October 2016: Stocks Finished the Week Modestly High

Submitted by The Blakeley Group, Inc. on October 6th, 2016SUGGESTED READING "Nuveen Briefing Paper on Markets and Presidential Election Cycles" Want your own copy? Email a request and we'll send it to you!

NOTE: Areas with blue text show the most recent market updates since the August Capital Highlights email.

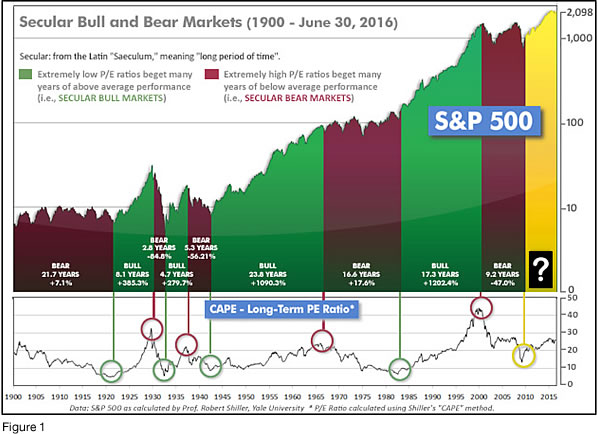

In the "decades" timeframe, the question of whether we are in a continuing Secular Bear Market that began in 2000 or in a new Secular Bull Market has been the subject of hot debate among economists and market watchers since 2013, when the Dow and S&P 500 exceeded their 2000 and 2007 highs. The Bear proponents point out that the long-term PE ratio (called “CAPE”, for Cyclically-Adjusted Price to Earnings ratio), which has done a historically great job of marking tops and bottoms of Secular Bulls and Secular Bears, did not get down to the single-digit range that has marked the end of Bear Markets for a hundred years, but the Bull proponents say that significantly higher new highs are de-facto evidence of a Secular Bull, regardless of the CAPE. Further confusing the question, the CAPE now has risen to levels that have marked the end of Bull Markets except for times of full-blown market manias. See Fig. 1 for the 100-year view of Secular Bulls and Bears.

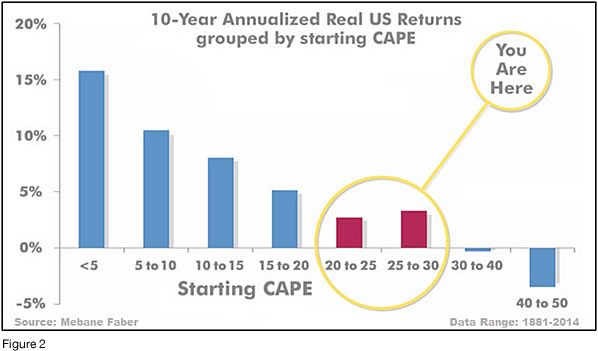

Even if we are in a new Secular Bull Market, market history says future returns are likely to be modest at best. The CAPE is at 26.90, nearly unchanged from the prior week’s 26.86, after having earlier reached the level also reached at the pre-crash high in October, 2007. Since 1881, the average annual return for all ten year periods that began with a CAPE around this level have been just 3%/yr (see Fig. 2).

This further means that above-average returns will be much more likely to come from the active management of portfolios than from passive buy-and-hold. Although a mania could come along and cause the CAPE to shoot upward from current levels (such as happened in the late 1920’s and the late 1990’s), in the absence of such a mania, buy-and-hold investors will likely have a long wait until the arrival of returns more typical of a rip-snorting Secular Bull Market.

In the big picture:

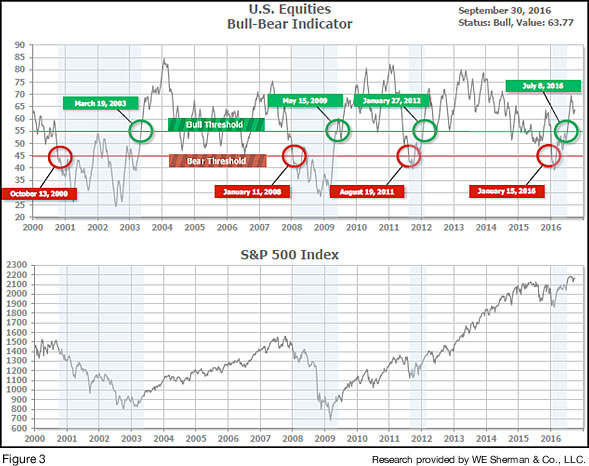

The “big picture” is the months-to-years timeframe – the timeframe in which Cyclical Bulls and Bears operate. The U.S. Bull-Bear Indicator (see Fig. 3) is in Cyclical Bull territory at 63.77, up from the prior week’s 62.85.

In the intermediate picture:

The Intermediate (weeks to months) Indicator (see Fig. 4) turned positive on June 29th. The indicator ended the week at 31, unchanged from the prior week. Separately, the Quarterly Trend Indicator - based on domestic and international stock trend status at the start of each quarter - gave a positive entering October, indicating positive prospects for equities in the fourth quarter of 2016.

Timeframe summary:

In the Secular (years to decades) timeframe (Figs. 1 & 2), whether we are in a new Secular Bull or still in the Secular Bear, the long-term valuation of the market is simply too high to sustain rip-roaring multi-year returns. The Bull-Bear Indicator (months to years) is positive (Fig. 3), indicating a potential uptrend in the longer timeframe. The Quarterly Trend Indicator (months to quarters) is positive for Q4, and the Intermediate (weeks to months) timeframe (Fig. 4) is also positive. Therefore, with all three indicators positive, the U.S. equity markets are rated as Very Positive.

In the markets:

Stocks finished the week modestly higher for the most part, but the tepid numbers masked the high day-to-day volatility. The Dow Jones Industrial Average experienced triple digit moves every day of the week, ending with a +164 point rally on Friday to close at 18,308, but ended up just +0.26% for the week. The NASDAQ Composite was likewise modestly higher for the week, adding just +0.12%. The LargeCap S&P 500 index gained +0.17%, the S&P 400 MidCap index rose only +0.09% and the SmallCap Russell 2000 index fell -0.24%.

In international markets, Canada’s TSX rose +0.19% but elsewhere markets were mostly in the red. The United Kingdom’s FTSE was off slightly, down -0.15%. On the mainland, France’s CAC 40 was off -0.9%, Germany’s DAX fell -1.09%, and Italy’s Milan FTSE was down -0.32%. In Asia, China’s Shanghai Composite fell -0.96%, along with Japan’s Nikkei which ended down -1.8%, and Hong Kong’s Hang Seng index lost -1.64%. Broadly speaking, developed countries were down -0.22% while emerging markets were down -0.48%, as measured by the ETFs EFA and EEM.

Commodities were mixed for the week. Precious metals lost some of their shine, as gold ended the week down ‑1.8% to $1,317.10 an ounce, and silver fell -3% to $19.21 an ounce. Oil had a strong week, with the price of a barrel of West Texas Intermediate crude oil surging +8.45% to $48.24. The industrial metal copper was also positive, up +0.43%.

The month of September saw modest moves among U.S. stock indexes. The Dow Industrials, the LargeCap S&P 500, and the MidCap S&P 400 were all down less than -1% for the month (-0.50%, -0,12%, and -0.80% respectively) , while the SmallCap Russell 2000 and the NASDAQ Composite were both positive for the month (+0.95% and +1.89%, respectively). International markets outstripped U.S. markets for September. Developed International, represented by the ETF EFA, gained +1.34% and the best performance came from Emerging Markets, represented by the ETF EEM, rising +2.52%.

The third quarter saw gains in stock markets around the world. The Dow Jones Industrial Average gained +2.1%. That gain was eclipsed by a +9.7% surge in the NASDAQ composite. The LargeCap S&P 500 index added +3.3%, while the S&P 400 MidCap index rose +3.7%, and the SmallCap Russell 2000 vaulted +8.7%. Canada’s TSX rose +4.7%. Developed International, represented by the ETF EFA, added +5.93%, and Emerging Markets, represented by the ETF EEM, added a handsome +8.99% for the quarter.

In U.S. economic news, applications for unemployment benefits rose slightly to 254,000 last week, according to the Labor Department. The number remains below the 300,000 threshold that economists use to indicate a healthy labor market. Initial claims first fell below 300,000 last year and have remained there for 82 straight weeks. In addition, new claims have numbered less than 270,000 for 3 months, an event not seen since 1973. The economy has added an average of 182,000 new jobs per month this year and the unemployment rate is at 4.9% - an 8-year low.

Sales of new homes fell in August, but the reading was the second-highest since the end of the Great Recession. According to the Commerce Department, sales of newly constructed homes ran at a seasonally-adjusted 609,000 annual rate exceeding economist forecasts of 600,000. At the current sales pace, there is a 4.6 month supply of homes available. The median sales price last month fell to $284,000, the lowest since September 2014 and -5.4% below year-ago levels. The lower median sales price is welcome news to a market short on affordable housing, and indicates more sales in the lower half of home prices. In August, Richard Moody, chief economist at Regions Financial noted that homes priced in the upper half ($300,000 or above) made up 44% of all sales—the lowest since February of 2014.

Pending home sales, which tracks real estate transactions in which a contract has been signed but the deal has not closed, fell -2.4% to 108.5 last month. It was the lowest reading in 7 months. The National Association of Realtors stated that without more inventory, the housing recovery ‘could stall’. Economists had forecasted a gain of +0.5%. Of all the regions, only the Northeast saw an increase, up +1.3%. It was also the only region in which the index reading was higher than its level this time last year.

Home prices in the Pacific Northwest saw the biggest gains according to the latest numbers from the S&P CoreLogic Case-Shiller home price index. Overall, house prices were up +0.6% in July and +5.0% from this time last year. Portland and Seattle led the 20-city index with the greatest annual price increases of +12.4% and +11.2%, respectively. One notable change was the formerly white-hot market of San Francisco, which was essentially flat for the month. San Francisco has had double-digit annual price increases for quite some time, but that appears to be moderating. Overall, the Case-Shiller National Index is near its high previously set in 2006.

In U.S. manufacturing, orders for durable goods (items expected to last at least 3 years) stagnated following a strong July reading. Orders fell -22% for large commercial aircraft, a volatile category that frequently exhibits large swings in orders received. Stripping out transportation, orders were down just -0.4%, according to the Commerce Department. Demand for heavy machinery, electrical equipment, and computers all declined. Shipments of core capital goods, a category used in the calculation of GDP, fell -0.4%, which was its fourth straight decline. However, on a more positive note, orders for core capital goods rose +0.6%, its third straight increase. Orders for core capital goods are frequently considered a proxy for business investment.

In Chicago, the Chicago regional Purchasing Managers Index (PMI) rose +2.7 points to 54.2 in September. The gains were led by an improvement in production, which was up +7.3 points to the highest level since the beginning of the year. PMI readings above 50 indicate improving conditions.

Consumer sentiment improved in September according to the University of Michigan’s index which showed a gain in September to 91.2, up +1.4 points. Households with incomes over $75,000 were responsible for the gain. On an annual basis, however, the trend has been basically flat as September’s number was the same as September 2015’s number.

Americans were the most optimistic about the economy since the summer of 2007 according to the Conference Board’s Consumer Confidence index. The index climbed to 104.1 this month, up +2.3 from August. Consumers were more upbeat about the strong labor market, in which the unemployment rate has held below 5% and millions of people have been added to payrolls. In addition, a shortage of skilled labor has forced companies to raise wages. Lynn Franco, director of economic indicators at the Conference Board stated, “Consumers’ assessment of present-day conditions improved, primarily the result of a more positive view of the labor market.” The present situation index, which measures current conditions, climbed to 128.5, up +3.2 points. That measure is also at its highest level since August of 2007. Analysts note that the rise in confidence could benefit the incumbent Democratic Party in the upcoming presidential election.

However, American’s rising confidence in the economy wasn’t reflected in consumer spending, which was barely changed in August according to the Commerce Department. A decline in sales of cars and trucks failed to offset an increase in services such as education and health care. The flat reading for August was the weakest since March and missed estimates of a +0.2% gain. Factoring in inflation, spending actually fell slightly in August. Incomes rose only +0.2% in August, the smallest increase in 7 months. The slower spending and modest growth in income did appear to have a positive impact on personal savings, however, which rose +0.1% to 5.7% for the typical consumer, a 3-month high.

Inflation as measured by the Personal Consumption Expenditure Index (PCE) rose +0.1% in August, according to the Commerce Department. The so-called “core” rate of inflation that strips out the volatile categories of food and energy increased +0.2%. The PCE index, the preferred Federal Reserve inflation barometer, rose 1% over the last 12 months as of the end of August. It rose +0.2% from July. Annualized core inflation was up +1.7%. At this point, inflation remains below the 2% target desired by the Federal Reserve—one reason that the Federal Reserve has been reluctant to raise interest rates.

Second quarter GDP rose +0.3% from earlier estimates to 1.4% as business investment in the second quarter was actually much better than had been previously reported. The improvement in GDP reflected stronger investment by companies than earlier government estimates showed. Investment excluding housing actually rose +1% instead of falling -0.9%, as previously reported. Excluding mining and drilling, investment was up a solid +10% in the second quarter. The all-important American consumer continues to be the growth engine of the economy. Consumer spending accounts for about 2/3’s of the economy and consumer spending increased +4.3% in the second quarter. Loretta Mester, president of the Cleveland Federal Reserve, stated “Based on incoming data, growth is poised to rebound in the second half of the year.”

The Canadian economy grew +0.5% in July, according to Statistics Canada, predominantly due to a rebound in oil and gas production. Activity in the oil and gas extraction and mining sectors was up +3.9% from June. The goods-producing sector of the economy rose +1% while the services side increased +0.3%. Economists had expected a gain of only +0.3%. Toronto Dominion (TD) bank economist Brian DePratto said "Today's report points to a healthy, if somewhat artificially boosted, economic momentum for the third quarter. We are currently tracking economic growth of roughly 3.0 per cent for the third quarter.”

According to the UK Office for National Statistics (ONS), Britain’s economy was stronger than previously thought leading up to the EU referendum. The ONS figures suggested that the economy had a decent start in the third quarter, with the services sector (which accounts for almost 80% of the UK economy) growing by +0.4% in July. According to the ONS there was no sign that Britain leaving the EU triggered any immediate shock to the economy. Economists largely agree that Britain will almost definitely avoid a recession this year, but that in 2017 the economy could slow down due to uncertainty.

In France, the Labor Ministry said the number of jobless people registered as out of work rose 50,200 to 3.5 million, an increase of +1.4% from July. The increase was the steepest since late 2013 and brought the total closer to the record 3.59 million set in February. Labor Minister Myriam El Khomri said the tourism sector suffered after a terrorist attack in the city of Nice that killed 86 people. French President Francois Hollande has given hints that he intends to run for re-election, but only if unemployment could be brought down. The latest increase is another blow to Hollande’s bid for re-election amid a term marred by low growth and high unemployment.

In Germany, all eyes have been on Deutsche Bank as questions have arisen regarding its liquidity position following multi-billion dollar judgements against the company in the United States and its derivatives exposure. Deutsche Bank is the region’s biggest investment bank. In addition, German car-manufacturer Volkswagen also faces multi-billion dollar fines in the United States related to an emissions issue. Together the two companies employ more than 700,000 and further weakening of these two major companies would impact growth in Germany and around the world. Horst Loechel, economics professor at the Frankfurt School of Finance and Management stated, “With two heavy-weights shaking, that could lead to a setback in consumption and investment.” Deutsche Bank (symbol DB) shares hit a record low Thursday.

The World Trade Organization cut its forecast for global trade growth this year by more than a third, prompting China’s Commerce Ministry to declare that China’s economic fundamentals are sound and it remains a contributor to global growth. China’s growth target for this year is 6.5-7%. Last quarter, the world’s second largest economy grew 6.7% from a year earlier, according to official data. Imports and exports both showed improvement last month. Imports were boosted by demand for coal and other commodities, and exports fell less than expected, down -2.8%, as demand in the United States, Europe and Japan was firmer than predicted.

Japanese Prime Minister Shinzo Abe pledged Monday to accelerate his policies to support Japan’s economic recovery and to speed up approval of the Trans-Pacific Partnership trade pact. In his policy statement, Abe outlined stimulus measures to help the recovery and spur more consumer and corporate spending. His proposal tacked on an additional 28 trillion yen ($2.8 billion) to the group of economic stimulatory measures that have become commonly known as ‘Abenomics’.

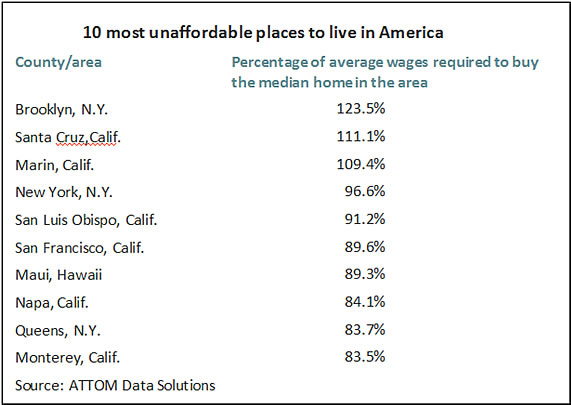

Finally, when asked to name the most unaffordable place to live in the United States, you would be forgiven for declaring locations like Maui, San Francisco, or the Napa Valley. But the answer is…..Brooklyn, NY. A person earning the average salary in Brooklyn cannot come close to affording to buy the average home there, according to a study by real estate data company ATTOM Data Solutions. The study looked at home sales price data in 414 of the most populous counties in the U.S. and corresponding wage data from the Bureau of Labor Statistics.

Home sale prices were compared to average wages in each locale to create a scale of “Home Prices as % of Average Local Wages”. For comparison, the U.S. Department of Housing and Urban Development recommends a maximum of 30% of household income should be spent on housing or one runs the risk of having “difficulty affording necessities such as food, clothing, transportation, and medical care.” The chart below lists the 10 most unaffordable places to live in America, and by that Department of Housing and Urban Development yardstick, homebuyers there must be going without food, clothing, transportation and medical care!

(sources: all index return data from Yahoo Finance; Reuters, Barron’s, Wall St Journal, Bloomberg.com, ft.com, guggenheimpartners.com, ritholtz.com, markit.com, financialpost.com, Eurostat, Statistics Canada, Yahoo! Finance, stocksandnews.com, marketwatch.com, wantchinatimes.com, BBC, 361capital.com, pensionpartners.com, cnbc.com, FactSet; Figs 1-5 source W E Sherman & Co, LLC)

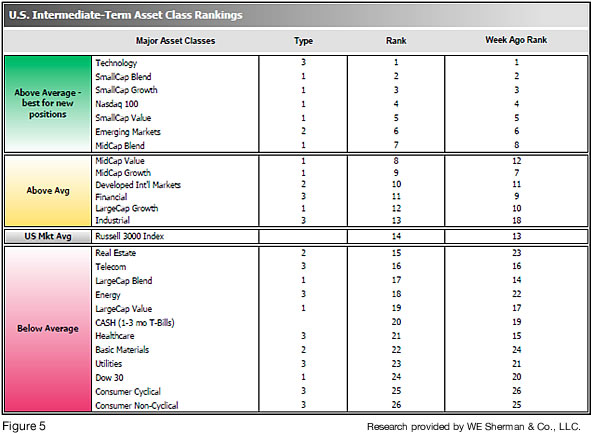

F5 The ranking relationship (shown in Fig. 5) between the defensive SHUT sectors ("S"=Staples [a.k.a. consumer non-cyclical], "H"=Healthcare, "U"=Utilities and "T"=Telecom) and the offensive DIME sectors ("D"=Discretionary [a.k.a. Consumer Cyclical], "I"=Industrial, "M"=Materials, "E"=Energy), is one way to gauge institutional investor sentiment in the market. The average ranking of Defensive SHUT sectors fell to 21.5, to19.3, while the average ranking of Offensive DIME sectors rose to 22.5 from the prior week’s 22.5. The Offensive DIME sectors recaptured the advantage over the Defensive SHUT sectors. Note: these are “ranks”, not “scores”, so smaller numbers are higher ranks and larger numbers are lower ranks.