but thanks to a concept known as “fraudulent conveyance,” very little can be done after. As with insurance, the time to have asset protection in place is well before you need it – or even think you might need it.

2. Cover the basics. Evaluate your liability insurance and other related policies and maximize them as best you can. Probably the fastest, easiest, and cheapest move you can make is to take out a large umbrella policy to safeguard assets. Another simple but powerful strategy is to place your assets in someone else’s name, such as your spouse’s. If you’re sued, those spouse-controlled assets are often untouchable.

Pro tip: Be sure you have a great deal of trust in your spouse and your marriage before transferring ownership of assets to him or her. In a divorce, your spouse could potentially walk away from those assets – or you could be forced to fight for them at least as hard as you’d fight a creditor who went after them.

3. Consider a variety of other asset protection strategies. The asset protection strategies you may need will depend on your specific situation, of course. That said, it’s generally a good idea to consider your options, which might include:

- Ascertain appropriate utilization of risk transfer through property-casualty insurance (homeowner’s, auto, rental, personal excess liability [umbrella], health, disability, life, long-term care, directors’ liability, and professional liability insurances).

- Consider various forms of ownership that either put assets beyond the reach of a creditor or make these assets less desirable for creditors.

- Discuss gifting assets when there are no current creditor issues in order to lessen the likelihood of raising fraudulent transfer issues.

- Structure any expected gifts and/or inheritances to protect them from claims of creditors.

4. Be sure your attorney or other professionals are qualified to help you protect your assets. We see that far too many financial professionals aren’t in a position to provide guidance on and implementation of many asset protection solutions. Assess the asset protection expertise among your professionals—either the expertise they possess themselves or the resources they have access to via their professional networks of other experts.

Conclusion

You can’t necessarily stop someone from suing you. But you can take steps that will make it harder for litigants to collect money from you unjustly—and maybe even prevent those litigants from coming after you in the first place.

When you think about how hard you’ve worked to grow your assets, we think you’ll agree that it makes sense to put strategies in place to protect them too.