OCT 2018: Remember All Those Predictions?

Submitted by The Blakeley Group, Inc. on October 6th, 2018“It’s tough to make predictions, especially about the future"

~ Yogi Berra

NOTE: Areas with blue text show the most recent market updates since the December Capital Highlights email.

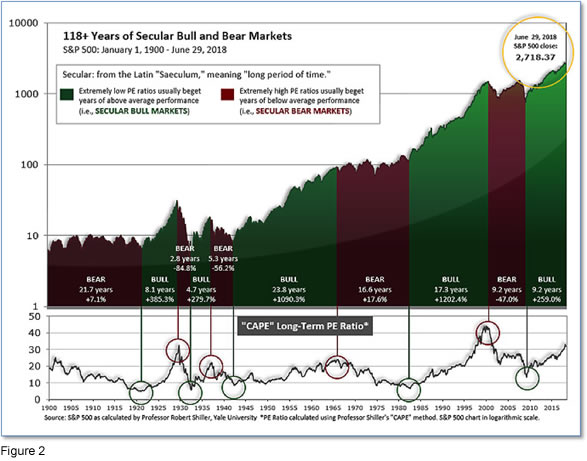

The very big picture: In the "decades" timeframe, the current Secular Bull Market could turn out to be among the shorter Secular Bull markets on record. This is because of the long-term valuation of the market which, after only eight years, has reached the upper end of its normal range.

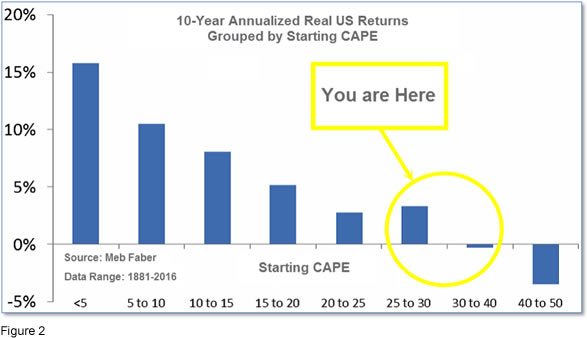

The long-term valuation of the market is commonly measured by the Cyclically Adjusted Price to Earnings ratio, or “CAPE”, which smooths out shorter-term earnings swings in order to get a longer-term assessment of market valuation. A CAPE level of 30 is considered to be the upper end of the normal range, and the level at which further PE-ratio expansion comes to a halt (meaning that increases in market prices only occur in a general response to earnings increases, instead of rising “just because”).

Of course, a “mania” could come along and drive prices higher – much higher, even – and for some years to come. Manias occur when valuation no longer seems to matter, and caution is thrown completely to the wind as buyers rush in to buy first and ask questions later. Two manias in the last century – the 1920’s “Roaring Twenties” and the 1990’s “Tech Bubble” – show that the sky is the limit when common sense is overcome by a blind desire to buy. But, of course, the piper must be paid and the following decade or two are spent in Secular Bear Markets, giving most or all of the mania gains back.

See Fig. 1 for the 100-year view of Secular Bulls and Bears. The CAPE is now at 33.36, down from the prior week’s 33.54, and exceeds the level reached at the pre-crash high in October, 2007. This value is in the lower end of the “mania” range. Since 1881, the average annual return for all ten year periods that began with a CAPE around this level have been in the 0% - 3%/yr. range. (see Fig. 2).

In the big picture:

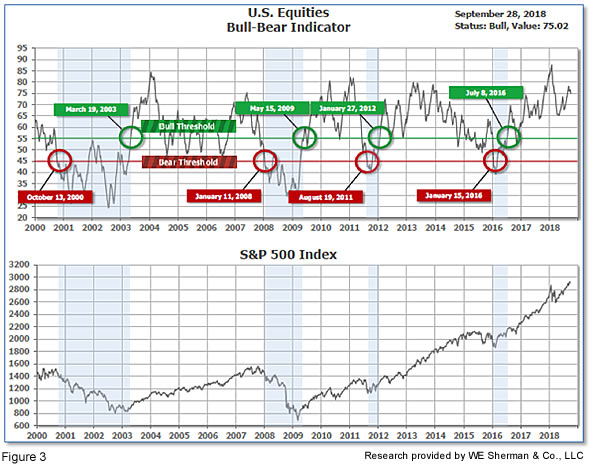

The “big picture” is the months-to-years timeframe – the timeframe in which Cyclical Bulls and Bears operate. The U.S. Bull-Bear Indicator (see Fig. 3) is in Cyclical Bull territory at 75.02, down from the prior week’s 76.68.

In the intermediate and Shorter-term picture:

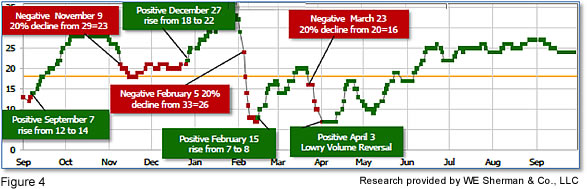

The Shorter-term (weeks to months) Indicator (see Fig. 4) turned positive on April 3rd. The indicator ended the week at 24, unchanged from the prior week. Separately, the Intermediate-term Quarterly Trend Indicator - based on domestic and international stock trend status at the start of each quarter – was positive entering October, indicating poor prospects for equities in the fourth quarter of 2018.

Timeframe summary:

In the Secular (years to decades) timeframe (Figs. 1 & 2), the long-term valuation of the market is simply too high to sustain rip-roaring multi-year returns – but the market has entered the low end of the “mania” range, and all bets are off in a mania. The only thing certain in a mania is that it will end badly…someday. The Bull-Bear Indicator (months to years) is positive (Fig. 3), indicating a potential uptrend in the longer timeframe. In the intermediate timeframe, the Quarterly Trend Indicator (months to quarters) is positive for Q4, and the shorter (weeks to months) timeframe (Fig. 4) is positive. Therefore, with all three indicators positive, the U.S. equity markets are rated as Positive.

In the markets:

U.S. Markets: The major U.S. indexes ended mixed for the second week. The technology-heavy Nasdaq Composite recorded a solid gain, while most of the other benchmarks declined. The Dow Jones Industrial Average fell 285 points, or -1.1%, closing at 26,458. The NASDAQ held above the 8,000-level rising 59.4 points to close at 8,046, a gain of 0.74%. By market cap, the large cap S&P 500 index declined -0.54%, while the mid cap S&P 400 and small cap Russell 2000 fell -1.1% and -0.9%, respectively.

International Markets: Canada’s TSX finished down -0.9%, while the United Kingdom’s FTSE added 0.3%. On Europe’s mainland, France’s CAC 40 was essentially flat, down just -0.01%, while Germany’s DAX fell -1.5%. China’s Shanghai Composite and Japan’s Nikkei added to last week’s gains by rising an additional 0.9% and 1.1%. As grouped by Morgan Stanley Capital International, developed international markets finished down -0.9%, and emerging markets were off -0.7%.

Commodities: Precious metals were mixed for the week as Gold was off -0.4% at $1196.20 an ounce, but Silver gained 2.5% to $14.71 an ounce. In energy, West Texas Intermediate crude oil rose 3.5% or $2.47 to end the week at $73.25 per barrel. Copper, seen as a barometer of global economic health due to its variety of industrial uses, retreated -1.8% last week.

September Summary: September was mixed in the U.S., with large caps doing well and the rest of the market slipping. The Dow Jones Industrial Average (the largest of the large) rose 1.9%, and the S&P 500 added 0.4%. But the Nasdaq Composite retreated -0.8%, the S&P 400 midcap index fell -1.2% and the Russell 2000 small cap index dropped a large -2.5%. Markets were similarly mixed internationally. Canada’s TSX was off -1.2%, the UK’s FTSE gained 1.1%, France’s CAC 40 rose 1.6% and Germany’s DAX finished down -1.0%. In Asia, China’s Shanghai Composite rebounded 3.5% and Japan’s Nikkei surged 5.5%. As a group, developed markets finished the month up 1.0% while emerging markets fell -0.6%. Gold gave up -1.5% in September and Silver was off -0.4%. West Texas Intermediate crude surged 6.9% and copper added 2.5%.

Q3 Summary: Q3 was positive for all U.S. market indices, with large caps and techs outperforming mid and small caps by a wide margin. The Dow Jones Industrial Average added 9.0%, the S&P 500 gained 7.2% and the Nasdaq Composite rose 7.1%. Mid caps and small caps did less than half as well, with the mid cap S&P 400 adding 3.5%, and the small cap Russell 2000 gaining 3.3%. Q3 was not as uniformly favorable in the rest of the world’s stock markets. Canada’s TSX lost -1.3% and the UK’s FTSE retreated -1.7%. France’s CAC 40 added 3.2% but Germany’s DAX was off -0.5%. In Asia, China’s Shanghai Composite fell -1.0% while Japan’s Nikkei - the big winner in major international markets in Q3 - surged 8.1%. As a group, developed markets rose 1.5% in the third quarter, while emerging markets were off -1.0%. Commodities were mostly down in the third quarter. Gold retreated -4.4%, silver plunged -8.3%, crude oil remained essentially flat, down -0.3% and copper ended the quarter down -5.6%.

U.S. Economic News: The number of Americans who applied for new unemployment benefits last week rose to their highest level since early August, but still below expectations. The Labor Department reported initial jobless claims rose 12,000 to 214,000 in the week ended September 22. Economists had expected a rise to 216,000. Officials stated it was too early to say whether the rise in claims was due to Hurricane Florence, but there were large jumps in claims in North and South Carolina so that cause seems likely. The monthly average of new claims rose by 250 to 206,250. Continuing claims, which counts the number of people already receiving unemployment benefits, rose by 16,000 to 1.66 million.

Prices for existing homes rose just 0.2% in July, according to the latest S&P CoreLogic Case-Shiller National Home Price Index reading. The increase was its smallest gain since May 2014. Year-over-year, prices are up 6.0% from the same time last year, down from a high of 6.5% a few months ago. The moderation was relatively broad-based across several geographic areas. The West continued to fare the best. In July, Las Vegas was the number one metro area with a 13.7% annual increase, followed by Seattle at 12.1% and San Francisco at 10.8%. David Blitzer, who chairs the committee that compiles the price indexes said, “Rising home prices are beginning to catch up with housing.”

Sales of new homes rebounded 3.5% in August and were up 12.7% compared to the same time last year. The Commerce Department reported new-home sales ran at a seasonally-adjusted annual rate of 629,000 in August, exceeding forecasts of a 625,000 pace. The median selling price for a new home in August was $320,200, up 1.9% from year-ago prices. At the current pace of sales, it would take 6.1 months to exhaust available supplies. Six months of supply is generally considered a “balanced” housing market, and this is the first time that the inventory has reached this “balanced” level since 2014, and only the second time since 2011.

A measure of the U.S. economy from the Chicago Federal Reserve held steady in August, indicating a pickup in economic activity over the course of the third quarter. The Chicago Fed National Activity Index remained unchanged at 0.18, while its three-month average rose 0.22 point to 0.24. The current reading is consistent with an environment of above-average economic growth. The Chicago Fed index is a weighted average of 85 economic indicators designed so that zero represents at-trend growth and a three-month average below negative 0.70 suggests a recession has begun. In August, 48 of the 85 individual indicators made positive contributions, while 37 weighed. Notably, production-related indicators, such as factories, contributed a positive 0.16 in August.

Orders for goods intended to last longer than three years, so-called “durable goods”, rose 4.5% in August predominantly due to orders for commercial aircraft and a surge in defense spending. It was the biggest increase since February, but the details of the report weren’t as robust. Stripping out the planes and cars categories, orders were up just 0.1% - weaker than many economists had expected. Orders for core capital goods, a key measure of business demand, fell 0.5% in August. On a year-over-year basis, though, both durable goods orders and capital goods orders were strong, up 8.3% and 8.2% respectively, a sign of sustained momentum in factory activity.

Confidence among the nation’s consumers surged to an 18-year high in September, very near an all-time peak. The Conference Board reported its Consumer Confidence Index rose 3.7 points to 138.4, its fourth increase in the past five months and its highest level since near the end of the internet boom in 2000. Economists had incorrectly forecast a 1.4 point decline to 132. The reading bodes well for consumer spending growth and is consistent with above-average economic growth. In the details, consumer expectations jumped 6.0 points to 115.3 as the outlook for job availability hit its highest level since January of 1984. The present conditions index also ticked up 0.3 point to 173.1 as assessments of both current conditions and employment conditions also rose. Overall, confidence increased across all demographic groups, but was mixed by income.

In a move that was widely anticipated, the Federal Reserve lifted its key U.S. interest rate by a quarter point, sticking to its gradualist strategy of raising the cost of borrowing. In a unanimous vote, the Fed raised its short-term fed funds rate to a range of 2.00%-2.25%, the highest level in a decade. Somewhat surprisingly, the Fed dropped longstanding language in its statement saying that its monetary policy “remains accommodative.” The Federal Open Market Committee currently projects one more rate hike before the end of the year, and three more in 2019.

International Economic News: Statistics Canada reported that Canada’s economy grew a stronger-than-expected 0.2% in July, raising market expectations that the Bank of Canada would increase interest rates next month. Economists had expected an increase of just 0.1%. The national statistics agency reported Gross Domestic Product (GDP) rose 0.2% month-over-month and 2.4% year-over-year. The manufacturing sector was up 1.2% in July, its fastest growth since November 2017. Stephen Brown, an economist at Capital Economics stated, “The economy is doing well and is on track for growth of around 2% annualized. That would be stronger than the 1.5% expected by the Bank of Canada and is therefore another reason to expect the Bank to raise interest rates next month." Analysts note, however, that the central bank will also be watching closely how trade negotiations with the U.S. play out.

Across the Atlantic, the Office for National Statistics (ONS) in the United Kingdom downgraded the annual rate of growth for the UK’s economy due to a bigger-than-expected hit from last winter’s snow storm dubbed “the Beast from the East”. The result is that the ONS reports that the annual growth of the economy had fallen to 1.2% from 1.3% - the weakest since 2011. Economists had been expecting no change. While the second reading for GDP confirmed initial estimates of 0.4% for the second quarter, the Office for National Statistics (ONS) said growth was weaker in the first three months of the year.

On Europe’s mainland, France’s Finance Minister Bruno LeMaire said it would be “suicidal” to grant the United Kingdom a Brexit deal that seems better than remaining in the European Union. LeMaire referred to the so-called “Chequers plan”, proposed by British Prime Minister Theresa May. LeMaire stated the plan would have given Britain advantages that are “unacceptable”. LeMaire told reporters in Paris, “I’m sorry to say it so callously: there is something more important for us than the future of the U.K., and that’s the future of the EU. Any decision that would give European citizens the feeling you can exit the EU and keep all the advantages would be suicidal and we won’t make that decision.”

Five of Germany’s top economic institutes prepared a report warning of recession if global trade disputes worsen. The researchers wrote that thus far, Germany and Europe have been largely spared from the trade conflict emanating from the United States, as the economic impact of new tariffs are relatively low. However, the researchers made clear that the situation is precarious. “Any escalation of the trade conflict, leading to considerable tariff increases by the US on a broad front, is likely to trigger a severe recession in Germany and Europe,” the report said. The institutes gave no time frame for that prospect. Underlining the risks to Germany’s export-led economy, the institutes cut their German growth forecast for this year to 1.7% from 2.2%.

Though the United States Federal Reserve raised the U.S. interest rate this week, China’s central bank left its interest rates unchanged. This move, or lack thereof, underscores Beijing’s desire to keep borrowing costs low to help stabilize economic growth in the midst of its ongoing trade war with the United States. The Fed’s interest rate hike and the lack of movement from China means the gap between U.S. and Chinese interest rates has narrowed. Normally the effect might be a sharp rise in capital outflows as Chinese investors seek better returns abroad. However, China maintains strict control over its capital flows, giving it more leeway to keep its interest rates low without risking capital flight. Chen Ji, a senior researcher with the Bank of Communications in Shanghai, said Beijing’s priority is dealing with a slowing economy amid the escalating trade spat with the US, which means keeping interest rates low.

Japan’s economy minister stated this week that U.S. President Trump is looking for a quick deal in limited scope trade negotiations. Former Japanese economy minister Akira Amari said U.S. farmers will be at a disadvantage when the new 11-nation Trans-Pacific Partnership (TPP) and the Japan-EU Economic Partnership Agreement take effect next year. And Trump, who pulled the U.S. out of the TPP, likely wants to make sure they aren’t “left out in the cold”, said Amari. Amari was the top Japanese negotiator in the original TPP trade agreement and a key driver of Prime Minister Shinzo Abe’s economic policies as minister until early 2016. Abe and Trump agreed to open limited bilateral trade talks. Japan had resisted U.S. efforts at a more comprehensive bilateral trade deal, saying it preferred that the U.S. return to the TPP.

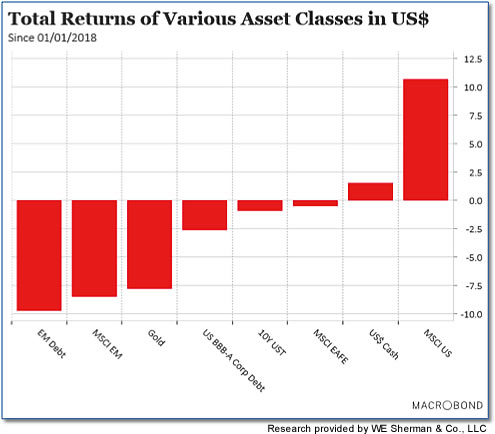

Finally: Remember all those predictions that Emerging Markets (both stocks and bonds) would be the breakout winners of 2018? Ooops. U.S. investors are to be forgiven for thinking that 2018 so far is yet another good year in the current long-running bull market, because it is – for them. But as the chart below from research firm Macrobond shows, the U.S. is pretty much alone. Even U.S. bond investors are modestly underwater for 2018 through Q3. And Emerging Market debt and equity? Fuggedaboudit – they are deeply in the red.

(sources: all index return data from Yahoo Finance; Reuters, Barron’s, Wall St Journal, Bloomberg.com, ft.com, guggenheimpartners.com, zerohedge.com, ritholtz.com, markit.com, financialpost.com, Eurostat, Statistics Canada, Yahoo! Finance, stocksandnews.com, marketwatch.com, wantchinatimes.com, BBC, 361capital.com, pensionpartners.com, cnbc.com, FactSet; Figs 1-5 source W E Sherman & Co, LLC)

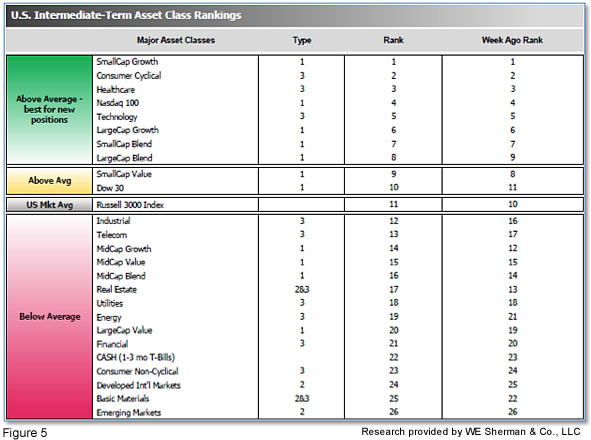

The ranking relationship (shown in Fig. 5) between the defensive SHUT sectors ("S"=Staples [a.k.a. consumer non-cyclical], "H"=Healthcare, "U"=Utilities and "T"=Telecom) and the offensive DIME sectors ("D"=Discretionary [a.k.a. Consumer Cyclical], "I"=Industrial, "M"=Materials, "E"=Energy), is one way to gauge institutional investor sentiment in the market. The average ranking of Defensive SHUT sectors rose to 14.25 from last week’s 15.50, while the average ranking of Offensive DIME sectors rose to 14.50 from last week’s 15.25. The Offensive DIME sectors and the Defensive SHUT sectors are essentially equally ranked.

Note: these are “ranks”, not “scores”, so smaller numbers are higher ranks and larger numbers are lower ranks.