May 2022 Lockdown and Delays

Submitted by The Blakeley Group, Inc. on May 8th, 2022The very big picture (a historical perspective):

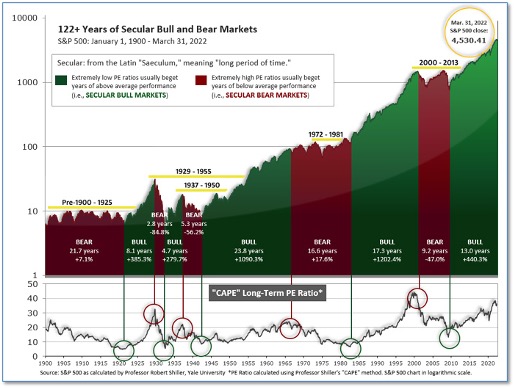

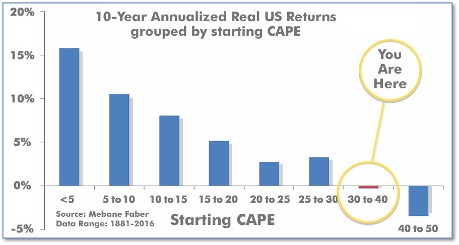

The long-term valuation of the market is commonly measured by the Cyclically Adjusted Price to Earnings ratio, or “CAPE”, which smooths-out shorter-term earnings swings in order to get a longer-term assessment of market valuation. A CAPE level of 30 is considered to be the upper end of the normal range, and the level at which further PE-ratio expansion comes to a halt (meaning that further increases in market prices only occur as a general response to earnings increases, instead of rising “just because”). The market is now above that level.

Of course, a “mania” could come along and drive prices higher - much higher, even - and for some years to come. Manias occur when valuation no longer seems to matter, and caution is thrown completely to the wind - as buyers rush in to buy first, and ask questions later. Two manias in the last century - the “Roaring Twenties” of the 1920s, and the “Tech Bubble” of the late 1990s - show that the sky is the limit when common sense is overcome by a blind desire to buy. But, of course, the piper must be paid, and the following decade or two were spent in Secular Bear Markets, giving most or all of the mania-gains back.

The Very Big Picture: 120 Years of Secular Bulls and Bears

Figure 1

See Fig. 1 for the 100-year view of Secular Bulls and Bears. The CAPE is now at 32.53, down from the prior week’s 33.63. Since 1881, the average annual return for all ten-year periods that began with a CAPE in this range has been negative (see Fig. 2).

The Very Big Picture: Historical CAPE Values

Current reading: 32.53

Figure 2

Note: We do not use CAPE as an official input into our methods. However, if history is any guide - and history is typically ‘some’ kind of guide - it’s always good to simply know where we are on the historic continuum, where that may lead, and what sort of expectations one may wish to hold in order to craft an investment strategy that works in any market ‘season’ … whether the current one, or one that may be ‘coming soon’!

The big picture:

As a reading of our Bull-Bear Indicator for U.S. Equities (comparative measurements over a rolling one-year timeframe), we entered a new Cyclical Bear on March 4, 2022.

The complete picture:

Counting-up of the number of all our indicators that are ‘Up’ for U.S. Equities (see Fig. 3), the current tally is that none of the four are Positive, representing a multitude of timeframes (two that can be solely days/weeks, or months+ at a time; another, a quarter at a time; and lastly, the {typically} years-long reading, that being the Cyclical Bull or Bear status).

The Current ‘Complete Picture’: The Sum of Positive Indicators.

Figure 3

In the markets:

U.S. Markets: The major U.S. market indexes endured a fourth consecutive week of losses as fears of slowing growth were compounded by disappointing earnings from some market heavyweights like Amazon. The benchmark S&P 500 index fell further into correction territory, now down about 14% from its recent peak, while the technology-heavy Nasdaq Composite and small-cap Russell 2000 Index fell further into their respective bear markets, down roughly 24% from their highs. For the week, the Dow Jones Industrial Average shed 834 points, closing at 32,977, a decline of -2.5%. The Nasdaq Composite declined -3.9% finishing the week at 12,335. By market cap, the large cap S&P 500 gave up ‑3.3%, while the mid-cap S&P 400 fell -3.2%. The small-cap Russell 2000 closed down -3.9%.

International Markets: Most of the major international markets finished the week to the downside as well. Canada’s TSX fell -2.0%, while the United Kingdom’s FTSE 100 rose 0.3%. France’s CAC 40 and Germany’s DAX pulled back -0.7% and -0.3%, respectively. In Asia, China’s Shanghai Composite retreated -1.3%. Japan’s Nikkei declined ‑0.9%. As grouped by Morgan Stanley Capital International, emerging markets ended the week flat. Developed markets ended down -0.9%.

Commodities: Precious metals failed to serve as a safe haven given the weakness in the financial markets. Gold pulled back -1.2% to $1911.70, while Silver gave up -4.8% to $23.09. Energy managed to buck the trend with West Texas Intermediate crude oil rising 2.6% to $104.69 per barrel, while Brent crude oil gained 0.9% to $106.67. The industrial metal copper, viewed by some analysts as a barometer of global economic health due to its wide variety of uses, ended the week down -3.8%.

April Summary: April was a difficult month for the markets everywhere. In the U.S., the Dow Jones Industrial Average finished the month down -4.9%, while the Nasdaq plunged -13.3%--its biggest monthly decline since October 2008. Large caps shed -8.8%, while mid-caps declined -7.2% and small caps fell -10.0%. For the month, Canada declined -5.2%, while the UK rose 0.4%. France and Germany ended down -1.9% and -2.2%, respectively, while in Asia fell -6.3%. Japan declined -3.5%. Emerging markets finished the month down -6.1%. Developed markets gave up ‑6.7%. Gold and Silver pulled back -0.3% and -6.7%, respectively. Oil finished the month up 0.4%. Copper finished April down -6.8%.

U.S. Economic News: The U.S. labor market remains extremely robust as initial claims for unemployment benefits fell again last week. The Labor Department reported claims fell by 5,000 to just 180,000 last week. The decline was in line with economists’ forecasts. Claims remain near multi-decade lows at levels not seen since the early 1970’s. Meanwhile, the number of people already collecting benefits, known as ‘continuing claims’, fell by 1,000 to 1.41 million. That number is also at its lowest level since the early 1970’s. Stuart Hoffman, senior economic advisor at PNC Financial Services Group noted that the labor market remains in “excellent shape”. Economists note that any increase in claims would be a leading indicator of a slowing economy—but there are no signs of that happening now.

The spring housing market is off to an unpredictable start amid rising mortgage rates, according to the National Association of Realtors (NAR). The NAR reported pending home sales, which counts the number of transactions in which a contract has been signed but not yet closed, dropped 1.2% in March. This was the fifth consecutive month in which contract signings declined. Pending sales dropped the most in the Midwest—down 6.1%. Contract signings also fell in the South and the West. Signings rose 4% in the Northeast, but every region saw a decline in pending sales compared to the same time last year. Lawrence Yun, chief economist for the NAR stated, “The falling contract signings are implying that multiple offers will soon dissipate and be replaced by much calmer and normalized market conditions.” Yun added that rising mortgage rates have already begun to reduce the pool of eligible homebuyers. Yun said he now predicts existing-home sales will decrease 9% in 2022.

Home prices continued their historic rise in February as rising mortgage interest rates have not yet (thru February) slowed the blistering pace of house appreciation. The S&P CoreLogic Case-Shiller 20-city home prices index posted a huge 20.2% year-over-year gain in February—up markedly from 18.9% the prior month. On a monthly basis, the index increased 2.4% between January and February. Similarly, on a national level the Case-Shiller home price index increased 19.8% over the past year. This represented the third-largest pace of home-price appreciation in the report’s history. As in previous months, Phoenix led the way with the highest rate of home price growth—up an annual 32.9% over the past year. Two Florida cities closely followed, Tampa with a 32.6% gain and Miami with a 29.7% rise. Selma Hepp, deputy chief economist at CoreLogic noted rising mortgage rates will undoubtedly cool the housing market sooner rather than later. Hepp wrote in a note to clients, “With diminished buying power and mortgage rates pushing above 5% in recent weeks, home-price growth is likely to take a step back in coming months.”

The Federal Reserve’s ‘preferred’ measure of inflation rose a sharp 0.9% in March, but the increase stemmed largely from a surge in the cost of gas. Over the past 12 months, the Personal Consumption Expenditures Index (PCE) has risen 6.6%, up 0.2% from February. That’s the steepest rise since 1981. Yet the narrower measure of inflation that strips out the food and energy categories, known as core PCE, rose at an annualized 5.2%. That number matched forecasts. The Fed views the PCE index--the core rate in particular--as the most accurate measure of U.S. inflation. It’s more comprehensive and takes into account when consumers substitute cheaper goods for more expensive ones--say ground beef for steak or frozen spinach for fresh.

Confidence of the nation’s consumers slipped this month but remained robust. The Conference Board reported its survey of consumer confidence pulled back -0.3 point to 107.3. Economists had been expecting a reading of 108.5. Consumer confidence had declined early in the year following the Omicron outbreak and later the war in Ukraine. Soaring inflation and higher gasoline prices have also weighed on sentiment. Still, economists state that the chance of a recession appears low—at least for now. The measure of how consumers feel about the economy right now slid to 152.6 from an eight-month high of 153.8 in March. A similar gauge that measures sentiment for the next six months rose to 77.2 from 76.7 indicating cautious optimism about the future. Mahir Rasheed, U.S. economist at Oxford Economics stated, “Confidence has held up relatively well in the face of elevated geopolitical disruptions and the fiery pace of price increases in recent months.”

Orders for goods expected to last at least three years rebounded in March signaling the economy continued to grow at a steady pace. The government reported orders at U.S. factories for long-lasting goods such as cars rose 0.8% last month—its sixth advance in the last seven months. Furthermore, the initially reported -2.2% decline in February was revised to show a lesser -1.7% drop. The increase matched the estimate of economists polled by the Wall Street Journal. Another measure of factory conditions, known as core orders, advanced 1% in the month. The core number strips out transportation and military equipment and gives a better sense of underlying demand in the U.S. economy. Many analysts expect the strength in manufacturing to continue—despite rising interest rates. Senior economist Jennifer Lee of BMO Capital Markets noted, “The solid increase in core orders suggests that businesses remain in good shape, and are still looking to bulk up its machines and equipment to contribute to their bottom lines.”

The U.S. economy contracted an annualized 1.4% in the first quarter, marking its first drop since the onset of the pandemic. However, analysts were quick to point out that the decline stemmed predominantly from a record trade deficit. Consumer spending and business investment remained robust. The trade deficit by itself reduced GDP by a whopping 3.2 percentage points, the third highest number on record. Lower government spending and a decline in inventory stockpiles also contributed to the weak GDP number. However, some analysts were quick to point out that the reading didn’t mean a recession was imminent. Chief economist Ian Shepherdson at Pantheon Macroeconomics stated, “This is noise, not signal. The economy is not falling into recession.”

International Economic News: Bank of Canada Governor Tiff Macklem acknowledged he and his staff had misjudged the strength of inflation at the beginning of the year, and pledged to act “as forcefully as needed” to make up for the mistake. “(We’re coming) out of the deepest recession we’ve ever had,” Macklem said during testimony at the Senate banking committee this week. “We got a lot of things right. We got some things wrong, and we are adjusting.” Macklem was referring to the Bank of Canada’s decision not to raise interest rates, despite hard evidence of the emergence of the fastest inflation in decades. Macklem held steady, leaving the benchmark rate at an emergency setting of 0.25%. Macklem suggested that another half-point hike could be in the cards, though anything larger than that would be “very unusual.”

Across the Atlantic, independent research consultancy Capital Economics said the Bank of England will meet market expectations and hike interest rates to 3.0% by 2023. The forecast put them well ahead of the institutional analyst community which sees the rate topping out at 2.0%. OIS data meanwhile shows investors to be anticipating Bank Rate to peak around 2.5% in 2023. Paul Dales, Chief UK Economist at Capital Economics wrote, “Even though jobs growth will slow, we think the labour market will remain tighter for longer and that wage growth will be higher.” Dales attributed the tight labor market to Brexit and the aftermath of the pandemic.

On Europe’s mainland, the incumbent French President Emmanuel Macron beat his right-wing rival Marine Le Pen in France’s presidential election. The win makes him the first French president in two decades to win a second term. Voter turnout was 2% lower than the 2017 election the Interior Ministry reported. Le Pen said her result was a “victory” for her political movement and pointed to parliamentary elections which take place in June. “The French showed this evening a desire for a strong counterweight against Emmanuel Macron, for an opposition that will continue to defend and protect them,” she said.

The German government forecast the country’s economy will grow by only 2.2% this year, as Russia’s war on Ukraine weighs on prospects. The Economy Ministry cut the outlook from the 3.6% growth it had forecast in January. Economy Minister Robert Habeck said the government was making a “conservative" estimate, pointing to still-fragile supply chains, the effect of sanctions against Russia on the availability of raw materials and the ongoing effects of the coronavirus pandemic. The 2.2% growth prediction assumes no energy embargo or blockade of gas deliveries, Habeck said. “If this came on top, we would have a recession in Germany," he added. Russian imports account for a significant, though declining, proportion of Germany's gas supplies. Habeck said that proportion has declined from 55% before the war to 35% now.

In Asia, Chinese President Xi Jinping has pledged to ramp up support for the economy as lockdowns from a COVID outbreak and the war in Ukraine threaten growth. China will roll out a package of measures to help industries and small firms affected by the pandemic, state media said. “The COVID-19 and Ukraine crisis have led to increased risks and challenges. The complexity, severity and uncertainty of China’s economic development environment have increased,” the Politburo was quoted as saying. “Stabilizing growth, employment and prices are facing new challenges. It is very important to do a good job in economic work and effectively protect and improve people’s livelihood.” Carlos Casanova, senior economist for Asia at UBP in Hong Kong expects China’s economy to get worse before it gets better. Casanova wrote in a note, “We expect that the economy will contract in the months March-April before stabilizing in June.”

Japan’s currency, the yen, hit a new 20-year low after the Bank of Japan reinforced its low-rate policy. As almost every other major central bank has begun monetary tightening, rate increases, or both, Japan has bucked the trend. Bank of Japan Governor Kuroda said at a news conference, “The Japanese economy is still on the road to recovery from the impact of the Covid-19 pandemic. It is most important to support economic recovery by patiently continuing monetary easing.” Mr. Kuroda’s comments accelerated a fall in the yen. The yen briefly weakened to 131 against the dollar, a 20-year low. That means the yen has lost more than 10% of its value in less than two months.

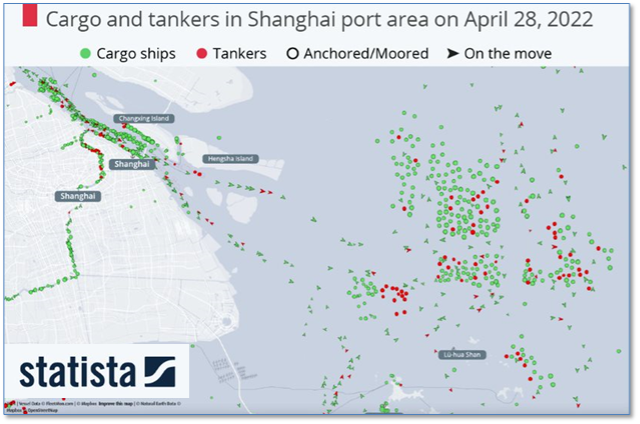

Finally: The largest city in China, Shanghai, remains in full lockdown as authorities try to contain yet another wave of COVID-19. Those lockdowns have led to a major backlog of cargo and container ships around the Port of Shanghai—the busiest container port in the world. Last year, over 47 million 20-foot equivalent units (unit of measure for container sizes) were handled there. For perspective, the largest container port in Europe, Rotterdam, had only 15.3 million TEUs. U.S. trucking giant JB Hunt expects the delays that Shanghai is experiencing to spread to the US West Coast by July. Shelley Simpson, chief commercial officer stated, “We do forecast that [shipping delays] to get a lot worse as we come into the summer months.” (Chart by statista.com)

(Sources: All index- and returns-data from Yahoo Finance; news from Reuters, Barron’s, Wall St. Journal, Bloomberg.com, ft.com, guggenheimpartners.com, zerohedge.com, ritholtz.com, markit.com, financialpost.com, Eurostat,0020Statistics Canada, Yahoo! Finance, stocksandnews.com, marketwatch.com, wantchinatimes.com, BBC, 361capital.com, pensionpartners.com, cnbc.com, FactSet.)