JUN 2020 Playing the Long Game

Submitted by The Blakeley Group, Inc. on June 23rd, 2020The very big picture (a historical perspective):

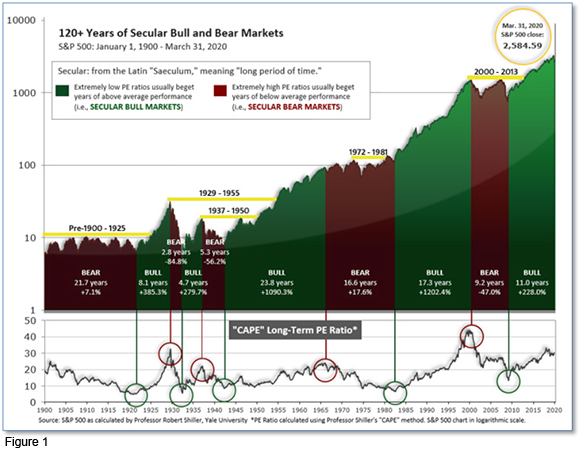

The long-term valuation of the market is commonly measured by the Cyclically Adjusted Price to Earnings ratio, or “CAPE”, which smooths-out shorter-term earnings swings in order to get a longer-term assessment of market valuation. A CAPE level of 30 is considered to be the upper end of the normal range, and the level at which further PE-ratio expansion comes to a halt (meaning that further increases in market prices only occur as a general response to earnings increases, instead of rising “just because”). The market was recently at that level.

Of course, a “mania” could come along and drive prices higher - much higher, even - and for some years to come. Manias occur when valuation no longer seems to matter, and caution is thrown completely to the wind - as buyers rush in to buy first, and ask questions later. Two manias in the last century - the “Roaring Twenties” of the 1920s, and the “Tech Bubble” of the late 1990s - show that the sky is the limit when common sense is overcome by a blind desire to buy. But, of course, the piper must be paid, and the following decade or two were spent in Secular Bear Markets, giving most or all of the mania-gains back.

The Very Big Picture: 120 Years of Secular Bulls and Bears.

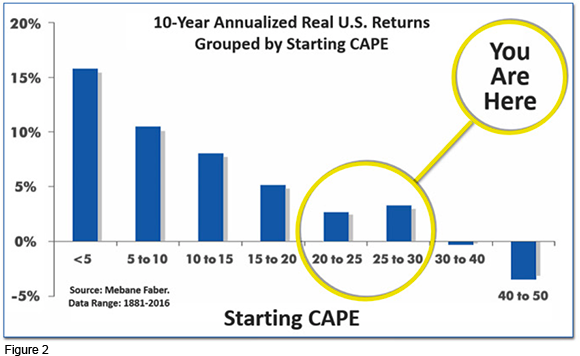

See Fig. 1 for the 100-year view of Secular Bulls and Bears. The CAPE is now at 28.62, up from the prior week’s 27.78 and now back below 30. Since 1881, the average annual return for all ten-year periods that began with a CAPE in the 20-30 range have been slightly-positive to slightly-negative (see Fig. 2).

Note: We do not use CAPE as an official input into our methods. However, if history is any guide - and history is typically ‘some’ kind of guide - it’s always good to simply know where we are on the historic continuum, where that may lead, and what sort of expectations one may wish to hold in order to craft an investment strategy that works in any market ‘season’ … whether current one, or one that may be ‘coming soon’!

The Very Big Picture: Historical CAPE Values.

Current reading: 28.62

The big picture:

As a reading of our Bull-Bear Indicator for U.S. Equities (comparative measurements over a rolling one-year timeframe), we remain in Cyclical Bull territory.

The complete picture:

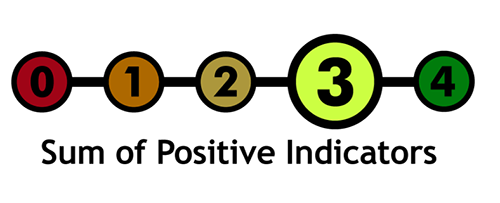

Counting-up of the number of all our indicators that are ‘Up’ for U.S. Equities (see Fig. 3), the current tally is that three of four are Positive, representing a multitude of timeframes (two that can be solely days/weeks, or months+ at a time; another, a quarter at a time; and lastly, the {typically} years-long reading, that being the Cyclical Bull or Bear status).

The Current ‘Complete Picture’: The Sum of Positive Indicators.

In the markets:

U.S. Markets: U.S. stocks recorded a second consecutive week of solid positive returns, with slower-growing value stocks again gaining ground ahead of more highly valued growth shares. At its peak this week, the S&P 500 got within 10% of its all-time high, pulling it out of “correction” territory. Similarly, the technology-heavy NASDAQ 100 Index climbed within almost 3% of its February peak before retreating. The Dow Jones Industrial Average rose over 900 points to close at 25,383, a gain of 3.8%, while the Nasdaq Composite added 1.8%. The large cap S&P 500 gained 3.0%, while the mid cap S&P 400 and small cap Russell 2000 gained 4.0% and 2.8%, respectively for the week.

International Markets: International markets were all green last week. Canada’s TSX rose 1.9%, while the United Kingdom’s FTSE 100 gained 1.4%. On Europe’s mainland, France’s CAC 40 rallied 5.6% along with Germany’s DAX which gained 4.6%. In Asia, China’s Shanghai Composite added 1.4% and Japan’s Nikkei surged 7.3%. As grouped by Morgan Stanley Capital International, developed markets gained 4.7% while emerging markets rose 3.6%.

Commodities: Gold rose 0.9% to close at $1751.70 per ounce, while Silver rallied a fourth consecutive week to close at $18.50 per ounce—a gain of 4.6%. Oil rose 6.7% to $35.49 per barrel of West Texas Intermediate crude. The industrial metal copper, viewed by some as a barometer of world economic health due to its wide variety of uses, rose a second consecutive week up 1.6%.

May Summary: All major U.S. indices rose in May. The Dow rose 4.3% and the NASDAQ 100 gained 6.8%. The S&P 500 gained 4.5%, the mid cap S&P 400 rose 7.1%, and the small cap Russell 2000 added 6.4%. Almost all major international markets were also higher for the month of May. Canada’s TSX gained 2.8%, while the FTSE 100 rose 3.0%. France’s CAC 40 and Germany’s DAX rose 2.7% and 6.7%, respectively. China’s Shanghai

Composite finished down -0.3%, while Japan’s Nikkei rallied 8.3%. Developed markets rose 5.3% and emerging markets gained 3.0%. Although gold was no slouch, rallying 3.4% in May, it was outshone by far by Silver, which surged 23.6%. Oil set a record for the largest ever gain in a single month, rallying 88.4%. Copper finished the month up 3.7%.

U.S. Economic News: The number of Americans applying for initial jobless benefits continued to recede last week, falling by 323,000 to a still-huge 2.123 million. Economists had estimated 2 million Americans would file. Over the past ten weeks, more than 40 million workers have filed for unemployment benefits as a result of the unprecedented coronavirus-driven shutdown of the economy. Continuing claims, which counts the number of Americans already receiving benefits, fell 3.860 million to 21.052 million—its first decline in 11 weeks.

The pace of home-price appreciation continued to rise in March despite the spread of the coronavirus according to a major home price barometer. The S&P CoreLogic Case-Shiller 20-city home price index posted a 3.9% year-over-year gain in March—a 0.4% increase from the previous month. On a monthly basis, the index increased 0.5% between February and March. Because of the two-month lag in the data for the index, the effects of the coronavirus pandemic on the housing market were not yet fully reflected in the data. Home prices have managed to thus far shrug off most of the economic impact of the coronavirus pandemic. Robert Kavcic, senior economist at BMO Capital Markets stated in a research note, “While March was still early days, it’s looking likely that the initial impact will be felt mostly on plunging sales and listings volumes, not prices.”

Sales of new homes ticked up 0.6% from March to April, to a seasonally-adjusted annual rate of 623,000 the government reported. Compared with the previous year, however, new home sales were down 6.2%. The reading was far higher than analysts’ expectations of just 480,000 new homes sold. However, because of the small sample size used to produce the new‑home sales report, it is prone to often significant revisions. By region, the Northeast experienced the largest increase with an 8.7% uptick, while new home sales rose 2.4% in the both the Midwest and the South. Sales fell 6.3% in the West. The median price of a new home sold was $309,900—down 8.5% from the same time last year. Furthermore, there was a 6.3 months’ supply of available homes on the market. Six months of inventory is generally considered a “balanced” housing market.

The Conference Board reported that the confidence of American consumers stabilized in May after sharp drops in March and April. The board’s Consumer Confidence Index ticked up 0.9 points in May to 86.6. Economists had expected a 4.6 point decline to 82.3. This initial sign of stabilization is particularly important as strengthening confidence should translate into a pickup in consumer spending, necessary for any reacceleration of broad economic growth. Consumers’ assessment of the present situation remained dire, with that indicator falling 1.9 points to 71.1—its lowest level since August 2013. However, consumer expectations for the near future surprisingly rose 2.6 points to 96.9, a three-month high.

Orders for goods expected to last at least 3 years, so-called “durable goods”, plunged -17.2% in April. Economists had forecast a decline of -18.2%. A key measure of business investment which strips out defense and transportation categories fell a lesser -5.8%. Orders for durable goods have declined three out of the last four months. CIBC economists Andrew Grantham and Katherine Judge in a note, “While the decline in durable goods orders in April wasn’t quite as bad as expected, the opening up of capacity in the industrial sector and continued struggles in the aviation industry will likely mean the rebound in the second half of the year in business investment lags behind other areas of the economy.”

The Chicago Federal Reserve reported that economic activity across the nation fell sharply in April. The Chicago Fed’s National Activity Index registered a -16.74 in April, a record low. The index’s less-volatile three month moving average declined to a -7.22 from -1.69, also a record low for the three-month measure. The regional bank noted there is an increasing likelihood of a recession when the three-month moving average falls below -0.7. The National Activity index is a weighted average of 85 economic indicators. A zero value indicates that the economy is expanding at its historic trend rate of growth. In April’s reading, 79 of the 85 individual indicators made negative contributions, while only 6 were positive.

The Federal Reserve’s latest “Beige Book”—a collection of anecdotal reports from each of the Federal Reserve’s district banks about economic conditions in their respective areas, showed economic activity falling sharply and steep job losses nationwide. Some sectors, like leisure and hospitality, continued to be hit hardest by the stay-at-home orders, while factory activity and agriculture also continued to deteriorate. One bright spot was an upturn in auto sales towards the middle of May. Thomas Simons, money market economist at Jefferies stated, “The bottom line is that the U.S. economy is quite far from being out of the woods yet. If there is anything to be gleaned about policy, it is that more needs to be done on the fiscal and monetary front, or perhaps both, before a meaningful recovery can take hold.”

International Economic News: Canada’s economy shrunk the most since the 2008-09 financial crisis, with some Canadian economists expecting the deepest contraction since World War 2. Statistics Canada reported gross domestic product dropped at an annualized -8.2% in the first quarter of the year. The agency also released preliminary estimates for April that show an 11% plunge in output, which follows a 7.2% drop in March when coronavirus restrictions were imposed halfway through the month. According to Bank of Montreal’s Doug Porter, Canada’s first quarter contraction is right in the middle of the pack among Group of Seven countries, better than the three Eurozone member countries but worse than the U.S., Japan and the U.K. “The new news here is that the figures were a little less dire than feared,” Porter said in a report.

According to a Guardian analysis, the British economy is showing its first signs of emerging from the worst of the economic damage triggered by the coronavirus pandemic. Analysts at the Guardian used eight economic indicators as well as the level of the FTSE 100 to gauge the state of the economy. Two components, the flash IHS Markit and Chartered Institute of Procurement and Supply purchasing managers indexes revealed a steeper pace of economic contraction than expected persisted in May. Writing in the Guardian, the governor of the Bank of England, Andrew Bailey, said Britain was entering the “second phase” of the crisis and warned the risks are “undoubtedly on the downside for a longer and harder recovery”. The new Guardian project will track the repercussions of the coronavirus pandemic on the United Kingdom’s economy.

For the first time ever, France has been named the top destination for foreign investment in Europe, overtaking both the United Kingdom and Germany. In newly released data from 2019, France showed the highest level of foreign investment. In total, France recorded a 17% increase in 2019 with 1,197 foreign investment projects while the UK showed a 5% rise to 1,109. German foreign investment projects flatlined at 971. Two thirds of business leaders surveyed at the end of April by consultancy firm EY expected to revise their French investment plans this year and 15% expected to push them back to 2021. Amazingly, none expected to cancel projects. President Emmanuel Macron has put making France more business-friendly at the heart of his presidency and has introduced a series of measures to boost the country's attractiveness to investors including loosening the strict labor laws.

The Munich-based economic think-tank Institute for Economic Research (Ifo) stated the German economy could enjoy a strong recovery next year following its record-setting economic slump in 2020. In an updated economic forecast, researchers reiterated that they expect the national economy to shrink by 6.6% in 2020, worse than a slump of 5.7% brought on by the 2008-2009 financial crisis. Nonetheless, a recent survey indicates that the situation could make a drastic turnaround in 2021, when Ifo predicts that Germany's economy could grow by 10.2%. The basis for the new sunnier forecast is the Ifo Institute's latest survey of 9,000 German companies. On average, these businesses expect their own economic situation to normalize within nine months, Chief Economic Researcher Timo Wollmershäuser said. "After a significant slump of 12.4% in the second quarter of 2020, the economy should recover by the middle of next year," he said, adding that only after that point would goods and services be produced on the same level as a situation without the coronavirus.

China pledged a package of 4 trillion yuan ($559 billion USD) worth of cost cuts for the country’s struggling factories and merchants this year, the largest rescue plan in the country’s history. The combined cuts on business costs will be in addition to the 2 trillion yuan in additional fiscal spending and government bond issuances announced earlier. Premier Li Keqiang stated the new round of pro-growth measures would focus on “ensuring employment, people’s livelihoods and [helping] market entities”. In addition, Li said Beijing has many fiscal, financial and social security policies in reserve, and it will roll out additional policy support “without hesitation”.

Japan doubled down and delivered the world’s biggest stimulus package to its economy. Prime Minister Shinzo Abe approved a 117 trillion yen ($1.1 trillion USD) relief package, doubling the amount previously committed in April. The new measures bring the total of Japan's stimulus spending to 234 trillion yen ($2.2 trillion) — a staggering amount equivalent to almost 40% of the annual Japanese output. The latest package includes rent subsidies for individuals, as well as for small and medium size businesses hit hard by the Covid-19 pandemic. The government will also pay 200,000 yen ($1,860) each to front line medical workers. "The economic revival would be the first priority for my administration," Abe said earlier this week.

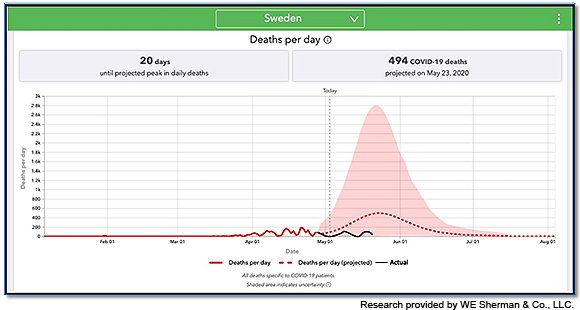

Finally: Sweden pursued its own distinct path in confronting the coronavirus pandemic. By choosing to keep its economy open, rather than instituting a policy of lockdown, it is the only major nation expected to report a positive gross domestic product reading for the first quarter. Epidemiologist Anders Tegnell, the architect behind Sweden’s policy, has repeatedly doubled down on the merits of his country's approach. Sweden, he said, is playing the long game despite the country currently experiencing a much higher death rate than its neighbors. “In the autumn, there will be a second wave. Sweden will have a high level of immunity and the number of cases will probably be quite low,” Tegnell said in an interview. “But [neighboring] Finland will have a very low level of immunity. Will Finland have to go into a complete lockdown again?” Critics, such as infectious disease expert Stefan Hanson, noted that Sweden’s mortality per million is as much as five times higher than all the other Nordic countries, though still lower than numerous other countries. What can be said unequivocally is that the disaster predicted by many to befall Sweden because of its relaxed response to the pandemic has simply not occurred…at least not yet. The chart below shows the actual number of covid-19 deaths (red then black line) vs the projected number (dotted line) and the worst-case number (shaded area). (Chart by Yinon Weiss from Institute for Health Metrics and Evaluation (IHME) data)

(Sources: All index- and returns-data from Yahoo Finance; news from Reuters, Barron’s, Wall St. Journal, Bloomberg.com, ft.com, guggenheimpartners.com, zerohedge.com, ritholtz.com, markit.com, financialpost.com, Eurostat, Statistics Canada, Yahoo! Finance, stocksandnews.com, marketwatch.com, wantchinatimes.com, BBC, 361capital.com, pensionpartners.com, cnbc.com, FactSet.)