MAY 2020 Uptrends

Submitted by The Blakeley Group, Inc. on June 23rd, 2020The very big picture (a historical perspective):

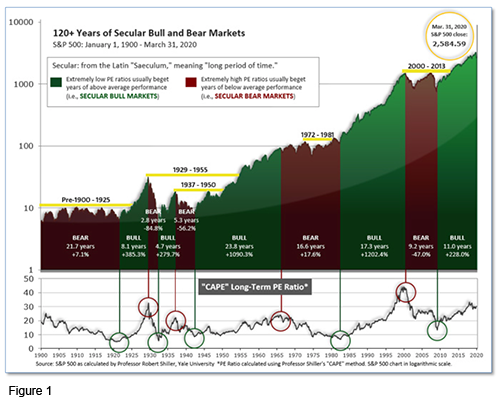

The long-term valuation of the market is commonly measured by the Cyclically Adjusted Price to Earnings ratio, or “CAPE”, which smooths-out shorter-term earnings swings in order to get a longer-term assessment of market valuation. A CAPE level of 30 is considered to be the upper end of the normal range, and the level at which further PE-ratio expansion comes to a halt (meaning that further increases in market prices only occur as a general response to earnings increases, instead of rising “just because”). The market was recently at that level.

Of course, a “mania” could come along and drive prices higher - much higher, even - and for some years to come. Manias occur when valuation no longer seems to matter, and caution is thrown completely to the wind - as buyers rush in to buy first, and ask questions later. Two manias in the last century - the “Roaring Twenties” of the 1920s, and the “Tech Bubble” of the late 1990s - show that the sky is the limit when common sense is overcome by a blind desire to buy. But, of course, the piper must be paid, and the following decade or two were spent in Secular Bear Markets, giving most or all of the mania-gains back.

The Very Big Picture: 120 Years of Secular Bulls and Bears.

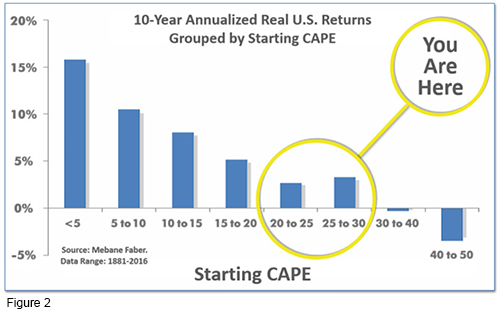

See Fig. 1 for the 100-year view of Secular Bulls and Bears. The CAPE is now at 27.43, up from the prior week’s 26.50 and now below 30. Since 1881, the average annual return for all ten-year periods that began with a CAPE in the 20-30 range have been slightly-positive to slightly-negative (see Fig. 2).

Note: We do not use CAPE as an official input into our methods. However, if history is any guide - and history is typically ‘some’ kind of guide - it’s always good to simply know where we are on the historic continuum, where that may lead, and what sort of expectations one may wish to hold in order to craft an investment strategy that works in any market ‘season’ … whether current one, or one that may be ‘coming soon’!

The Very Big Picture: Historical CAPE Values.

Current reading: 27.43

The big picture:

As a reading of our Bull-Bear Indicator for U.S. Equities (comparative measurements over a rolling one-year timeframe), we remain in Cyclical Bull territory.

The complete picture:

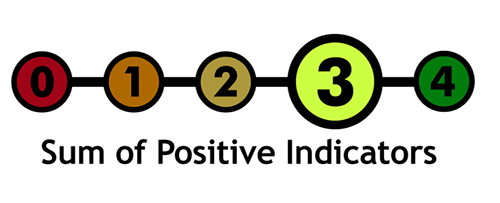

Counting-up of the number of all our indicators that are ‘Up’ for U.S. Equities (see Fig. 3), the current tally is that three of four remain Positive, representing a multitude of timeframes (two that can be solely days/weeks, or months+ at a time; another, a quarter at a time; and lastly, the {typically} years-long reading, that being the Cyclical Bull or Bear status).

The Current ‘Complete Picture’: The Sum of Positive Indicators.

In the markets:

U.S. Markets: U.S. stocks recorded solid gains for the week as investors appeared to have reconciled themselves to the depth of the economic downturn and turned their focus to the reopening of parts of the economy. The gains for the week even brought the technology-heavy NASDAQ Composite index back into positive territory for the year, and within a mere 7% of its all-time high. For the week, the NASDAQ added 6%, while the Dow Jones Industrial Average added 2.6% to close at 24,331. By market cap, the large cap S&P 500 rose 3.5%, while the mid cap S&P 400 added 5.4% and the small cap Russell 2000 gained 5.5%.

International Markets: A majority of major international markets finished the week in the green. Canada’s TSX added 2.4% while the United Kingdom’s FTSE 100 rallied 3%. On Europe’s mainland, France’s CAC 40 finished down -0.5%, while Germany’s DAX rose 0.4%. In Asia, China’s Shanghai Composite rose 1.2% and Japan’s Nikkei added 2.9%. As grouped by Morgan Stanley Capital International, developed markets rose 2.7% while emerging markets added 4.3%.

Commodities: Precious metal retraced some of last week’s decline. Gold rose 0.8% to finish the week at $1713.90 an ounce, while Silver rallied 5.6% to finish the week at $15.78 an ounce. Energy rebounded strongly for a second week rallying over 32% to close at $26.17 per barrel for West Texas Intermediate crude oil. The industrial metal copper, viewed by some analysts as a barometer of global economic health due to its wide variety of uses, finished the week up 4.1%.

U.S. Economic News: The number of Americans seeking first-time unemployment benefits fell by 677,000 last week to 3.169 million—its fifth consecutive week of declines. While lower than the previous weeks’ readings, the number is still more than ten times higher than the typical reading at the start of the year. Some 33 million new claims have been filed over the past seven weeks—a record-shattering surge that has sent the economy plunging into a deep recession. Continuing claims, which counts those already receiving benefits, jumped 4.636 million to a new record high of 22.647 million. This suggests that the current unemployment rate is near 20%. “That’s one in five jobs likely gone in seven weeks,” said Nick Bunker, director of economic research at Indeed Hiring Lab. “The outlook for the labor market remains frightening. Not only does the pace of layoffs remain at unprecedented levels, but hiring intentions remain depressed.”

Manufacturing remains under pressure as factory orders fell at their fastest pace on record in March as the coronavirus pandemic shut down large parts of the economy. The Commerce Department reported factory orders tumbled a worse-than-expected $51 billion or -10.3% as travel slowed to a trickle and supply-chain disruptions started to build. Economists had predicted just a -9.7% decline. Orders for so-called “durable goods”, items expected to last at least 3 years, fell -14.7%, while orders for nondurable goods slid a smaller -5.8%. On a year-over-year trend basis, factory orders were down -4.1%, the most since August 2016, with both durable and nondurable goods orders trending lower. Orders are expected to remain weak for months. The U.S. and global economies could take several years to recover, analysts say.

The vast services side of the U.S. economy crashed in April, according to the latest report from the Institute for Supply Management (ISM). The massive losses by retailers, restaurants, hotels, airlines, and other service-oriented companies from the coronavirus pandemic pushed the ISM’s non-manufacturing index (NMI) down 10.7 points to 41.8 in April. It was the index’s lowest reading since the 2007-2009 Great Recession. Although slightly better than the consensus of 40.0, the current level is historically consistent with recession. Of the 18 NMI industries, 16 shrank, the worst breadth also since March 2009, indicating a broad-based contraction. Only two of the 18 service industries tracked by ISM — government and finance — grew in April.

The “jobs report from hell” showed the highest unemployment rate since the 1930’s as the coronavirus pandemic and associated lockdown cost the U.S. almost 21 million jobs in April. The unemployment rate soared to 14.7%. In the report, job losses were heaviest at restaurants, hotels, and retailers but every major industry suffered large declines. Surprisingly, even the health-care sector wasn’t spared as nearly 1.5 million jobs were lost in that industry. The unemployment rate surged to 14.7% from a 50-year low of just 3.5% two months ago. In the seven weeks since the coronavirus shut down much of the U.S. economy, more than 33 million people have applied for unemployment benefits.

International Economic News: According to the former chief economic analyst for Statistics Canada, the word recession doesn’t capture how bad the economic impact of the COVID-19 crisis will really be. Philip Cross, with the Macdonald-Laurier Institute, argued governments and policymakers haven’t fully grasped the consequences of restricting and closing down parts of the economy. Furthermore, Cross says a quick bounce back isn’t coming on the other side of the pandemic either. “For some sectors, years is going to be the good time required for recovery,” he says, pointing to Air Canada, which recently announced it will take about three years to recover after the pandemic losses. “But the idea that we’re going to have a ‘V-shaped’ recovery where we go straight down and then we go straight back up, that’s not going to happen. It’s much more likely to be much more like a ‘hockey stick’ kind of decline with a slight uptick at the end,” he says.

According to the latest forecast from the Bank of England, the UK is headed for its worst crash in more than 300 years because of the coronavirus pandemic. The central bank said the British economy could shrink by 14% this year. That would be the biggest annual contraction since a 15% decline in…1706. Governor Andrew Bailey said the bank would respond as necessary to support the economy as the coronavirus threat evolves, but stopped short of announcing any new stimulus measures. In a report that examined the impact of the pandemic, the Bank of England said that GDP contracted by 3% in the first quarter of this year and would fall by as much as 25% in the second quarter, leaving the economy about 30% smaller than it was at the end of 2019.

French Prime Minister Edouard Philippe said the country was ready for a nationwide plan to relax curbs on public life, though strict controls will remain on public transport in Paris, where infection rates remain high. Looser restrictions on businesses and stores will go into effect at the beginning of the week of May 10th in a gradual process designed to avoid a second wave of infections. “We are always looking for a balance between the indispensable return to normal life and the indispensable respect of all measures that will prevent the epidemic from restarting,” Philippe said, adding that restrictions could be re-imposed if infections rise. “The target of all the French people is that we can live with this virus” until a cure is found.

German researchers say the world should brace itself for a second and even a third wave of the coronavirus pandemic before the population achieves sufficient immunity to the virus. Lothar Wieler, president of the Robert Koch Institute, said that a second wave of infections would come “with great certainty”. “This is a pandemic, and in a pandemic this virus will remain on our list of medical concerns until 60% to 70% of the population has been infected," he said. But Wieler also praised the German government for its handling of the outbreak, noting that new infections had dropped to between 700 and 1,600 per day.

Over 80 million Chinese are believed to already be out of work, and over 9 million more are expected to join them in the near future, economists at Societe Generale say. While official data from Beijing is often more than somewhat suspect, even the official numbers are starting to spike. China reported its official unemployment rate was 5.9% in March, just shy of the record 6.2% reported a month earlier. That would translate to more than 27 million people out of work according to a CNN Business calculation. Willy Lam, adjunct professor at the Center of Chinese Studies at Chinese University of Hong Kong said, “China's unemployment could be seriously understated. It's unusual they are willing to report data that bad. Given the government often massages the figures, the real situation must be worse." Beijing’s data does not include people in rural communities or the majority of the 290 million migrant workers. Including those workers, as many as 80 million people could have been out of work according to Zhang Bin, an economist at the Chinese Academy of Social Sciences.

Japanese household spending plunged earlier this year and the service sector shrank at a record pace in April, fulfilling expectations that the coronavirus pandemic was tipping the world’s third-largest economy into a deep recession. Analysts say the weak readings make it a near certainty that Japan’s economy suffered a second consecutive quarter of contraction in January-March—the technical definition of a recession. “Even without the virus, Japan’s economy was very weak due to the hit from last year’s sales tax hike. The pandemic has completely destroyed any chance of a recovery,” said Taro Saito, executive research fellow at NLI Research Institute. “The economy may rebound somewhat in July-September but won’t return to pre-coronavirus levels for the rest of this year,” he said. Furthermore, Saito expects the economy to contract an annualized 30% in the current quarter.

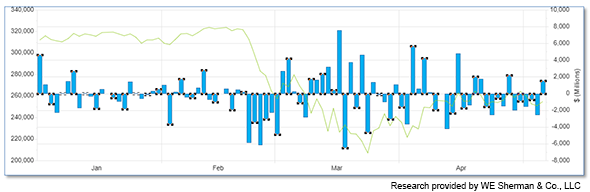

Finally: Even as the S&P surged back in April from its March lows, market technician Tom McClellan noted that investors have been fleeing one of the most popular ETFs on Wall Street. The SPDR S&P 500 ETF, symbol ‘SPY’, gives investors exposure to the stocks that make up the widely-followed S&P 500 index, and is among the most liquid and frequently traded ETFs in existence. McClellan noted that, despite rising more than 29% since touching its low on March 23rd, funds have been flowing out of the SPY. However, in good news for market bulls, McClellan writes that negative flows may actually indicate that the uptrend in stocks could continue higher. “This conveys the message that investors are not believing in the uptrend, which of course is a sign familiar to every contrarian: the uptrend could continue,” he said. The chart below shows daily inflows and outflows, with twice as many outflow days as inflow days during the robust April rally. (Chart from the McClellan Market Report).

(Sources: All index- and returns-data from Yahoo Finance; news from Reuters, Barron’s, Wall St. Journal, Bloomberg.com, ft.com, guggenheimpartners.com, zerohedge.com, ritholtz.com, markit.com, financialpost.com, Eurostat, Statistics Canada, Yahoo! Finance, stocksandnews.com, marketwatch.com, wantchinatimes.com, BBC, 361capital.com, pensionpartners.com, cnbc.com, FactSet.)