July 2023 Farm Equipment

Submitted by The Blakeley Group, Inc. on July 19th, 2023The very big picture (a historical perspective):

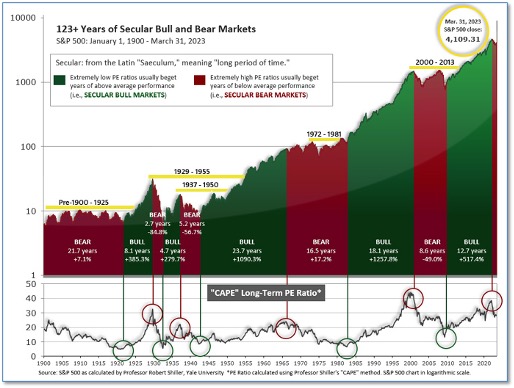

The long-term valuation of the market is commonly measured by the Cyclically Adjusted Price to Earnings ratio, or “CAPE”, which smooths-out shorter-term earnings swings in order to get a longer-term assessment of market valuation. A CAPE level of 30 is considered to be the upper end of the normal range, and the level at which further PE-ratio expansion comes to a halt (meaning that further increases in market prices only occur as a general response to earnings increases, instead of rising “just because”). The market was recently above that level and has fallen back.

Of course, a “mania” could come along and drive prices higher - much higher, even - and for some years to come. Manias occur when valuation no longer seems to matter, and caution is thrown completely to the wind - as buyers rush in to buy first, and ask questions later. Two manias in the last century - the “Roaring Twenties” of the 1920s, and the “Tech Bubble” of the late 1990s - show that the sky is the limit when common sense is overcome by a blind desire to buy. But, of course, the piper must be paid, and the following decade or two were spent in Secular Bear Markets, giving most or all of the mania-gains back.

Figure 1

See Fig. 1 for the 100-year view of Secular Bulls and Bears. The CAPE is now at 31.07, up from the prior week’s 30.35. Since 1881, the average annual return for all ten-year periods that began with a CAPE in this range has been slightly positive to slightly negative (see Fig. 2).

Note: We do not use CAPE as an official input into our methods. However, if history is any guide - and history is typically ‘some’ kind of guide - it’s always good to simply know where we are on the historic continuum, where that may lead, and what sort of expectations one may wish to hold in order to craft an investment strategy that works in any market ‘season’ … whether the current one, or one that may be ‘coming soon’!

The big picture:

As a reading of our Bull-Bear Indicator for U.S. Equities (comparative measurements over a rolling one-year timeframe), we entered a new Cyclical Bull on April 21, 2023.

The complete picture:

Counting-up of the number of all our indicators that are ‘Up’ for U.S. Equities (see Fig. 3), the current tally is that four of the four are Positive, representing a multitude of timeframes (two that can be solely days/weeks, or months+ at a time; another, a quarter at a time; and lastly, the {typically} years-long reading, that being the Cyclical Bull or Bear status).

In the markets:

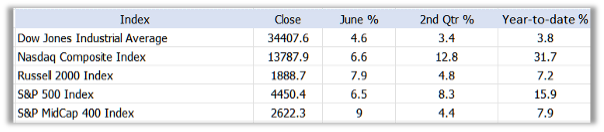

U.S. Markets: Positive growth and inflation surprises helped the major benchmarks round out a solid quarter on a high note, with the S&P 500 Index recording its best weekly gain since the end of March. The rally also broadened, with small-caps and value shares outperforming, and the equal-weighted S&P 500 Index handily outpacing its market-weighted counterpart. The technology-heavy Nasdaq Composite remained well ahead of the other benchmarks for the year-to-date ending the week with a six-month gain of nearly 32%, its best start to the year since 1983. The Dow Jones Industrial Average rose 2% last week finishing the quarter at 34,408, while the Nasdaq Composite added 2.2%. By market cap, the large cap S&P 500 rose 2.3%, the mid cap S&P 400 rallied 4.3%, and the small cap Russell 2000 gained 3.7%.

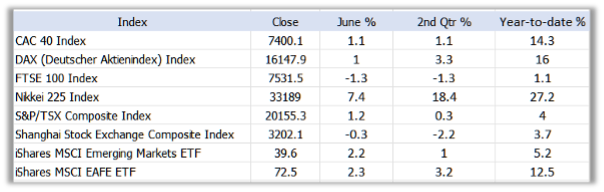

International Markets: Major international markets finished the week in the green as well. Canada’s TSX rebounded 3.8% and the United Kingdom’s FTSE 100 tacked on 0.9%. France’s CAC 40 and Germany’s DAX rose 3.3% and 2.0% respectively, while China’s Shanghai Composite ticked up 0.1%. Japan’s Nikkei finished up 1.2%. As grouped by Morgan Stanley Capital International developed markets gained 2.2%. Emerging markets finished the week up 1%.

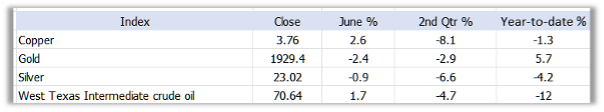

Commodities: Major commodities finished the week mixed. Gold ticked down -0.01% holding steady at $1929.40 per ounce, while Silver rose 3% to $23.02. The industrial metal copper, viewed by some analysts as a barometer of world economic health due to its wide variety of uses, finished the week down -1.2%. West Texas Intermediate crude oil rose 2.1% to $70.64 per barrel.

U.S. Economic News: The number of Americans who applied for first-time unemployment benefits last week fell to a one-month low, indicating the U.S. labor market remains fairly robust. The Labor Department reported initial jobless claims declined by 26,000 to 239,000. Jobless claims declined in 35 of the 53 states and territories that report these figures. Senior economist advisor Stuart Hoffman of PNC Financial Services stated, “Even with the increase this year initial claims remain quite low on an historical basis.” Meanwhile, the number of people already collecting unemployment benefits fell by 19,000 to 1.74 million—its lowest level since February.

Despite elevated mortgage rates, existing home prices continued to rise as homeowners remained reluctant to sell. The S&P CoreLogic Case-Shiller 20-city home price index rose 0.9% in April. Home prices remained the strongest in the Southeast, while the rest of the country saw declines. Seattle and San Francisco led the way with home value declines over the past year, down -12.4% and -11.1% respectively. Most existing homeowners either bought or refinanced at rates at or below 3%, so there’s little incentive to give up their low mortgage rate for a home loan in the 7% range.

Orders for manufactured goods jumped 1.7% in May and rose for a third consecutive month boosted by strong demand for aircraft and new vehicles. The reading far exceeded economists’ expectations for a 0.9% decline. Notably, “core orders”, which exclude defense and aircraft rose 0.7%. However, these orders are up just 2% over the past year and underscore the big slowdown that’s taken place since the end of 2021 as higher interest rates began to weigh on growth. Higher interest rates have dampened demand for expensive manufactured goods and consumers have shifted more of their spending to services such as travel.

Confidence among the nation’s consumers rose to a 17-month high this month, reflecting fewer worries about a recession. The Conference Board reported its consumer confidence index increased 7.2 points to 102.5. The measure of how consumers feel about the economy right now rose to 155.3 from 148.9—its highest level in two years, while the gauge that looks ahead six months rose to 79.3 from 71.5—its highest reading this year. Consumers have made it clear for the past year that they are unhappy about the economy, yet they are still spending like the economy is in good shape. Analysts note that despite high inflation, unemployment remains low and people feel secure in their jobs giving them the confidence to spend.

In a conference in Madrid, Federal Reserve Chairman Jerome Powell stated the risks of ‘overdoing’ and ‘underdoing’ rate hikes aren’t in balance just yet. “In the beginning, there was a little risk of overdoing it and a lot of risk of underdoing it. As you get closer and closer to where you think you’re going to your destination, those risks begin to become more into balance,” said Powell, in comments during a panel discussion at the Bank of Spain’s financial-stability conference. “I wouldn’t say they’re in balance yet.” Powell noted a “strong majority” of Fed policy makers were looking for two more quarter-percentage-point interest-rate hikes this year, potentially at the next policy meeting in July. “The decision was made not to move in one meeting so that we can have more information,” he said.

Inflation pressures eased slightly in May as consumer spending slowed considerably, according to a Commerce Department report. The core personal consumption expenditures price index, a number closely watched by the Federal Reserve, increased 0.3% for the month. On the year, core PCE inflation increased 4.6%, though the headline number was up just 3.8%. Spending rose just 0.1% for the month, below the 0.2% estimate and a sharp drop from the 0.6% increase in April. “The spending splurge is likely nearing the end as consumers released most of the pent-up demand for spending,” said Jeffrey Roach, chief economist at LPL Financial.

The economy performed better than initially reported, according to the latest revision of first quarter GDP. Higher interest rates had been expected to slow down the economy this year, but it grew at a solid 2.0% annual pace in the first quarter, updated figures show—0.7% higher than the initial report. The U.S. is also expected to expand between 1% to 2% in the second quarter that ends on Friday, based on the most recent forecasts. The increase in GDP in the first quarter was led by strong consumer spending, the main engine of the economy. Consumer spending rose 4.2% from a prior 3.8% annual clip, explaining most of the upward increase in GDP. It was the biggest gain in two years.

International Economic News: The pace of inflation in Canada slowed in May, weakening the case for a rate hike in July. Canada's annual inflation rate came in at 3.4% in May, its slowest pace in two years. Analysts had expected the rate to come in at a range of 3.4%-4.4%. On a monthly basis, the consumer price index was up 0.4%, Statistics Canada said—a tick lower than forecasts of 0.5%. The annual rate, which benefited from comparison to last May's strong price increases, is the slowest since June 2021 and broadly in line with the Bank of Canada's expectation that inflation will cool to around 3% by mid-year. The inflation reading "might give the Bank of Canada some reason to skip July," said Derek Holt, vice president of capital markets at Scotiabank. While Holt sees another hike coming this year, he characterized it as "fine tuning" and now more likely in September.

The Bank of England’s quantitative easing money-printing program enabled high inflation to take root in Britain, while creating “windfall gains” for the rich, a former Treasury secretary has warned. Nick Macpherson, who was permanent secretary to the Treasury under the last Labour government and during David Cameron’s premiership, said the central bank’s £895bn bond-buying stimulus program had gone “too far” and made the inflation shock hitting Britain worse. “I once compared it to heroin. The economy gets addicted to it and needs bigger and bigger fixes for it to have an impact,” he told the Lords economic affairs committee this week.

French President Emmanuel Macron's government will need to make an unprecedented effort to rein in spending for France to meet its deficit-reduction target, the national public audit office said. Macron's government aims to reduce its public sector budget deficit to 2.7% by the end of his five-year term in 2027 from an estimated 4.9% of economic output this year. The gradual reduction in the budget shortfall meant that France would be the only large euro zone economy to still have a deficit in excess of a European Union limit of 3% in 2026, the Cour des Comptes said in its annual outlook for the public finances. With the highest public spending among rich countries relative to the size of its economy, France has rarely respected the EU limits.

The health of Germany’s business sector dropped significantly in June, according to data from research institute Ifo. The Ifo Business Climate index for Germany, which measures the health of the commercial sector, registered 88.5 in June, down from 91.5 in May. This sign of weakness follows the manufacturing Purchasing Managers Index (PMI) released last week, which also showed a dramatic fall. That reading fell to 41 in June from 43.2 in the previous month—its 11th consecutive decline. Analysts at London-based Capital Economics wrote, “Overall, the surveys for June leave us comfortable with our forecast for German GDP to fall again in Q2. And with stagnating real incomes, rising interest rates, and weakening external demand set to keep weighing on activity, we expect further contractions in Q3 and Q4."

Official surveys showed China's factory activity declined for a third straight month in June and weakness in other sectors deepened, adding pressure for authorities to do more to shore up growth as demand falters at home and abroad. The world's second-largest economy grew faster than expected in the first quarter largely due to a strong post-COVID rebound in consumption, but policymakers have been unable to sustain the momentum in the second quarter. Services sector activity for June also recorded its weakest reading since China abandoned its strict COVID curbs late last year, data from the National Bureau of Statistics showed. The official manufacturing purchasing managers' index (PMI) inched up to 49.0 from 48.8 in May, staying below the 50-point mark that separates expansion from contraction and in line with forecasts. The non-manufacturing PMI fell to 53.2 from 54.50 in May, indicating a slowdown in service sector activity and construction.

Japan’s stock markets have been testing new highs not seen since 1990 evoking memories of its “bubble economy” right before the country plunged into its so-called “lost decade.” Since late May, the Nikkei 225 has breached the 30,000-mark, a level not seen in 33 years. To be clear, the benchmark index is still about 18% below its all-time high when the Nikkei hit 38,915 on Dec. 29, 1989. The bubble burst after the Bank of Japan tightened monetary policy at the start of 1990, triggering the collapse of equity and land prices. By September of that year, the Nikkei index crashed to just half its record high.

Finally: The cost of farm equipment continues to soar, but it might not be the tractors, combines, and harvesters you expect. The newest tractors and combines come with all sorts of bells and whistles like GPS, automation, remote operation, sensors, and diagnostics. But as many in the farm belt already know, the real demand is for older used farm equipment. Many farmers are ditching new high-tech tractors in favor of older tractors with less technology that are easier to work on and faster to repair. For example John Deere equipped its newest tractors with sophisticated technology but didn’t give farmers the tools needed to fix their own equipment setting off a debate over “right-to-repair”. Deere finally caved this year by giving farmers the tools they needed.

(Sources: All index- and returns-data from Norgate Data and Commodity Systems Incorporated; news from Reuters, Barron’s, Wall St. Journal, Bloomberg.com, ft.com, guggenheimpartners.com, zerohedge.com, ritholtz.com, markit.com, financialpost.com, Eurostat, Statistics Canada, Yahoo! Finance, stocksandnews.com, marketwatch.com, wantchinatimes.com, BBC, 361capital.com, pensionpartners.com, cnbc.com, FactSet.)