September 2016: Securities Markets were pretty "blah" in August

Submitted by The Blakeley Group, Inc. on September 12th, 2016“If I had an hour to solve a problem and my life depended on the solution, I would spend the first 55 minutes determining the proper question to ask. for once I know the proper question, I could solve the problem in less than five minutes." ~ Albert Einstein

NOTE: Areas with blue text show the most recent market updates since the August Capital Highlights email.

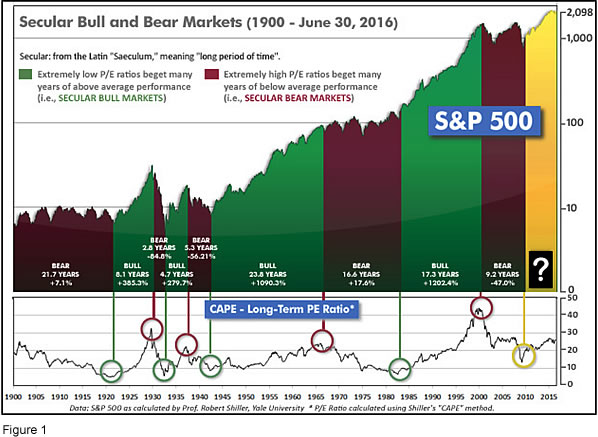

The very big picture: In the "decades" timeframe, the question of whether we are in a continuing Secular Bear Market that began in 2000 or in a new Secular Bull Market has been the subject of hot debate among economists and market watchers since 2013, when the Dow and S&P 500 exceeded their 2000 and 2007 highs. The Bear proponents point out that the long-term PE ratio (called “CAPE”, for Cyclically-Adjusted Price to Earnings ratio), which has done a historically great job of marking tops and bottoms of Secular Bulls and Secular Bears, did not get down to the single-digit range that has marked the end of Bear Markets for a hundred years, but the Bull proponents say that significantly higher new highs are de-facto evidence of a Secular Bull, regardless of the CAPE. Further confusing the question, the CAPE now has risen to levels that have marked the end of Bull Markets except for times of full-blown market manias. See Fig. 1 for the 100-year view of Secular Bulls and Bears.

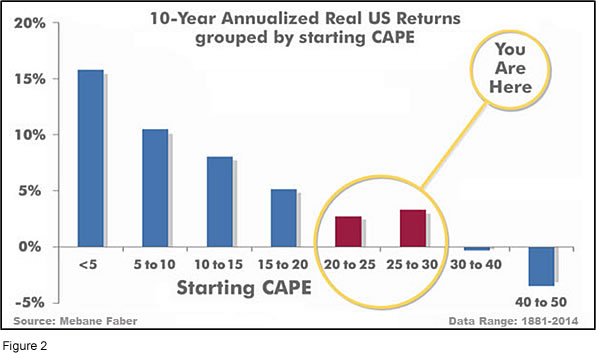

Even if we are in a new Secular Bull Market, market history says future returns are likely to be modest at best. The CAPE is at 27.07, up from the prior week’s 26.93, after having earlier reached the level also reached at the pre-crash high in October, 2007. Since 1881, the average annual return for all ten year periods that began with a CAPE around this level have been just 3%/yr (see Fig. 2).

This further means that above-average returns will be much more likely to come from the active management of portfolios than from passive buy-and-hold. Although a mania could come along and cause the CAPE to shoot upward from current levels (such as happened in the late 1920’s and the late 1990’s), in the absence of such a mania, buy-and-hold investors will likely have a long wait until the arrival of returns more typical of a rip-snorting Secular Bull Market.

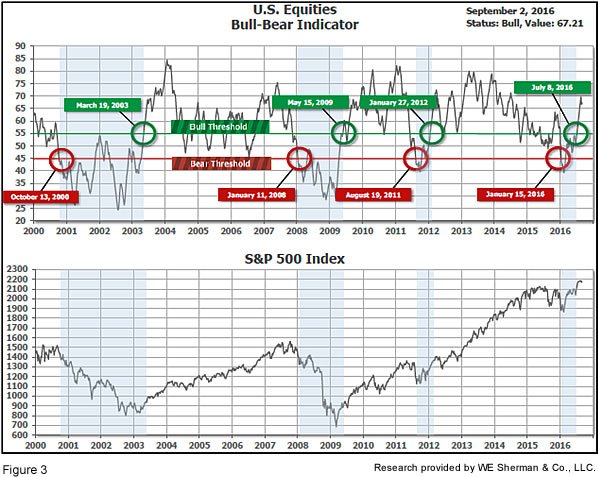

In the big picture: The “big picture” is the months-to-years timeframe – the timeframe in which Cyclical Bulls and Bears operate. The U.S. Bull-Bear Indicator (see Fig. 3) is in Cyclical Bull territory at 67.21, up from the prior week’s 66.70.

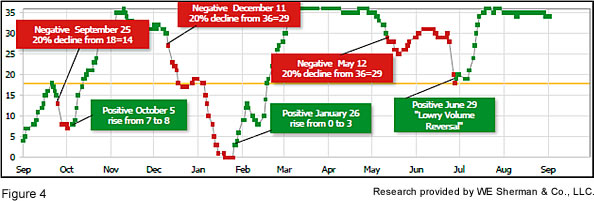

In the intermediate picture: The Intermediate (weeks to months) Indicator (see Fig. 4) turned positive on June 29th. The indicator ended the week at 34, down from the prior week's 35. Separately, the Quarterly Trend Indicator - based on domestic and international stock trend status at the start of each quarter - gave a positive indication on the first day of July for the prospects for the third quarter of 2016.

Timeframe summary: In the Secular (years to decades) timeframe (Figs. 1 & 2), whether we are in a new Secular Bull or still in the Secular Bear, the long-term valuation of the market is simply too high to sustain rip-roaring multi-year returns. The Bull-Bear Indicator (months to years) is positive (Fig. 3), indicating a potential uptrend in the longer timeframe. The Quarterly Trend Indicator (months to quarters) is positive for Q3, and the Intermediate (weeks to months) timeframe (Fig. 4) is also positive. Therefore, with all three indicators positive, the U.S. equity markets are rated as Very Positive.

In the markets:

Major U.S. indexes were positive across the board last week. The Dow Jones Industrial Average rose +96 points to close at 18,491, up +0.5%. The tech-heavy NASDAQ Composite added +31 points to 5,249, up +0.59%. The LargeCap S&P 500 index gained +0.5%, while the MidCap (+1.22%) and SmallCap (+1.11%) indexes outperformed, continuing their trend of outperformance for most of this year. Utilities and Transports were both in the green last week, with Transports rising +1.56%, while Utilities gained +0.9%.

Most international markets were also up for the week. Canada’s TSX rebounded +1.06% following 2 weeks of losses. In Europe, the United Kingdom’s FTSE rose +0.83%. On Europe’s mainland, Germany’s DAX gained +0.91%, France’s CAC 40 index rallied +2.26%, and Italy’s Milan FTSE rose +2.02%. In Asia, China’s Shanghai Stock Exchange fell slightly, down -0.1%, but Hong Kong’s Hang Seng Index added over +1.5% and Japan’s Nikkei surged a robust +3.45%.

In commodities, oil was down its second straight week, falling more than -6% to $44.44 a barrel. Precious metals were a bit positive with Gold rising +$0.80 an ounce to $1,326.70, and silver up over +3.3% to $19.37 an ounce. The CRB Index, an index that measures the overall direction of commodity sectors, declined more than -3.2%.

The month of August was pretty “blah” in the securities markets, with few markets moving more than +/- 1% from the flatline. The Dow (-0.17%) and S&P 500 (-0.12%) were both slightly down, the MidCap 400 slightly up (+0.34%) and the SmallCap Russell 2000 was the biggest U.S. mover at +1.64%. Developed International averaged +0.53% (EFA), while Emerging International averaged +0.88% (EEM). The commodities markets were considerably more volatile than the stock markets, with gold falling more than -3% for the month, while oil gained a handsome +8%.

In U.S. economic news, the number of Americans who applied for unemployment benefits rose slightly last week, but remained near post-recession lows. The Labor Department reported that 263,000 people filed for unemployment last week. A reading below 300,000 is generally considered a sign of a healthy labor market. New claims have remained in the 260,000 range over the past six weeks. The four-week average of new jobless claims, smoothed to reduce volatility, fell slightly and also came in at 263,000. New claims fell below the key 300,000 threshold in early 2015, and have remained there for 78 straight weeks, the longest stretch since 1970. Continuing jobless claims, those already receiving unemployment benefits, rose by +14,000 to 2.16 million in the week ended August 20. All figures are seasonally adjusted.

On Wednesday, payroll processor ADP reported that the private sector added 177,000 jobs last month. In addition, July’s gain of 179,000 was revised up to 194,000. Jim O’Sullivan, chief U.S. economist at High Frequency Economics said the data “continued to suggest that the trend in employment growth remains fairly strong - strong enough to keep the unemployment rate trending down.” Economists frequently use ADP’s data to get an early indication of the Labor Department’s employment report released on Friday.

However, Friday’s release of the Labor Department’s Non-Farms Payroll report did not live up to expectations, coming in at 151,000 – far below the median forecast. Nor did the unemployment rate come down, instead remaining unchanged at 4.9%. The stock market decided that bad news was good news, and rallied on the sub-par payroll report on the theory that the report was bad enough to stave off an increase in interest rates by the Fed in September, but not bad enough to signal anything disastrous for the economy.

In housing, the Case-Shiller 20-city composite real estate index recorded a +0.8% monthly gain and is up +5.1% year-over-year. Portland and Seattle continue to lead the pack with double-digit annual price increases of +12.6% and +11% respectively. The formerly white-hot real estate market of San Francisco has slowed to its lowest rate since August 2012, but still up +6.4%. House prices continue to run far ahead of inflation, as consumer prices rose just +1% annualized at the end of June.

Pending home sales in July reached their second highest reading in a decade, as a strong jobs market and record low mortgage rates support the demand. The National Association of Realtors reported that its pending home sales index rose +1.3% in July, up +1.4% versus year ago levels, and the second strongest reading since April. For the West, the index rose to the highest level in over three years. Pending home sales refer to when a contract has been signed, but the transaction has not yet closed. The National Association of Realtors forecast that existing home sales will reach almost 5.4 million units this year, an increase of +2.8% and the highest level since 2006. In addition, the group forecasts median existing home price growth of +4%, down -2.8% from last year.

Americans increased spending by +0.3% in July, rising for the fourth straight month. July’s rise was led by an uptick in spending on motor vehicles and services. The increase in July matched Wall Street expectations. Strength in household spending since the early spring has helped support the US economy and offset weaker business investment.

Consumer confidence is at the highest in nearly a year as the index rose +4.4 points to 101.1, exceeding analysts’ expectations. The Conference Board reported that Americans’ current view of the economy is the strongest since the Great Recession. The “present situation index”, which measures perceptions of current conditions, climbed almost +5 points to 123 - the highest level since late 2007. However, the “future expectations index” of what consumers expect six months down the road, was less optimistic at 86.4.

In Chicago, the Chicago-region Purchasing Managers Index (PMI) fell -4.3 points to 51.5. While PMI readings above 50 indicate expansion, the index had been hovering around 56 the last few months. The measure reinforces the theory of a divide in the economy in which consumer spending remains strong, but businesses (particularly manufacturing businesses) are holding back. The two other regional surveys from New York and Philadelphia were also soft in August.

The Institute for Supply Management’s (ISM) key manufacturing gauge fell into contraction last month, signaling continued difficulty in the factory sector. ISM’s manufacturing index fell to 49.4 from 52.6 last month, widely missing expectations for a reading of 52 (any reading below 50 indicates contraction). The last time the index was in contraction was February of this year. Of the 18 different industries in the report, 11 had weakened from the prior month. The key metrics of new orders, production, and employment were all below the 50-level.

In Canada, economic output shrank by its largest percentage since the global economic crisis as the country’s oil sector continued to face headwinds. The Canadian government reported that GDP fell by -1.6% in the second quarter, the largest setback since 2009. Wildfires in its oil producing region also weighed on production. Sal Guatieri, senior economist at BMO Capital Markets stated the GDP report “could have been worse, given the hit from the wildfire, and clearly confirms the disappointing downward trend in exports over the last few months.” It was not only energy that declined in the spring. Declines in manufacturing exports also hit the economy, but the Bank of Canada is confident that exports will turn up and lead an expansion in the second half of the year.

In the United Kingdom, good news continues to accumulate following the voters’ decision to leave the EU despite in spite of warnings from politicians and economists. Sterling rose to its highest level in four weeks against the dollar and the euro, while U.K. manufacturing output expanded in August. Furthermore, market researcher GfK reported that its household confidence index regained half the ground lost prior to the vote. It’s the latest indications that the nation’s fortunes outside of the European Union may not be nearly as dire as doomsayers had predicted.

With German Chancellor Angela Merkel’s popularity at a 5-year low, she has now (like any politician worth her salt) flipped 180 degrees and is now supporting repatriations of “economic migrants”. On Wednesday, Italian Prime Minister and the German Chancellor jointly agreed to step up efforts to send migrants with no right to asylum in Europe back to their homelands. Renzi remarked, “All of us in Europe must work for the repatriation of those who do not have rights (to stay). It is unthinkable that we can accommodate everyone.” Chancellor Merkel added, “Not everyone can stay, and Italy has the same problem, so we have a common agenda.” The German people, particularly young women, have suffered from widespread crime waves, especially sexual assaults and rapes, following the influx of over 1 million middle-eastern refugees.

The leaders of the world’s most important nations are in China this weekend for the annual G20 meeting. This is the first time China is hosting a G20 summit, and like other major international events Beijing is pulling out all the stops to make it a success. The government shut down local factories and restricted car traffic to generate cleaner air for the duration of the meeting. Economic issues are set to dominate the agenda, with the global economy continuing to be plagued by a weak recovery and stagnant job growth.

In Japan, Japanese Prime Minister Shinzo Abe will meet Russian President Vladimir Putin on the sidelines of a business conference in Vladivostok to discuss closer economic cooperation in areas such as energy and technology. Japan is hoping that deeper economic ties with Russia will strengthen strategic relations in the face of a rising China. Former lawmaker Muneo Suzuki said broadening economic ties with an eye to the eventual resolution of the territorial dispute over islands in the western Pacific made sense because Russia’s energy resources and Japan’s technological expertise and investments were a good fit.

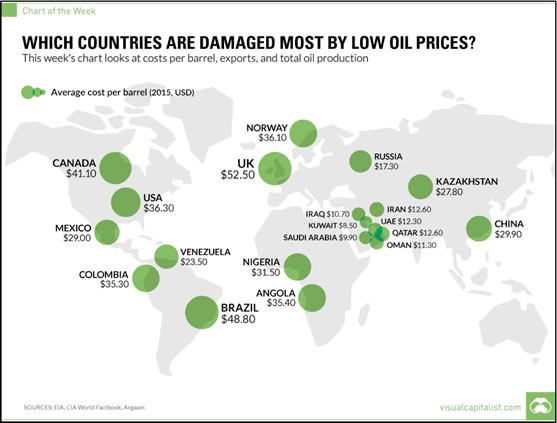

Finally, oil prices have stabilized in the $35/bbl-$50/bbl range recently, and may stay there for a while. With that price level in mind, it is interesting to take a look at the production costs per barrel of oil for the major oil producing nations around the world. Interestingly, some of the most-stressed economies around the world are still producing oil at a bit of profit, but their government budgets were built on the assumption of much, much higher revenues from their oil production. The most visible example of this genre is Venezuela – still above their cost of production, but with revenues far, far lower than anticipated. The would-be socialist paradise has become a broken country of hyperinflation, rioting in the streets, government-imposed controls on everything and extreme scarcity of necessities.

(sources: all index return data from Yahoo Finance; Reuters, Barron’s, Wall St Journal, Bloomberg.com, ft.com, guggenheimpartners.com, ritholtz.com, markit.com, financialpost.com, Eurostat, Statistics Canada, Yahoo! Finance, stocksandnews.com, marketwatch.com, wantchinatimes.com, BBC, 361capital.com, pensionpartners.com, cnbc.com, FactSet; Figs 1-5 source W E Sherman & Co, LLC)

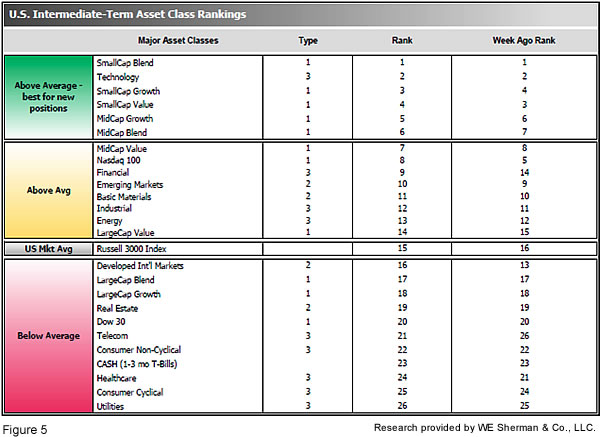

The ranking relationship (shown in Fig. 5) between the defensive SHUT sectors ("S"=Staples [a.k.a. consumer non-cyclical], "H"=Healthcare, "U"=Utilities and "T"=Telecom) and the offensive DIME sectors ("D"=Discretionary [a.k.a. Consumer Cyclical], "I"=Industrial, "M"=Materials, "E"=Energy), is one way to gauge institutional investor sentiment in the market. The average ranking of Defensive SHUT sectors rose slightly to 23.5, up from the prior week’s 23.5, while the average ranking of Offensive DIME sectors fell to 15.3 from the prior week’s 14.3. The Offensive DIME sectors remain much higher in rank than the Defensive SHUT sectors. Note: these are “ranks”, not “scores”, so smaller numbers are higher ranks and larger numbers are lower ranks.