Stress Test Your Financial Plans

Submitted by The Blakeley Group, Inc. on March 1st, 2018

Asking “What If?”

Stress testing financial plans can be a very smart way to help make certain that the plan will deliver as promised. The fact is, financial plans that might look great on paper all too often prove to be much less impactful once they are implemented. It is not uncommon for there to be unintended consequences that can even derail one’s agenda.

At heart, stress testing is when you ask, “What if …?” about a variety of areas of a financial plan you have or are considering. When it comes to estate planning, for instance, an one might ask questions like:

- What will actually happen to my assets when I pass on?

- How will my family be affected, precisely?

- Who will be tracking the hard assets such as artwork and jewelry to make sure they go to the designated heirs—as opposed to vanishing?

- Who is going to make sure my estate plan is being executed as it’s supposed to be?

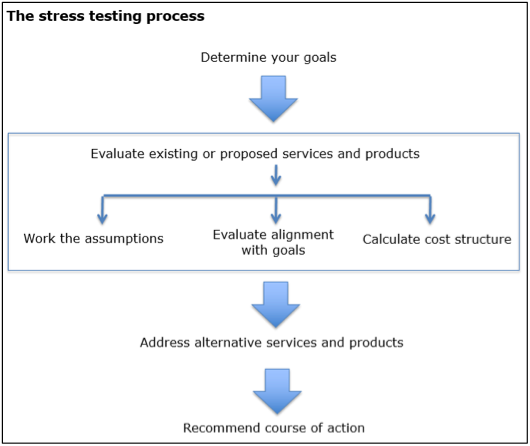

To be effective and informative, stress testing should be done in a systematic manner. While there are some variations, the basic process starts by determining your goals. Your goals, any problems to be addressed and opportunities to benefit should be the driving forces behind the financial and legal solutions you employ.

Determining Courses of Action to Take

Once you clearly understand your goals, you can evaluate the specific existing or proposed financial services or products. There are numerous ways to dissect and critically assess financial services and products:

- Work the assumptions. A plethora of assumptions underlie all services and products. In stress testing, these assumptions are modified to determine how the solutions will work when a given scenario changes.

- Evaluate alignment with goals and objectives. A solution might prove to work extremely well, but still not achieve the desired results. It’s essential to help ensure that the services and products will accomplish your goals.

- Calculate cost structure. The intent here is to identify the best and most cost-effective solution possible. When calculating cost structures, all the expenses should be specified—including long-term costs.

Based on the stress test’s evaluation of the existing or proposed solutions, you might consider alternative products or services. It can be very useful to do side-by-side comparisons between the solutions being considered or currently used and such alternatives, asking questions like:

- How do the assumptions compare?

- How do the alternatives rate when it comes to potentially achieving my goals?

- Which solutions are more cost-effective?

The end result of the process: recommendations. Based on those recommendations, there are five courses of action to consider taking:

- Stay the course. If the stress testing found the solutions being used or proposed to be on target and of high quality, the recommended action is to stay the course.

- Choose different solutions. If the stress testing finds what may be described as a system failure—the financial products being used are not going to achieve the desired results and might even blow up, for instance—the right move is to take a different course of action.

- Choose a different professional. If the solutions are appropriate but the professionals involved are really not up to the task of implementing them (or they charge too much money), it will usually make sense to switch to more capable and/or cost-effective experts.

- Modify the approach with the original professional. If the solutions can be made more powerful with only slight modifications, the best route is often to stick with the original professionals and have them make the minor changes needed.

- Continue stress testing. There are occasions when the individual or family chooses a professional to conduct a stress test and that professional is not up to the task. This comes out often clearly in the process or results of the stress testing. The only viable course of action is to select a different professional to conduct the stress testing.

Stress tests should be a part of most people’s due diligence process when vetting financial plans, financial products and financial services. Frequently, stress tests uncover flaws in financial plans as well as better ways to achieve desired outcomes. For those reasons, stress tests will likely benefit a great number of people—especially business owners and their families, who generally have so much of their future financial security riding on one asset: their business.

Certainly there is a cost to stress testing estate, asset protection and income tax plans. That cost will depend greatly on the complexity of the testing involved and your situation. However, a stress test fee can be a whole lot cheaper than the costs—financially but also emotionally and psychologically—of a plan or solution that is fundamentally flawed or in conflict with your goals.

ACKNOWLEDGMENT: This article was published by the BSW Inner Circle, a global financial concierge group working with affluent individuals and families, and is distributed with its permission. Copyright 2019 by AES Nation, LLC.