AUG 2021 The Electric Vehicle Revolution

Submitted by The Blakeley Group, Inc. on August 12th, 2021The very big picture (a historical perspective):

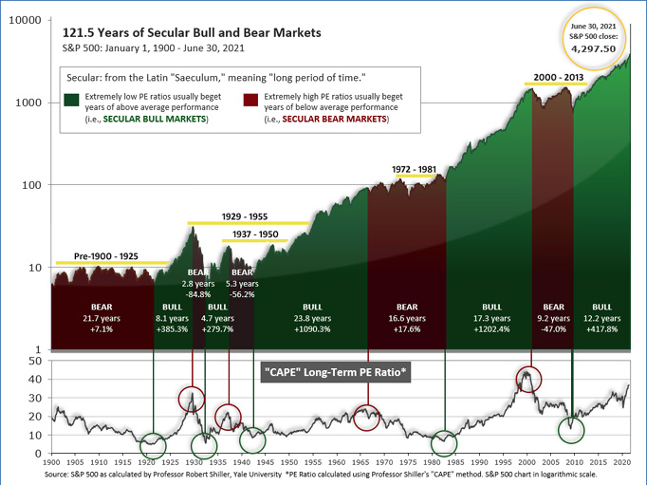

The long-term valuation of the market is commonly measured by the Cyclically Adjusted Price to Earnings ratio, or “CAPE”, which smooths-out shorter-term earnings swings in order to get a longer-term assessment of market valuation. A CAPE level of 30 is considered to be the upper end of the normal range, and the level at which further PE-ratio expansion comes to a halt (meaning that further increases in market prices only occur as a general response to earnings increases, instead of rising “just because”). The market was recently at that level.

Of course, a “mania” could come along and drive prices higher - much higher, even - and for some years to come. Manias occur when valuation no longer seems to matter, and caution is thrown completely to the wind - as buyers rush in to buy first, and ask questions later. Two manias in the last century - the “Roaring Twenties” of the 1920s, and the “Tech Bubble” of the late 1990s - show that the sky is the limit when common sense is overcome by a blind desire to buy. But, of course, the piper must be paid, and the following decade or two were spent in Secular Bear Markets, giving most or all of the mania-gains back.

Figure 1

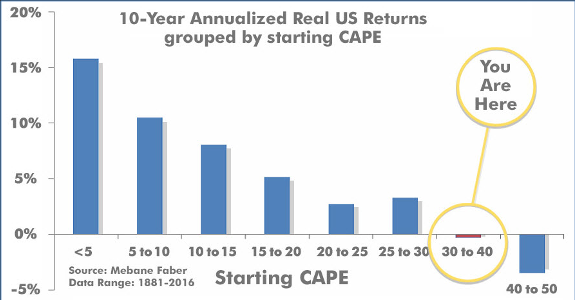

See Fig. 1 for the 100-year view of Secular Bulls and Bears. The CAPE is now at 38.21, up from the prior week’s 37.92. Since 1881, the average annual return for all ten-year periods that began with a CAPE in the 30-40 range has been slightly negative (see Fig. 2).

Note: We do not use CAPE as an official input into our methods. However, if history is any guide - and history is typically ‘some’ kind of guide - it’s always good to simply know where we are on the historic continuum, where that may lead, and what sort of expectations one may wish to hold in order to craft an investment strategy that works in any market ‘season’ … whether current one, or one that may be ‘coming soon’!

Figure 2

The big picture:

As a reading of our Bull-Bear Indicator for U.S. Equities (comparative measurements over a rolling one-year timeframe), we remain in Cyclical Bull territory.

The complete picture:

Counting-up of the number of all our indicators that are ‘Up’ for U.S. Equities (see Fig. 3), the current tally is that four of four are Positive, representing a multitude of timeframes (two that can be solely days/weeks, or months+ at a time; another, a quarter at a time; and lastly, the {typically} years-long reading, that being the Cyclical Bull or Bear status).

In the markets:

U.S. Markets: The benchmark S&P 500 large cap index and technology-heavy NASDAQ Composite moved to new highs and closed out a fifth consecutive quarterly advance this week. The Dow Jones Industrial Average added 353 points finishing the week at 34,786, a gain of 1%. The NASDAQ, likewise, finished the week up 1.9%. By market cap, the S&P 500 added 1.7%, while the mid cap S&P 400 and small cap Russell 2000 retreated -0.6% and -1.2%, respectively.

International Markets: In international markets, Canada’s TSX closed essentially unchanged, while the United Kingdom’s FTSE 100 ticked down -0.2%. On Europe’s mainland France’s CAC 40 gave up -1.1%, while Germany’s DAX rose 0.3%. China’s Shanghai Composite declined -2.5% and Japan’s Nikkei retreated -1.0%. As grouped by Morgan Stanley Capital International, developed markets declined -0.8% and emerging markets fell -1.3

Commodities: Precious metals finished the week to the upside, with Gold rising 0.3% to $1783.30 an ounce and Silver adding 1.6% to $26.50. Oil had its sixth consecutive week of positive closes finishing the week up 1.5% to $75.16 per barrel for West Texas Intermediate crude. The industrial metal copper, viewed by some analysts as a barometer of world economic health due to its wide variety of uses, ended the week down -0.4%.

June and Q2 Summary, U.S.: The Nasdaq led the way in June with a 5.5% gain, followed by the S&P 500, up 2.2%, and the Russell 2000, up 1.9%. The Dow and mid caps finished the month down -0.1% and -1.1% respectively. In the second quarter, the NASDAQ led the pack with a gain of 9.5%. The Dow rose 4.6% while Large caps rallied 8.2% and mid caps and small caps tacked on a smaller 3.3% and 4.1%, respectively.

June and Q2 Summary, International: Canada and European stocks were the best international performers in June. Canada rose 1.6%, the UK gained 0.2%, France added 0.4% and Germany ticked up 0.1%. China retreated -0.3% and the Nikkei pulled back -1.2%. Emerging markets as a group finished the month flat, while developed markets ended the month down ‑1.3%. In the second quarter, Canada rose 7.8%, the UK gained 4.8%, France rallied 7.3%, and Germany added 3.5%. China rose 4.3%, while Japan declined -1.3%. Emerging markets added 3.1%, while developed markets gained 4.1% in the quarter.

June and Q2 Summary, Commodities: June was not kind to precious metals. Gold and Silver retreated -7.0% and ‑6.5%, respectively. June was better for oil, which rallied 10.8% in the month. Copper finished the month down ‑8.3%. In the second quarter, Gold gained 3.3%, Silver added 6.8%, and Copper rose 7.4%, while oil beat them all by soaring 24.2%.

U.S. Economic News: The number of Americans filing for first-time unemployment benefits sank to a pandemic low as extra benefits began to phase out. The Labor Department reported new applications for unemployment benefits fell by 51,000 last week to a new pandemic low of 364,000, further evidence of the rapid economic rebound and more aggressive efforts by companies to hire workers. The decline in new claims was bigger than expected. Economists had expected a reading of 390,000. Of note, the enhanced federal benefits due to the coronavirus are set to expire in all states in September. New jobless claims posted the biggest decline in Pennsylvania, and fell sharply in Kentucky, California, Texas, Illinois, Michigan and Ohio. Meanwhile, continuing claims, which counts the number of people already receiving benefits rose by 56,000 to 3.47 million. Continuing claims had dropped to a pandemic low the prior week.

The U.S. added the most new jobs in almost a year in June as the economy perked up and companies rushed to hire more workers. The Bureau of Labor Statistics reported the U.S. created 850,000 new jobs. Economists had forecast just 706,000 new jobs. Most of the new jobs were in service-oriented positions such as restaurants, hotels, and retailers. Government payrolls also rose by 188,000, but that was largely the result of pandemic-related effects on education. The unemployment rate, meanwhile, rose slightly to 5.9% from 5.8%. Despite the robust economic recovery and record number of job openings, unemployment remains quite high. Some 26 states will stop giving out extra federal benefits of up to $300 a week by early July in an effort to nudge people to return to work.

The National Association of Realtors (NAR) reported that pending home sales rose 8% in May, well above the consensus forecast of a 1% decline. Compared with the same time last year, pending home sales were up 13.1%, but at that time last year home sales activity had fallen amid the onset of the COVID-19 pandemic. Lawrence Yun, chief economist at NAR stated, “May’s strong increase in transactions--following April’s decline, as well as a sudden erosion in home affordability--was indeed a surprise.” In the report, all regions saw an uptick in sales, led by a 15.5% surge in the Northeast. The South saw the smallest increase, with a 4.9% uptick.

Home prices rose at their fastest pace on record in April according to the latest data from S&P CoreLogic. S&P’s Case-Shiller National Home Price index increased 14.6% over the past year—the highest year-over-year reading in more than 30 years of data. The separate 20-city index, which gauges home prices across a group of major cities across the country, increased at an even higher 14.9%, well over the 13.3% growth recorded the month prior. Comparisons between April 2020 and April 2021 are skewed due to the onset of the coronavirus pandemic, but even given that, home prices have been on a tear. CoreLogic deputy chief economist Selma Hepp stated, “Pressures on home prices that have built over the last year culminated in the strongest home-price growth since the beginning of the data series in 1987.” As in recent months, Phoenix, San Diego and Seattle experienced the largest gains over the past year, with home prices in all three of these cities rising 20% from last April. Overall, there were five cities where home prices rose by record amounts: Charlotte, Cleveland, Dallas, Denver and Seattle.

Confidence among the nation’s consumers surged in June, hitting its highest level since before the onset of the pandemic. The Conference Board reported its Consumer Confidence index rose over 7 points to 127.3, reflecting the growing sense that fears of COVID are fading away and people can get on with their lives. Economists had expected a reading of just 118.7. The index has risen for six consecutive months. The U.S. economy is surging again given the massive government stimulus and number of new jobs available. In the details, the part of the survey that asks how consumers feel about the economy right now shot up by almost 10 points to 157.3 - more than double the pandemic low of 68.4 in May 2020. Consumers were optimistic about the future, too. A measure of how Americans view the next six months rose to 107 from 100.9 - almost back to pre-crisis levels.

A survey of U.S. manufacturers slipped in May, according to the Institute for Supply Management (ISM). The ISM reported manufacturing activity dropped to 60.6 in June from 61.2 in May. Businesses are still struggling to cope with broad shortages of key supplies and skilled labor as customer demand for their goods soared above pre-pandemic levels. Although readings above 60 are considered exceptional, companies still had lots of concerns as orders continue to roll in. The survey highlighted that prices for many materials have risen sharply, products aren’t getting delivered on time, and in some cases companies simply lack enough labor to make as much as they can sell.

International Economic News: Canada’s economy appears to have suffered its worst two-month stretch since the onset of the pandemic over a year ago. Statistics Canada reported real gross domestic product fell 0.3% in April, although that was better than the initial estimate of a 0.8% decline a few weeks ago. It was the first decline in real GDP since April 2020. The agency also said its preliminary estimate for May showed a similar drop of 0.3% as many restrictions remained in place through the month while the country grappled with the third wave of the COVID-19 pandemic. The overall decline in April plus the early estimate for May put overall economic activity about one per cent below pre-pandemic levels seen in February 2020.

Across the Atlantic, the Bank of England’s outgoing chief economist warned that inflation could rise by more than expected and force the central bank into a dangerous “handbrake turn” to stop the economy from overheating. Andy Haldane said he expected that a surge in consumer prices would drive UK inflation close to 4% this year. The Bank’s nine-member monetary policy committee (MPC), from which he is standing down, said last week it expected inflation to peak at 3% by the end of 2021, before falling back in 2022 as the post-Covid economic boom fades. Haldane said there were reasons to believe that current isolated pockets of rising prices in parts of the UK economy would translate into a wider “significant and persistent” rise in inflation.

On Europe’s mainland, France’s Finance Ministry reported payment card data showed spending was up 18% in the third week of June from the same period in 2019, with little sign of slowing down. Finance Minister Bruno LeMaire said “The real surprise is that it’s holding up over time. That proves that (consumers) are using their savings for consumption and reviving the economy.” Spending on electronic goods was up more than 45%, and nearly 30% on clothes while spending in hotels and restaurants was up more than 10%, the data showed. In related news, French statistics agency INSEE reported its consumer confidence index jumped to 102 in June from 98 in May, surpassing economists’ average expectation for a reading of 100.

Electricity demand in Germany, Europe’s leading power market, has stagnated at levels seen before the onset of the coronavirus. Citing research for the first half of the year, Team Consult said net German power consumption last year was down 4.6% after accounting for imports and exports, storage movements and grid losses data from utility group BDEW showed. Nonetheless, Team Consult noted macro-economic analysis showing that Germany's manufacturing activity had held up strongly during the pandemic, mostly undisturbed by lockdowns, helped by generous state support measures. "The accelerating economy will continue to hold up demand for commodities," it predicted.

The Chinese government has gone “too far” in cracking down on large technology companies, which will hurt innovation and slow down economic growth, said Scott Kennedy senior advisor and trustee chair in Chinese business and economics at the Center for Strategic and International Studies. Regulators in China have in the last few months ramped up scrutiny on the country’s tech giants such as Alibaba and Tencent. The companies now face fines and new rules aimed at reining in monopolistic business practices. Kennedy said the crackdowns have “basically scared the innovators from innovating”. The crackdown may hinder the formation of new companies, while existing firms--particularly small ones--may be scared to make investments in the future, he added.

Business sentiment among Japan's large manufacturers has improved to the highest level since 2018, the Bank of Japan's latest Tankan survey shows, raising hopes that the economy is finally in for sustained growth. The improvement reflects strong international demand, as the U.S. and Chinese economies continue to recover steadily, boosting demand for Japanese autos and machinery. The headline diffusion index of sentiment among large manufacturers came to plus 14 in June, compared with plus 5 in March, marking a fourth straight quarter of improvement. The latest Tankan survey, conducted over the past month, covers some 9,400 companies of various sizes and industries in Japan.

Finally: What if a large factor in the current worker shortage is...unexpectedly high retirements? Oxford Economics and Capital Economics analysts have highlighted the huge jump in recent baby-boomer retirements, each one of which is another worker removed from the country’s workforce. Michael Pearce of Capital Economics writes “…that is equivalent to 2 million workers, which would explain more than half of the current shortfall in the labor force." Bob Schwartz of Oxford Economics notes that “…older households hold more wealth than younger ones, and the improved balance sheets of senior workers may well have tipped them over into retirement.” (Chart from Capital Economics)

(Sources: All index- and returns-data from Yahoo Finance; news from Reuters, Barron’s, Wall St. Journal, Bloomberg.com, ft.com, guggenheimpartners.com, zerohedge.com, ritholtz.com, markit.com, financialpost.com, Eurostat, Statistics Canada, Yahoo! Finance, stocksandnews.com, marketwatch.com, wantchinatimes.com, BBC, 361capital.com, pensionpartners.com, cnbc.com, FactSet.)