November 2015: The Future of China

Submitted by The Blakeley Group, Inc. on November 5th, 2015“Once you have commitment, you need the discipline and hard work to get you there.”

NOTE: Areas with blue text show the most recent market updates since the October Capital Highlights email.

The very big picture:

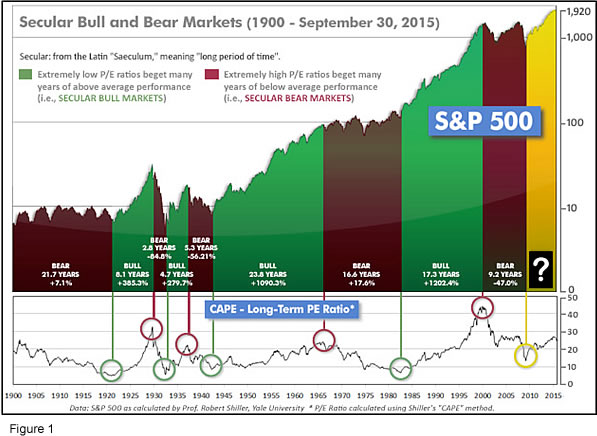

In the “decades” timeframe, the question of whether we are in a continuing Secular Bear Market that began in 2000 or in a new Secular Bull Market has been the subject of hot debate among economists and market watchers since 2013, when the Dow and S&P 500 exceeded their 2000 and 2007 highs. The Bear proponents point out that the long-term PE ratio (called “CAPE”, for Cyclically-Adjusted Price to Earnings ratio), which has done a historically great job of marking tops and bottoms of Secular Bulls and Secular Bears, did not get down to the single-digit range that has marked the end of Bear Markets for a hundred years, but the Bull proponents say that significantly higher new highs are de-facto evidence of a Secular Bull, regardless of the CAPE. Further confusing the question, the CAPE now has risen to levels that have marked the end of Bull Markets except for times of full-blown market manias. See Fig. 1 for the 100-year view of Secular Bulls and Bears.

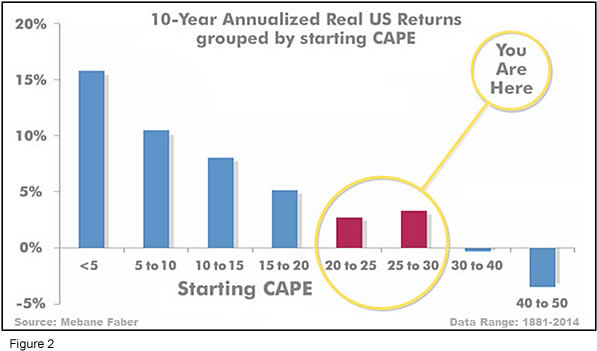

Even if we are in a new Secular Bull Market, market history says future returns are likely to be modest at best. The CAPE is at 26.3, little change from the prior week’s 26.2, and approximately at the level reached at the pre-crash high in October, 2007. In fact, since 1881, the average annual returns for all ten year periods that began with a CAPE at this level have been just 3%/yr (see Fig. 2). (Note: all P/E references are to the Shiller P/E values, sometimes called PE10 or CAPE, which are calculated so as to remove shorter-term fluctuations; see robertshiller.com for details).

This further means that above-average returns will be much more likely to come from the active management of portfolios than from passive buy-and-hold. Although a mania could come along and cause the CAPE to shoot upward from current levels (such as happened in the late 1920’s and the late 1990’s), in the absence of such a mania, buy-and-hold investors will likely have a long wait until the arrival of returns more typical of a rip-snorting Secular Bull Market.

In the big picture:

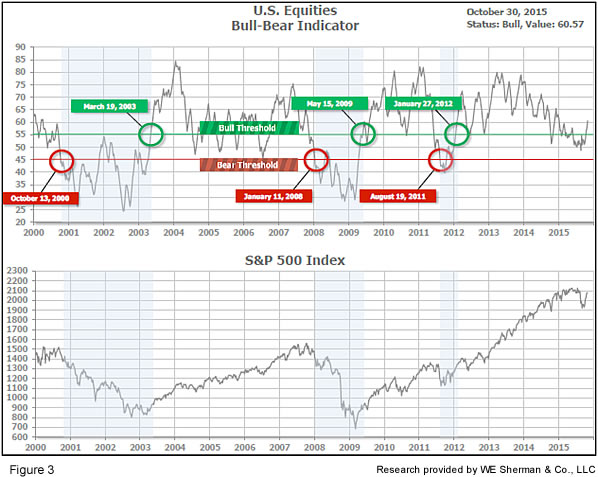

The “big picture” is the months-to-years timeframe – the timeframe in which Cyclical Bulls and Bears operate. The US Bull-Bear Indicator (see Fig. 3) is at 60.57, up from the prior week’s 57.59, and continues in Cyclical Bull territory. Several of the world’s major markets have entered Bear territory, most notably China and Brazil, while many of the world’s other markets – including the US – are in “correction” territory (10% or more from their highs).

In the intermediate picture:

The intermediate (weeks to months) indicator (see Fig. 4) returned to positive on October 5. The indicator ended the week at 31, up from the prior week’s 27. Separately, the quarter-by-quarter indicator – based on domestic and international stock trend status at the start of each quarter – gave a negative indication on the first day of October for the prospects for the fourth quarter of 2015.

Timeframe summary:

In the Secular (years to decades) timeframe (Figs. 1 & 2), whether we are in a new Secular Bull or still in the Secular Bear, the long-term valuation of the market is simply too high to sustain rip-roaring multi-year returns. In the Cyclical (months to years) timeframe (Fig. 3), all major equity markets are in Cyclical Bull territory. In the Intermediate (weeks to months) timeframe (Fig. 4), US equity markets are rated as Negative. The quarter-by-quarter indicator gave a negative signal for the 4th quarter: neither US equities nor ex-US equities were in an uptrend at the start of Q4 2015, sufficient to signal a higher likelihood of a down quarter than an up quarter.

In the markets:

The LargeCap indexes registered modest gains for the week thanks to a strong rally Wednesday, which compensated for losses on each of the other days of the week. Roughly one-third of the companies in the S&P 500 were scheduled to report third-quarter earnings during the week, and the mix of positive and negative surprises appeared to drive much of the market action. For the week, the Dow Jones Industrial Average gained +16 points to close at 17663. The Nasdaq composite held the 5000-level and gained +0.43% to end the week at 5053. The LargeCap S&P 500 gained +0.2%. The MidCap S&P 400 added +0.34% and the SmallCap Russell 2000 was the weakest US index, down -0.36%.

Canada’s Toronto Stock Exchange Index declined -3.04% as the weakness in natural resources continues to impact Canada’s economy. The United Kingdom’s FTSE declined -1.29%. Germany’s DAX gained +0.52% and France’s CAC 40 declined -0.53%. In the major Asian markets, Hong Kong’s Hang Seng declined -2.21%, China’s Shanghai Stock Exchange declined -0.88%, but Japan’s Nikkei bucked the trend by gaining +1.37%.

In commodities, precious metals sold off as Gold and Silver both lost ground down, with gold settling down ‑$22.30 to $1141.70 and silver settling down -$0.28 to $15.54 an ounce. A barrel of West Texas Intermediate crude oil rebounded after 2 down weeks, closing up +3.71% to $46.39 a barrel.

October was the best month for LargeCap US indices in the last four years. Outside of the LargeCap space, gains were unevenly spread. The S&P 500 and Dow gained more than 8% for the month, but MidCap and SmallCap indices gains were less eye-popping, at 5%+. Major International indices also gained strongly, in the 6%-7% range for the month, but the gains were not evenly spread and some, like Canada’s TSX, settled for a smaller +1.7% gain.

In US economic news, the economy slowed to a Gross Domestic Product (GDP) growth rate of just 1.5% in the 3rd quarter, down from a 3.9% pace in Q2. This was a bit slower than the 1.7% growth rate analysts had forecast. Consumer spending was up a strong +3.2% and housing investment was up +6.1%. Auto sales have been extremely strong, pushing durable goods spending up +6.7%. Export growth dipped to +1.9% from +5.1% in the second quarter—the strong dollar is weighing on exports.

The Federal Reserve left interest rates unchanged Wednesday, which was widely expected, but hinted that a stabilization of market conditions could allow a rate increase at its next meeting in December. In the release of their meeting notes, Fed policymakers noted a mixed view of economic conditions in their statement—household spending and business investment had increased at “solid rates”, and noted strength in the housing market, but the pace of job gains has slowed. One statement that Fed watchers noted was missing in the latest notes release was their previous assertion that “recent global economic and financial developments” had stayed their hand. The absence of the phrase could mean that policymakers are more comfortable with a rate liftoff in December and less concerned about global problems.

There were 260,000 initial claims for unemployment last week, up 1000 from the previous week. Continuing claims were 2.144 million, down 27,000 from the week before—the lowest level since late 2000.

New-home sales were reported by the Commerce Department at a running at a rate of 468,000, missing forecasts of 549,000. Supply rose to 5.8 months at the current rate, up from 4.9 in August. The median sales price was $296,900—14% higher than this time last year. Housing market research firm Black Knight reported that prices were up +5.5% versus a year ago in August and are now amazingly just 5.3% lower than their 2006 peak. Its national index is 27% above its lows and 9 of its 40 metro areas notched new highs in August. S&P/Case-Shiller’s index rose +0.1% in August, matching expectations. The index is up +5.1% versus a year ago. San Francisco and Denver remain two of the hottest markets with +10.7% yearly gains. Case-Shiller’s index is 12% lower than its 2006 peak.

Pending home sales declined -2.3% in September according to the National Association of Realtors, whose analysts had estimated a gain of +1%. It was the second straight monthly decline and took NAR’s index to the second lowest reading of the year.

The Conference Board’s consumer confidence reading declined -5 points to 97.6 in October, widely missing the 102.5 forecast. The present situation index declined to 112.1 from 120.3. The expectations gauge also declined to 88 from 90.8. The University of Michigan’s consumer confidence reading rose less than expected in the final October reading. Interestingly, the gain came mostly from lower-income households. The current conditions gauge gained +1.1%, and the expectations component gained +5%.

The US service sector weakened more than expected, according to Markit’s October flash Purchasing Managers Index (PMI), which fell to 54.4 from 55.6. October saw the weakest rise in service-sector employment since February. The service sector had been a source of strength as manufacturing continues to struggle.

On the manufacturing side, US Durable goods orders declined -1.2% in September, worse than the -1% expected. Excluding transportation, orders fell -0.4% whereas analysts had expected a decline of -0.1%. Core capital goods, an indicator for business investment, declined -0.3% on top of a -1.6% decline in August. However, there were two pockets of strength: motor vehicle orders gained +1.8%, and defense aircraft surged +25%.

In Canada, railway car loadings fell -5% in August versus a year ago. Freight origination also declined -4.9%.

In the United Kingdom, GDP grew +0.5% in the 3rd quarter, slightly lower than the +0.6% expected. The yearly rate of expansion is now +2.3%, down from +2.4%. Similar to the United States, the service sector is offsetting weakness in manufacturing and construction. CBI’s October Industrial Trends Survey reported a decline in the rate of manufacturing growth to -18, worse than the -9 analysts were expecting. Export orders fell to the lowest level since January 2013. Retail activity in the U.K. sank in October to 19 from 49 according to CBI’s High Street survey—expectations were for a reading of 35. This was the weakest retail reading since April.

In the Eurozone, German business confidence declined -0.3 point to 108.2 in the German Center for Economic Studies October survey. However, that beat expectations of a reading of 107.9. The current conditions gauge also declined, but the expectations component increased ½ point to 103.8—the highest since June 2014. Consumer confidence in Germany continued to slide a 3rd straight month according to German consumer researcher GfK’s November survey, which fell to 9.4 while analysts had been expecting 9.6. That’s the lowest reading since February. A gauge of economic expectations fell for the fifth straight month, into contraction territory for the first time since May 2013. The surge of refugees into the labor market was widely cited by respondents as a concern.

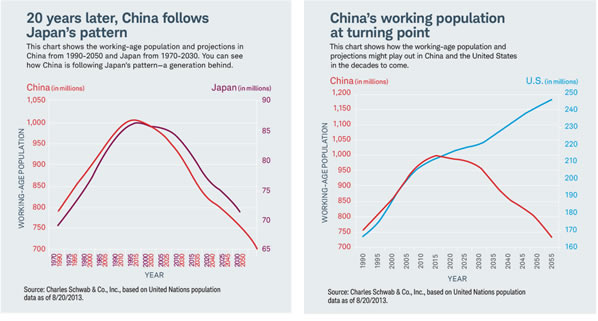

Finally, China this week officially ended its one-child per working-class couple policy, which had been in place since 1980. Originally, the program was intended to curb China’s then-ballooning population. However, China’s most recent population growth rate is closer to 0.5% rather than the 1.2% rate back when the policy was initiated, according to the World Bank. That rate of population growth compares to a current rate of 0.7% for the United States and 1.2% for India. Under China’s new policy, couples can now have two children, which had only been allowed in special circumstances previously. An unintended consequence of the 1-child policy has been a gender-skewing among younger Chinese, with many more men than women (hundreds of millions of baby girls were aborted by parents more interested in having a boy as their only allotted child). This will make it even more difficult to spur procreation, as there is a huge imbalance of genders preventing the formation of new households on a scale necessary to support the desired growth – or even stability – of the population.

China’s working-age population, defined as the ages between 15 and 64, is now peaking and is poised to fall just as its economy slows. A shrinking working age population makes it harder to support a growing number of older citizens who will be retiring from the workforce. China’s population pattern appears to be following Japan’s pattern from 20 years ago, as seen in the first chart below. Unlike China and Japan, the US working-age population is forecast to continue rising slowly, as seen in the second chart, helped in part by continued high levels of immigration.

(sources: Reuters, Barron’s, Wall St Journal, Bloomberg.com, ft.com, guggenheimpartners.com, ritholtz.com, markit.com, financialpost.com, Eurostat, Statistics Canada, Yahoo! Finance, stocksandnews.com, marketwatch.com, wantchinatimes.com, BBC, 361capital.com, pensionpartners.com, cnbc.com, Charles Schwab & Co,; Figs 3-5 source W E Sherman & Co, LLC)

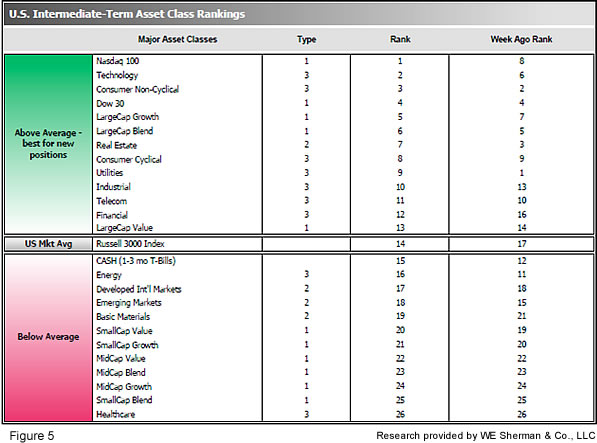

The ranking relationship (shown in Fig. 5) between the defensive SHUT sectors (“S”=Staples [a.k.a. consumer non-cyclical], “H”=Healthcare, “U”=Utilities and “T”=Telecom) and the offensive DIME sectors (“D”=Discretionary [a.k.a. Consumer Cyclical], “I”=Industrial, “M”=Materials, “E”=Energy), is one way to gauge institutional investor sentiment in the market.

The average ranking of Defensive SHUT sectors fell to 12.3 from the prior week’s 9.8, while the average ranking of Offensive DIME sectors rose slightly to 13.3 from the prior week’s 13.5. The Defensive SHUT sectors retain a slight rankings lead overs the Offensive DIME sectors. Note: these are “ranks”, not “scores”, so smaller numbers are higher ranks and larger numbers are lower ranks.

Summary:

The US has led the worldwide recovery, and continues to be among the strongest of global markets. However, the over-arching Secular Bear Market may remain in place globally even through new highs were reached in the US earlier this year. Because the world may still be in a Secular Bear, we have no expectations of runs of multiple double-digit consecutive years, and we expect poor market conditions to be a frequent occurrence. Nonetheless, we remain completely open to any eventuality that the market brings, and our strategies, tactics and tools will help us to successfully navigate whatever happens.

Check out the latest article in the Resource area of our website:

“Hacking and Identity Theft: A Simple Step to Better Protect Yourself