May 2016: Millennials

Submitted by The Blakeley Group, Inc. on May 5th, 2016"Determine that the thing can and shall be done, and then we shall find the way."

~ Abraham Lincoln

NOTE: Areas with blue text show the most recent market updates since the June Capital Highlights email.

The very big picture:

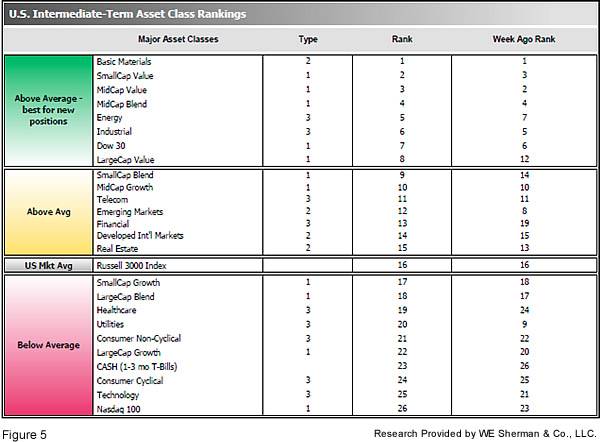

In the "decades" timeframe, the question of whether we are in a continuing Secular Bear Market that began in 2000 or in a new Secular Bull Market has been the subject of hot debate among economists and market watchers since 2013, when the Dow and S&P 500 exceeded their 2000 and 2007 highs. The Bear proponents point out that the long-term PE ratio (called “CAPE”, for Cyclically-Adjusted Price to Earnings ratio), which has done a historically great job of marking tops and bottoms of Secular Bulls and Secular Bears, did not get down to the single-digit range that has marked the end of Bear Markets for a hundred years, but the Bull proponents say that significantly higher new highs are de-facto evidence of a Secular Bull, regardless of the CAPE. Further confusing the question, the CAPE now has risen to levels that have marked the end of Bull Markets except for times of full-blown market manias. See Fig. 1 for the 100-year view of Secular Bulls and Bears.

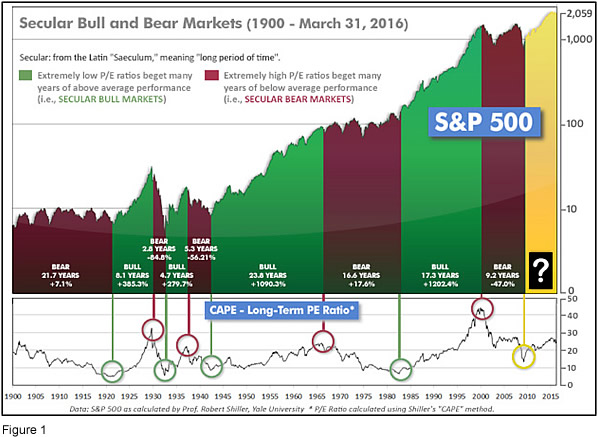

Even if we are in a new Secular Bull Market, market history says future returns are likely to be modest at best. The CAPE is at 25.92, down from the prior week's 26.25 after having earlier reached the level also reached at the pre-crash high in October, 2007. Since 1881, the average annual returns for all ten year periods that began with a CAPE around this level have been just 3%/yr (see Fig. 2).

This further means that above-average returns will be much more likely to come from the active management of portfolios than from passive buy-and-hold. Although a mania could come along and cause the CAPE to shoot upward from current levels (such as happened in the late 1920’s and the late 1990’s), in the absence of such a mania, buy-and-hold investors will likely have a long wait until the arrival of returns more typical of a rip-snorting Secular Bull Market.

In the big picture:

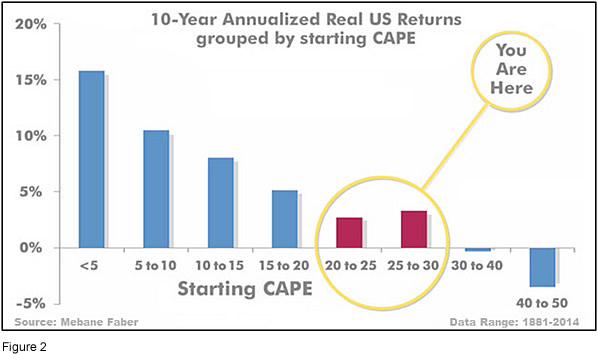

The “big picture” is the months-to-years timeframe – the timeframe in which Cyclical Bulls and Bears operate. The US Bull-Bear Indicator (see Fig. 3) turned negative on January 15th, and remains in Cyclical Bear territory at 51.30, down from the prior week’s 52.99.

In the intermediate picture:

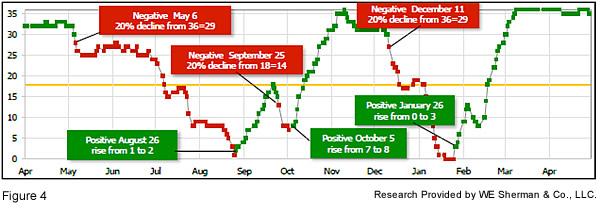

The intermediate (weeks to months) indicator (see Fig. 4) turned positive on January 26th. The indicator ended the week at 35, down 1 from the prior week's 36. Separately, the quarter-by-quarter indicator - based on domestic and international stock trend status at the start of each quarter - gave a positive indication on the first day of April for the prospects for the second quarter of 2016.

Timeframe summary:

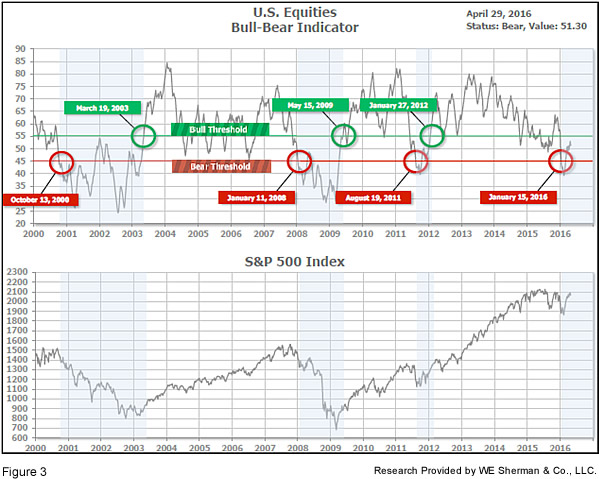

In the Secular (years to decades) timeframe (Figs. 1 & 2), whether we are in a new Secular Bull or still in the Secular Bear, the long-term valuation of the market is simply too high to sustain rip-roaring multi-year returns. The Bull-Bear Indicator (months to years) is negative (Fig. 3), indicating a new Cyclical Bear has arrived. The Quarterly Trend Indicator (months to quarters) is positive for Q2, and the Intermediate (weeks to months) timeframe (Fig. 4) is positive. Therefore, with two of the three indicators positive, the U.S. equity markets are rated as Mostly Positive.

In the markets:

U.S. stocks ended lower for the week after losses on Thursday and Friday that erased earlier gains. For the week, the Dow Jones Industrial Average fell -230 points to 17,773, down -1.28%. The NASDAQ Composite, the worst of US indices, fell -130 points to 4,775, down -2.67%. Apple and several other mega-cap technology stocks weighed on the NASDAQ, more than could be offset by good reports from Facebook and Amazon. The LargeCap S&P 500 ended down -1.26% along with the MidCap S&P 400 index and the SmallCap Russell 2000 index which closed down -1.04% and -1.38% respectively. Transports and Utilities were split as the Transports fell -2.65%, but the defensive Utilities sector rose +2.33%.

International markets generally had a worse week than the U.S., except for Canada’s TSX which rose +0.56% on recent strength in the energy sector. In Europe, Germany’s DAX fell -3.22%, France’s CAC 40 declined -3.08%, and the United Kingdom’s FTSE ended down -1.09%. In Asia, Japan’s Nikkei plunged -4.02%. Hong Kong’s Hang Seng index fell -1.86%, while China’s Shanghai Stock Exchange declined -0.71%.

In commodities, precious metals began to shine as gold gained +$61.20 an ounce to $1,294.90, up +4.96%, and silver rose over +5% to $17.89 an ounce. Crude oil climbed +5.12% to almost $46 a barrel. The industrial metal copper also gained, up +0.56%.

The month of April was positive for most equity and commodity markets, with the notable exception of U.S. tech stocks as reflected in the NASDAQ Composite’s April return of -1.94%. The LargeCap S&P 500 gained a modest +0.27%, while MidCaps and SmallCaps outperformed at +1.14% and +1.51% respectively. Emerging International (EEM) gained +0.41%, and Developed International (EFA) rose a more-robust +2.22%. The greatest strength was to be found in commodity markets, paced by the headliners Gold (+4.44%) and, especially, Oil (+15.52%). Unsurprisingly, resource-dependent equity markets benefited, as reflected in Canada’s TSX April gain of +3.39%.

In U.S. economic news, new-home sales fell -1.5% last month to an annual rate of 511,000 according to the Commerce Department. It was the third straight monthly decline. Economists had expected an annual rate of 522,000. New-home median prices fell to $288,000 from $293,400 a year earlier, at the same time that the number of new homes for sale rose to the highest level since the fall of 2009. On a positive note for housing, the National Association of Realtors (NAR) reported that pending home sales rose more than expected in April. The NAR’s pending-home sales Index climbed +1.4% to 110.5, a 10-month high. Economists had expected a +0.5% increase. The pending-home sales Index tracks existing-home contract signings. It serves as an indicator for the actual existing-home sales closings which follow a month or two later.

The government released its initial look at first-quarter U.S. GDP and it was a disappointing +0.5% annualized growth rate—the slowest in 2 years. A similar pattern emerged in 2014 and 2015 when initial readings of -0.9% and +0.6% were followed by strong second quarter GDP readings of +4.9% and +3.9%, respectively. Digging deeper into the latest numbers, real final sales to domestic purchasers rose just +1.2%, the weakest annualized gain since the second quarter of 2013. “Real” sales strip out net exports and inventory investment, and according to Steve Blitz, chief economist at ITG Investment Research “is about as core a measure of GDP as there is.”

Orders for U.S. durable goods missed expectations, climbing less than forecast in April as demand for capital equipment remained weak. The Commerce Department reported orders for items meant to last at least three years rose +0.8% after a -3.1% drop a month earlier. Despite the rise, it was a “miss” relative to expectations as the median forecast had called for a +1.9% advance. Orders for business equipment were essentially flat last month, also weaker than expected. Businesses continue to face headwinds with soft global sales and lackluster U.S. consumer spending, making it difficult to justify expanding plans for capital outlays. Shipments of non-military capital goods ex-aircraft (a measure used to calculate gross domestic product) increased +0.3% last month after declining -1.8% in February.

Also in U.S. manufacturing, the Chicago Purchasing Managers Index (PMI) fell -3.2 points to 50.4, widely missing expectations of a 53 reading and just barely remaining in expansion (>50) territory. The PMI decrease was led by a decline in new orders and an even sharper drop in order backlogs. Chief Economist of forecasting firm MNI Indicators Philip Uglow stated "This was a disappointing start to the second quarter, with the barometer barely above the neutral 50 mark in April. Against a backdrop of softer domestic demand and the slowdown abroad, panelists are now more worried about the impact a rate hike might have on business than they were at the same time last year."

In earnings news, 55% of the S&P 500 companies have now reported earnings and Thomson Reuters is forecasting that earnings will decline and overall -6.1% in the first quarter. After removing energy components, Thomson Reuters is forecasting a smaller -0.5% decline. This would mark the third consecutive quarter of earnings declines.

This past week, the Federal Reserve held its key rate steady, as expected, and gave no indication that it is ready to shift to a tightening mode anytime soon. The Fed noted in its post-meeting statement that even amid further labor market strengthening “growth in economic activity appears to have slowed” and household spending growth has moderated. Unlike the March statement, where global economic and financial concerns outweighed domestic activity, U.S. domestic growth issues took precedence in this statement. CME Group’s FedWatch reports that investors are now pricing in 52% odds of a rate hike at the September Fed meeting, but only 19% odds of a move in June.

In Canada, GDP fell by -0.1% in February but still beat expectations. Canada’s economy shrank for the first time in 5 months as manufacturing, mining, and energy all slowed. Statistics Canada reported that agriculture and forestry also suffered declines. Despite the contraction, February’s performance still beat analyst expectations of a -0.2% drop.

In Europe, a flash reading of first-quarter Euro-Area GDP was up a better than expected +0.6% over last year’s 4th quarter, and up +1.6% from the year-ago quarter. Analysts note that +1.6% is good, but growth greater than +2% is needed to get out of the state of stagnation that the region has been mired in for several years. Also in the Euro-area, the unemployment rate fell to 10.2% in March from 10.4% in February. Country-specific unemployment rates show Germany’s unemployment rate was at 4.2%, France’s at 10%, Italy at 11.4%, and Spain at 20.4%.

In the United Kingdom, Britain’s GDP grew +0.4% in the first quarter, down -0.2% from the final quarter of 2015 according to the U.K. Office for National Statistics. It was the weakest pace since the end of 2012. A significant factor was the fall in construction output which fell -0.9%. The service sector was the only major part of the economy to report growth, growing +0.6% from last quarter.

In France, the economy grew +0.5% in the first quarter on the heels of the strongest increase in consumer spending since 2004 and a pick-up in business investment. Consumer spending was up +1.2% over the first 3 months of the year and business investment rose +1.6%, the strongest increase in 5 years.

The Conference Board released a new report on future global GDP, estimating that by 2018 China’s contribution to global GDP will surpass that of the U.S., making China’s economy the most significant on the global stage. In 1970, the U.S. contributed 21.2% of total global economic output. This remained consistent until the year 2000. Since that time, America’s percentage of world’s economic output has declined steadily. In 2015, the U.S. contributed 16.7% of the world’s economy. In contrast, China’s contribution to global GDP was a mere 4.1% in 1970. Last year, their contribution was 15.6%. Since 1990, China’s percentage of total global output has risen every year with one exception, the “Asian Contagion” of 1998.

In Japan, the Bank of Japan surprised economists by voting against more stimulus. Despite weak inflation and household spending, the central bank decided against fresh measures to stimulate the economy. Although it kept its negative interest rate policy and voted to continue its massive asset purchase schemes, the bank refrained from any extra measures to kick-start the stagnant economy. The dollar plunged -2.35% against the yen following the news and the Nikkei fell -3.5%.

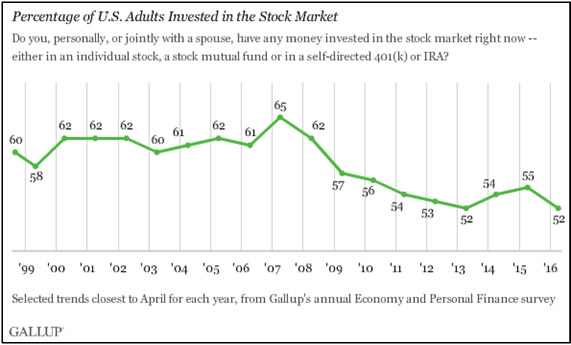

Finally, the Gallup Organization released a poll revealing that only slightly more than half of Americans say they currently have money in the stock market, even including 401(k) and IRA holdings. What’s striking about the poll is that it is back to the lowest rate in the survey’s 19 year history.

In 2007, nearly 2/3’s of Americans reported investing in the stock market, but that percentage has shrunk steadily since that high-water mark, representing many millions of Americans who have left the stock market.

According to Gallup, all American income segments are less likely to have stock investments now than before the Great Recession, but stock ownership for middle class Americans (with annual household incomes ranging from $30,000-$74,999) has plunged the most. The -22% drop for the middle class is more than double the amount among higher and lower income groups.

Among age groups, millennials (18 to 34) showed the greatest decline in market participation, dropping from 52% all the way to 38%. The so-called “robo-advisors”, catering to millennials, seem to be wooing a surprisingly disinterested market segment.

(sources: all index return data from Yahoo Finance; Reuters, Barron’s, Wall St Journal, Bloomberg.com, ft.com, guggenheimpartners.com, ritholtz.com, markit.com, financialpost.com, Eurostat, Statistics Canada, Yahoo! Finance, stocksandnews.com, marketwatch.com, wantchinatimes.com, BBC, 361capital.com, pensionpartners.com, cnbc.com, FactSet; Figs 1-5 source W E Sherman & Co, LLC)

The ranking relationship (shown in Fig. 5) between the defensive SHUT sectors ("S"=Staples [a.k.a. consumer non-cyclical], "H"=Healthcare, "U"=Utilities and "T"=Telecom) and the offensive DIME sectors ("D"=Discretionary [a.k.a. Consumer Cyclical], "I"=Industrial, "M"=Materials, "E"=Energy), is one way to gauge institutional investor sentiment in the market. The average ranking of Defensive SHUT sectors fell 17.8, down from the prior's week's 16.5, while the average ranking of Offensive DIME sectors rose to 9.0 from the prior week's 9.5. The Offensive DIME sectors retained their lead over the Defensive SHUT sectors. Note: these are “ranks”, not “scores”, so smaller numbers are higher ranks and larger numbers are lower ranks.