|

"Be wary of strong drink. It can make you shoot at tax collectors...and miss."

~ Robert A. Heinlein - American Science Fiction Writer

The very big picture:

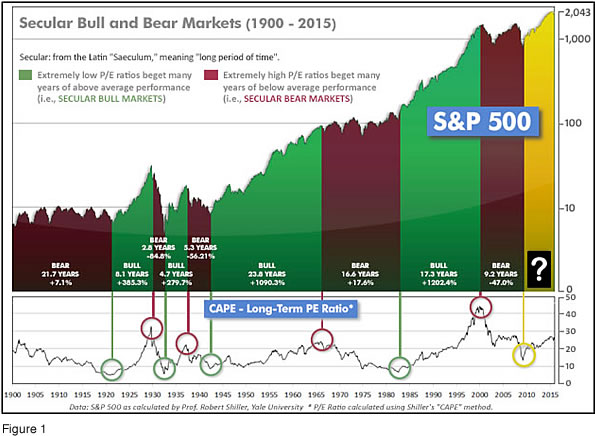

In the "decades" timeframe, the question of whether we are in a continuing Secular Bear Market that began in 2000 or in a new Secular Bull Market has been the subject of hot debate among economists and market watchers since 2013, when the Dow and S&P 500 exceeded their 2000 and 2007 highs. The Bear proponents point out that the long-term PE ratio (called “CAPE”, for Cyclically-Adjusted Price to Earnings ratio), which has done a historically great job of marking tops and bottoms of Secular Bulls and Secular Bears, did not get down to the single-digit range that has marked the end of Bear Markets for a hundred years, but the Bull proponents say that significantly higher new highs are de-facto evidence of a Secular Bull, regardless of the CAPE. Further confusing the question, the CAPE now has risen to levels that have marked the end of Bull Markets except for times of full-blown market manias. See Fig. 1 for the 100-year view of Secular Bulls and Bears.

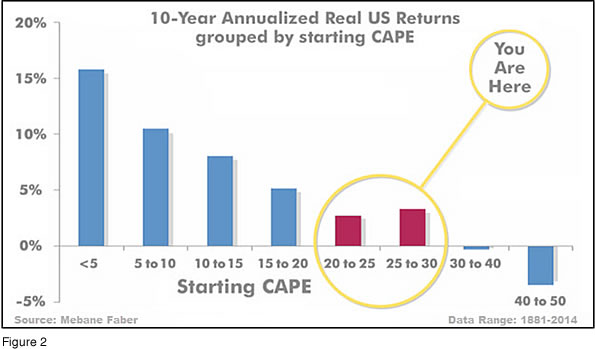

Even if we are in a new Secular Bull Market, market history says future returns are likely to be modest at best. The CAPE is at 24.64, up from the prior week's 24.24 after having earlier reached the level also reached at the pre-crash high in October, 2007. Since 1881, the average annual returns for all ten year periods that began with a CAPE around this level have been just 3%/yr (see Fig. 2).

This further means that above-average returns will be much more likely to come from the active management of portfolios than from passive buy-and-hold. Although a mania could come along and cause the CAPE to shoot upward from current levels (such as happened in the late 1920’s and the late 1990’s), in the absence of such a mania, buy-and-hold investors will likely have a long wait until the arrival of returns more typical of a rip-snorting Secular Bull Market.

In the big picture:

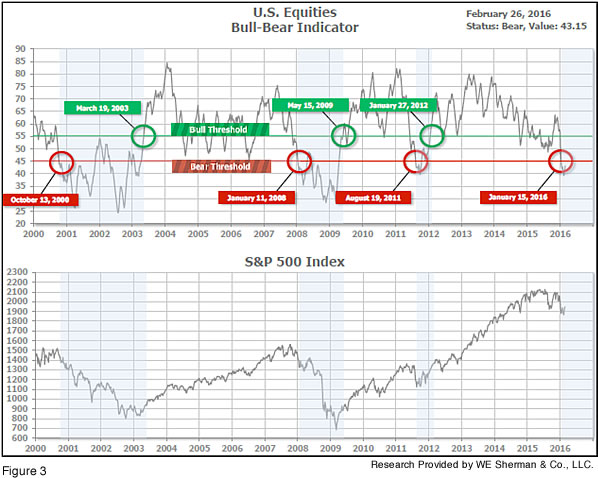

The “big picture” is the months-to-years timeframe – the timeframe in which Cyclical Bulls and Bears operate. The US Bull-Bear Indicator (see Fig. 3) turned negative on January 15th, and remains in Cyclical Bear territory at 43.75, up from the prior week’s 40.78.

In the intermediate picture:

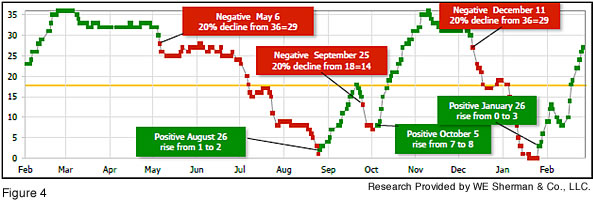

The intermediate (weeks to months) indicator (see Fig. 4) turned positive on January 26th. The indicator ended the week at 27, up sharply from the prior week’s 19. Separately, the quarter-by-quarter indicator - based on domestic and international stock trend status at the start of each quarter - gave a negative indication on the first day of January for the prospects for the first quarter of 2016.

Timeframe summary:

In the Secular (years to decades) timeframe (Figs. 1 & 2), whether we are in a new Secular Bull or still in the Secular Bear, the long-term valuation of the market is simply too high to sustain rip-roaring multi-year returns. The Bull-Bear Indicator (months to years) is negative (Fig. 3), indicating a new Cyclical Bear has arrived. The Quarterly Trend Indicator (months to quarters) is negative, and the Intermediate (weeks to months) timeframe (Fig. 4) is positive. Therefore, with two of the three indicators negative, the U.S. equity markets are rated as Mostly Negative.

In the markets:

All major U.S. indices were green as the stock market was able to manage a second consecutive weekly advance. The LargeCap S&P 500 climbed +1.6%, extending its two-week rally to +4.5% and is now up +0.4% for the month. The Dow Jones Industrial Average gained 247 points to end the week at 16,639, up +1.5%. MidCaps and SmallCaps also fared well as the S&P 400 MidCap index rose +2.7% and the SmallCap Russell 2000 index also gained 2.7%. The defensive Dow Jones Utilities barely managed a positive close, up just +0.07%, while the Dow Jones Transports added +1.63%.

In international markets, Canada’s TSX was essentially flat, down just -0.12%. European markets were generally higher for the week in the +1.2 to +2.5% range, while major Asian markets were mixed, with the biggest loser being the China Shanghai Index, down -3.25%. Developed markets as a whole were flat for the week, and Emerging markets were down -0.6% on average for the week.

In commodities, crude oil surged more than +10%, up +$3.12 to $32.84 on news of supply disruptions in Iraq and Nigeria. Precious metals lost their upward momentum as Gold ended the week at $1222.80 an ounce, down ‑0.31%, and silver plunged more than -4.3% to $14.69 an ounce.

In U.S. economic news, GDP for the fourth quarter was revised upward to +1.0% growth by the Commerce Department, better than the +0.7% gain initially reported. For the year, the economy grew a very modest +2.4%, the same as in 2014. The report was a surprise to Wall Street, which had expected a downward revision. However on a not-so-positive note, the report reveals that the boost in growth resulted from a smaller decline in inventories and weaker imports.

New claims for jobless benefits rose 10,000 to 272,000 last week, according to the Labor Department. Continuing claims decreased 19,000 to 2.253 million. Despite the latest increase weekly initial claims remain in the lower half of the 250,000 to 300,000 range they have been in for 19 months.

The National Association of Realtors reported that existing home sales rose in January to an annualized 5.47 million rate, a six month high. Home sales were up +11% from a year ago, the biggest annual gain since July, 2013. Sales were up +0.4% from last month. Nationally, the median home price rose +8.2% from a year ago, the largest since last spring. The S&P/Case-Shiller index showed year-over-year price gains of +5.7% in December, in its 20-city index. But new-home sales fell in January to a seasonally adjusted rate of 494,000 housing units, according to the Commerce Department. This was a bigger decline than economists had expected. New home sales fell -5.2% compared with a year earlier and are down -9.2% from December’s rate. The median sales price for new homes was $278,800, while the average sales price was $365,700. The median price is down -4.5% versus a year earlier, the biggest year-over-year decline since January 2012. The seasonally adjusted inventory of new homes for sale was 238,000, representing a supply of almost 6 months at the current rate.

The Conference Board reported that consumer confidence fell -5.6 points to 92.2, missing forecasts by a wide margin. It was the lowest reading since last summer. Analysts suggest that recent market weakness and slowing job growth were behind the reading. In the report, the “present situation” sub-index declined -4.5 points to 112.1. Respondents who stated current business conditions were good decreased to 26%, while those describing current business conditions as bad rose to 19.8%. The 6.2% spread between the two was the smallest since last August. The expectations gauge sank -6.4 points to 78.9, a two year low. Only 12.2% of consumers expect more jobs in the future versus 17.2% who expect fewer jobs. Nonetheless, Lynn Franco, Director of Economic Indicators at The Conference Board, stated “continued turmoil in the financial markets may be rattling consumers, but their assessment of current conditions suggests the economy will continue to expand at a moderate pace in the near term.”

Consumer spending - the backbone of the U.S. economy - remains strong, rising +0.5% in January and beating analyst forecasts according to the Commerce Department. Personal income also beat projections rising +0.5%. The Federal Reserve’s favorite inflation gauge, the core personal consumption expenditures index, rose +0.3%, which was the biggest monthly gain in four years. The +1.7% annual gain for the personal consumption expenditures index was the most since July 2014, and nearing the Fed’s stated 2% target.

Good news for manufacturing has been rare in recent months. We got some this week, in the form of orders for durable goods, which jumped +4.9% last month - the most in ten months and handily beating forecasts. Economists had been expecting a +2% gain. Year-over-year, durable goods orders rose a less-robust +0.6%.

In international economic news, the Conference Board of Canada predicts little economic growth over the coming years for Canada. The report states that the global downturn in mineral prices has hit the Canadian economy particularly hard and it will be years before the territories regain their financial footing.

In the Eurozone, the president of Germany’s Bundesbank gave a positive outlook for the global economy on Wednesday, but stated that “central banks shouldn’t be overburdened with creating economic growth.” “The global recovery is on track,” he added. His cheerleading speech followed a report Tuesday that showed German exports dropped -0.6% in the fourth quarter for the first time since 2012. Business sentiment in Germany fell to the lowest level in more than a year.

In France, French Finance Minister Michel Sapin stated that the global economy faced a series of difficulties but described them as “surmountable”, and warned against investor overreaction – and against the UK exiting the European Union.

In Asia, a long-standing issue facing the world’s third-largest economy – Japan - has finally manifested itself in a visible way. The official population of Japan as of Oct. 1 is 127.1 million, which is down by 947,000 or -0.75% from the previous census in 2010; this is the first-ever decline since the census started in 1920. Even during World War II the population rose. A UN report last year projected that Japan’s population would fall to about 83 million by 2100. The average number of children a Japanese woman will bear in a lifetime – just 1.42 as of 2014 – is far below the replacement rate of 2.1. It doesn’t help that Japan keeps a tight lid on immigration, which business leaders are calling to be loosened, but Prime Minister Shinzo Abe is showing no signs of changing existing policy.

The Japanese census figures are likely to further Japan’s decades-long stagnation. From a government standpoint, further stimulus packages are likely. The declining Japanese population is particularly visible in many rural prefectures. While Tokyo’s population grew +2.7% from 2010 to 2015, the population in 39 of Japan’s 47 prefectures declined.

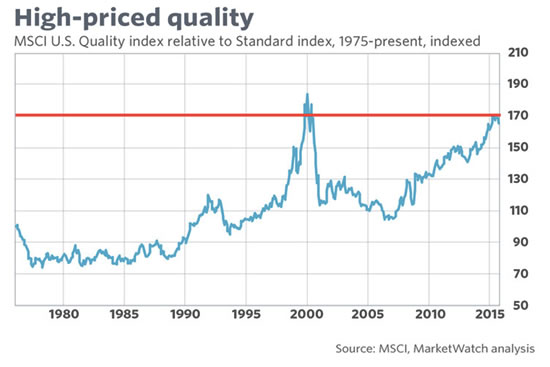

Finally, Rob Arnott, the widely-followed financial guru and chairman of investing firm Research Affiliates, recently put out a rather striking research note exhorting investors to “dump quality stocks and buy value stocks”. He states that stocks that bear high-quality characteristics such as high profits, and strong balance sheets have now become too expensive in relation to the rest of the stock market. Meanwhile, value stocks, which traditionally mean boring companies with low future growth prospects but still cheap in relation to profits and dividends, are, according to Arnott, trading at a significant discount to historical norms. Arnott’s call is interesting given the fact that he is the best-known and one of the earliest proponents of “smart beta” investing, which targets known anomalies in market returns that favor low volatility, high quality, and higher momentum stocks, among other characteristics. So why did he put out the “sell quality” call? Perhaps because his proselytizing in favor of high quality has been too successful leading to too many buyers in this now-overcrowded space, and inviting a reversion to the mean.

(sources: all index return data from Yahoo Finance; Reuters, Barron’s, Wall St Journal, Bloomberg.com, ft.com, guggenheimpartners.com, ritholtz.com, markit.com, financialpost.com, Eurostat, Statistics Canada, Yahoo! Finance, stocksandnews.com, marketwatch.com, wantchinatimes.com, BBC, 361capital.com, pensionpartners.com, cnbc.com, FactSet; Figs 1-5 source W E Sherman & Co, LLC)

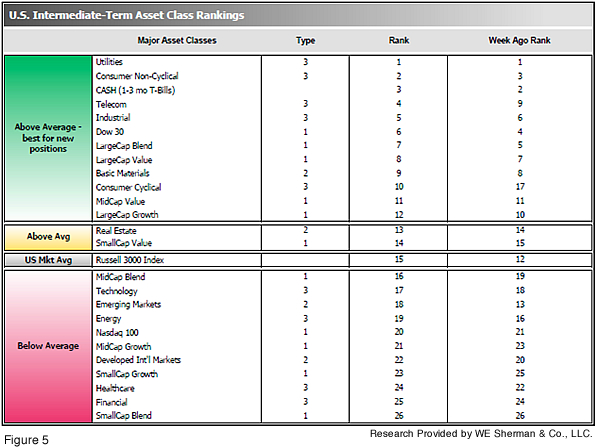

The ranking relationship (shown in Fig. 5) between the defensive SHUT sectors ("S"=Staples [a.k.a. consumer non-cyclical], "H"=Healthcare, "U"=Utilities and "T"=Telecom) and the offensive DIME sectors ("D"=Discretionary [a.k.a. Consumer Cyclical], "I"=Industrial, "M"=Materials, "E"=Energy), is one way to gauge institutional investor sentiment in the market. The average ranking of Defensive SHUT sectors rose to 8.0 from the prior week’s 8.8, while the average ranking of Offensive DIME sectors rose to 10.8 from the prior week’s 11.8. The Defensive SHUT sectors have maintained their lead over the Offensive DIME sectors. Note: these are “ranks”, not “scores”, so smaller numbers are higher ranks and larger numbers are lower ranks.

Summary:

The US has led the worldwide recovery, and continues to be among the strongest of global markets. However, the over-arching Secular Bear Market may remain in place globally even through new highs were reached in the US earlier this year. Because the world may still be in a Secular Bear, we have no expectations of runs of multiple double-digit consecutive years, and we expect poor market conditions to be a frequent occurrence. Nonetheless, we remain completely open to any eventuality that the market brings, and our strategies, tactics and tools will help us to successfully navigate whatever happens.

Check out the latest article in the Resource area of our website:

"Hacking and Identity Theft: A Simple Step to Better Protect Yourself"

by Dick Blakeley

|