July 2016: S&P 500 Regained Almost All of the Brexit-related Declines

Submitted by The Blakeley Group, Inc. on July 7th, 2016Even if we are in a new Secular Bull Market, market history says future returns are likely to be modest at best.

NOTE: Areas with blue text show the most recent market updates since the June Capital Highlights email.

The very big picture:

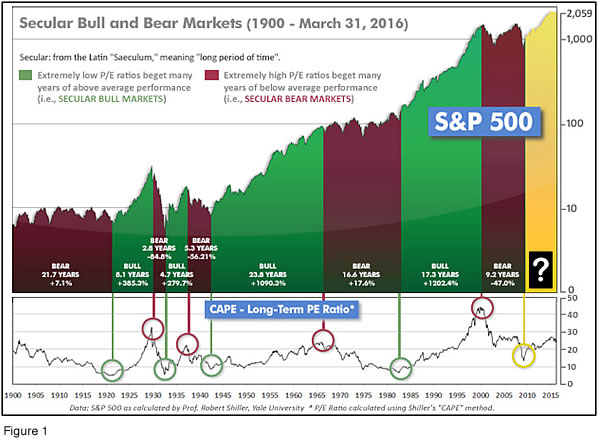

In the "decades" timeframe, the question of whether we are in a continuing Secular Bear Market that began in 2000 or in a new Secular Bull Market has been the subject of hot debate among economists and market watchers since 2013, when the Dow and S&P 500 exceeded their 2000 and 2007 highs. The Bear proponents point out that the long-term PE ratio (called “CAPE”, for Cyclically-Adjusted Price to Earnings ratio), which has done a historically great job of marking tops and bottoms of Secular Bulls and Secular Bears, did not get down to the single-digit range that has marked the end of Bear Markets for a hundred years, but the Bull proponents say that significantly higher new highs are de-facto evidence of a Secular Bull, regardless of the CAPE. Further confusing the question, the CAPE now has risen to levels that have marked the end of Bull Markets except for times of full-blown market manias. See Fig. 1 for the 100-year view of Secular Bulls and Bears.

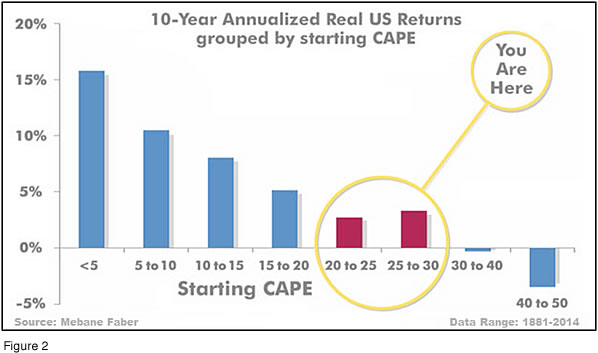

Even if we are in a new Secular Bull Market, market history says future returns are likely to be modest at best. The CAPE is at 26.21, up from the prior week's 25.35 after having earlier reached the level also reached at the pre-crash high in October, 2007. Since 1881, the average annual returns for all ten year periods that began with a CAPE around this level have been just 3%/yr (see Fig. 2).

This further means that above-average returns will be much more likely to come from the active management of portfolios than from passive buy-and-hold. Although a mania could come along and cause the CAPE to shoot upward from current levels (such as happened in the late 1920’s and the late 1990’s), in the absence of such a mania, buy-and-hold investors will likely have a long wait until the arrival of returns more typical of a rip-snorting Secular Bull Market.

In the big picture:

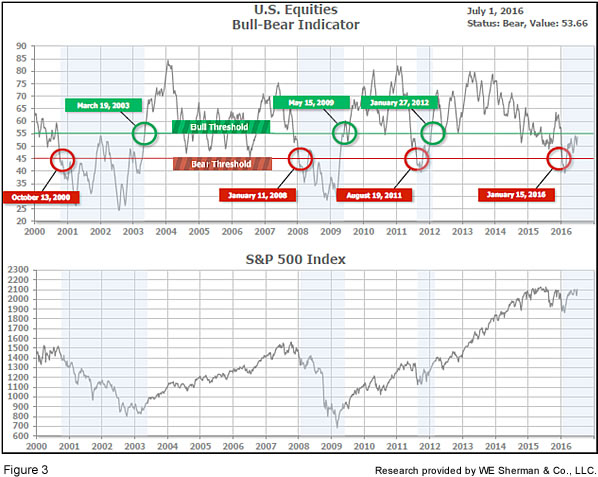

The “big picture” is the months-to-years timeframe – the timeframe in which Cyclical Bulls and Bears operate. The US Bull-Bear Indicator (see Fig. 3) turned negative on January 15th, and remains in Cyclical Bear territory at 53.66, up from the prior week’s 50.56 and very close to the Bull level of 55.

In the intermediate picture:

The intermediate (weeks to months) indicator (see Fig. 4) turned positive on June 29th. The indicator ended the week at 20, down from the prior week’s 28, after a violent drop to 18 followed by a rebound that turned it positive. Separately, the Quarterly Trend Indicator - based on domestic and international stock trend status at the start of each quarter - gave a positive indication on the first day of July for the prospects for the third quarter of 2016.

Timeframe summary:

In the Secular (years to decades) timeframe (Figs. 1 & 2), whether we are in a new Secular Bull or still in the Secular Bear, the long-term valuation of the market is simply too high to sustain rip-roaring multi-year returns. The Bull-Bear Indicator (months to years) is negative (Fig. 3), indicating a new Cyclical Bear has arrived. The Quarterly Trend Indicator (months to quarters) is positive for Q3, and the Intermediate (weeks to months) timeframe (Fig. 4) is positive. Therefore, with two of the three indicators positive, the U.S. equity markets are rated as Mostly Positive.

In the markets:

U.S. stocks traded higher for a fourth consecutive day Friday, with the S&P 500 regaining almost all of the Brexit-related declines. All major U.S. indexes were up, with the Dow Jones Industrial Average, rallying +548 points to 17,949, a healthy gain of +3.15%. The tech heavy NASDAQ composite and LargeCap S&P 500 notched gains of +3.2%. MidCaps and SmallCaps were not quite as strong, with the S&P 400 MidCap index gaining +2.92% and the Russell 2000 SmallCap index rising +2.59%. Despite the “risk-on” nature of the week, even the defensive Dow Utilities index rallied over +4.4%.

In international markets, Canada’s Toronto Stock Exchange rose +1.24% on the heels of renewed strength in energy. In Europe, the United Kingdom’s FTSE surged +7.15% to reach its highest level in a year, confounding doomsayers by exceeding pre-Brexit highs. On the mainland, France’s CAC 40 rose +4.07%, Germany’s DAX gained +2.29%, and Italy’s Milan FTSE added over +3.6%. In Asia, China’s Shanghai Composite Index added +2.7%, Hong Kong’s Hang Seng rose +2.64%, and Japan’s Nikkei surged +4.89%.

In commodities, precious metals continued to shine, with silver surging over +11.4% to $19.86 an ounce. Gold gained +$25.80 ending the week at $1,344.90 an ounce, up +1.96%. Oil continued its rise nearing the $50 a barrel mark, up 3.59% to $49.28 a barrel for West Texas Intermediate crude oil. The industrial metal copper surged over +4.89%.

The month of June was tumultuous, to say the least, but the whole-month results were almost boring. In the U.S., the worst performing index was the NASDAQ Composite, at -2.13%, while all other U.S. indices were within the narrow range of flat plus or minus 1% - remarkable given all the late-month volatility: LargeCap S&P 500 +0.09%, Dow Jones Industrial +0.80%, MidCap S&P 400 +0.23%, SmallCap Russell 2000 -0.23%. International indexes were both the best and the worst: Developed international markets (EFA) lost -2.42% while Emerging International markets (EEM) gained +4.56%. The shiniest return for June was in Gold, which gained +8.47%.

For the Second Quarter, the MidCap S&P 400 paced U.S. indexes with gains of +3.55%, the SmallCap Russell 2000 not far behind at +3.40%, the LargeCap S&P 500 positive at +1.90%, the Dow Jones Industrials positive at +1.38%, but the Nasdaq Composite was negative at -0.56%. Canada’s TSX enjoyed a strong quarter at +4.22%, much better than both Developed International (EFA) at -0.34% and Emerging International (EEM) at +1.11%. The biggest gusher of the quarter was oil, returning +16.85!

In U.S. economic news, initial jobless claims rose by 10,000 to 268,000 last week, exceeding economists’ forecasts of 265,000. New claims remained below the benchmark 300,000 mark for the 69th straight week, the longest streak of sub-300,000 since 1973.

U.S. house prices, according to the S&P/Case-Shiller 20-City Index, were up +5.4% versus a year earlier. As usual, there was sharp division among metro areas. Super-hot metro areas like Portland, Seattle and Denver continue to see double-digit annual price gains, while home prices in legacy cities like New York and Washington rose only +2%. None of the 20 cities showed a decline last month. Nationally, prices are still about 11% lower than the peak in 2007, although 7 of the 20 cities have notched new highs.

Home sales, on the other hand, posted their first annual decline in nearly 2 years, due in part to a tighter home inventory. The National Association of Realtors’ index fell -3.7% to 110.8 in May, from a downwardly-revised 115.0 in April. Economists had forecasted a 1.0% decline. The Realtors index forecasts future sales by tracking transactions in which a contract has been signed, but not yet closed. NAR chief economist Lawrence Yun blamed the decline on an increasingly tight inventory rather than waning interest. “There are simply not enough homes coming onto to the markets to catch up with demand and to keep prices more in line with inflation and wage growth,” he wrote.

Consumer confidence rose to an eight-month high in June as Americans became more optimistic about the economy, according to The Conference Board. The “Confidence Index” subcomponent rose to 98 last month, beating forecasts by 4.5 points. The “Consumer Expectations Index” for the next 6 months climbed to a five-month high of 84.5, up +6 points. The “Present Conditions Index” also advanced to 118.3, the second strongest reading since the fall of 2007. Respondents to the survey said they anticipated more job and income gains in the coming 6 months, which should help lift spending after the first-quarter slowdown.

Personal spending moderated in May following April’s strong +1.1% rise. The Commerce Department reported that spending by Americans’ rose +0.4% in May, matching analyst expectations. Incomes climbed less-than-expected, up 0.2%. Jim O’Sullivan, chief U.S. economist at High Frequency Economics stated “The pick-up in consumption is a big plus for [second quarter] GDP growth.” Purchases rose +0.3% in May after a +0.8% increase in April. Durable goods spending (items meant to last more than 3 years), climbed +0.6% after adjusting for inflation following April’s +2.6% advance. Non-durable goods spending rose +0.5%. Ex-food and energy, the price measure rose +0.2%, matching expectations, and is up +1.6% year-over-year through the end of May.

An indicator of economic activity in the Chicago-area surged in June, as a greater number of purchasing managers signaled improving production and new orders. The Chicago Purchasing Managers Index (PMI) rose to 56.8, up +7.5 points into expansion (>50) territory. The new orders sub-index rose to the highest level since fall of 2014, and order backlogs were the strongest since spring of 2011. For the 2nd quarter as a whole, the Chicago PMI index fell -0.1 point to 52.2.

National U.S. manufacturing grew at the fastest pace in over a year according to the Institute for Supply Management (ISM) manufacturing index, which jumped to 53.2% in June from 51.3%. The ISM reading is back to its highest level since February of 2015. U.S. manufacturers are on their fourth straight month of growth following five months of negative readings (which was the weakest stretch since the Great Recession). Companies have benefitted from recent mild weakness in the value of the U.S. dollar, which makes their goods cheaper overseas. The ISM new orders gauge also increased to a 3-month high of 57% in June, up +1.3% from May. The ISM report agreed with the Purchasing Managers Index (PMI) of national manufacturing conditions, which also hit a 3-month high in June, rising to 51.3 from 50.7.

Canada’s economy rebounded +0.1% in April, in line with analysts’ forecasts. According to figures from Statistics Canada, the economy grew at +0.1% in April following a decline the previous month. Economic output improved in the manufacturing and service sectors, but the important mining and oil and gas extraction segments continued to fall, putting a drag on overall gross domestic product. Manufacturing rose by +0.4% for the month and +1.4% in the last year, driven mainly by transportation equipment manufacturing and primary metal manufacturing.

In the United Kingdom, Bank of England Governor Mark Carney warned that further stimulus measures may soon be needed for the United Kingdom, following the country’s vote to leave the European Union. In a speech at the Bank of England in London he stated “the economic outlook has deteriorated and some monetary policy easing will likely be required over the summer.” Some good news was also revealed, as the UK’s PMI manufacturing index increased to a five month high of 52.1 for June, up from 50.4 the previous month. The International Monetary Fund said that Britain’s exit from the EU poses a “downside risk” to Germany’s economic outlook and that it may lower growth forecast for Europe’s biggest economy in the coming weeks. The IMF’s mission chief for Germany Enrica Detragiache stated that “Britain is an important trade partner for Germany, and significant changes in the economic relationship between the two countries will have repercussions for Germany.”

In Asia, Chinese stocks posted their biggest weekly gain in a month as investors bet that China’s central bank would loosen monetary policy to cushion a possible drop in European demand for Chinese exports resulting from the Brexit vote. In manufacturing, two gauges weakened in June, suggesting that China’s economy slowed in the second quarter. The official manufacturing Purchasing Managers Index (PMI) fell -0.1 point in June from May, while the nonmanufacturing PMI, which measures service sector activity, rose +0.6 point to 53.7. In a separate private manufacturing gauge compiled by Caixin-Markit, manufacturing declined last month at the fastest pace in four months. Taken together, the data suggests that China’s second quarter GDP may trail the first quarter’s annualized +6.7% rise.

Japanese industrial output fell for the sixth consecutive month, down -2.3% in May from April, according to the Ministry of Economy, Trade and Industry. The miss was larger than almost all private forecasts. Factories were affected by weak international demand and the aftershocks of a recent earthquake near the country’s manufacturing center. Retail sales were flat in May and showed a monthly drop in exports, leading to analysts’ concerns that Japan’s recovery is unstable.

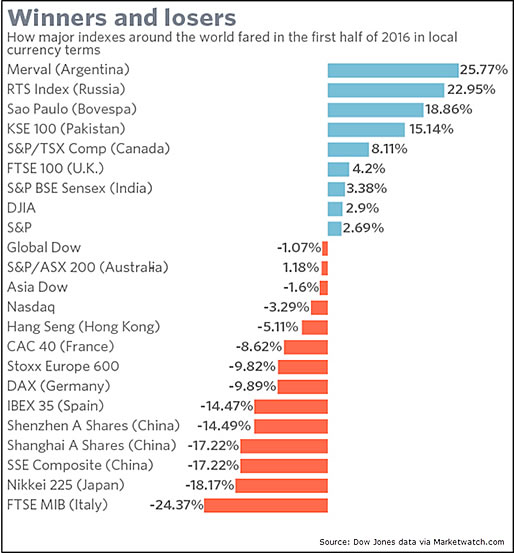

Finally, as we reach the halfway point of the year we can now look back and ask the question “where in the world were the best places to be invested in the first half of 2016?”

The answer is - as shown in the chart below - in some pretty unexpected places.

Argentina led the study with a gain of over +25%. The nation’s Merval index recovered after President Mauricio Macri took office in December. True to his campaign promises, Marci eliminated most capital controls in the country and moved to make deals on debts still lingering from the country’s 2001 default.

Next on the list is Russia, up almost +23%. Some might remember that President Obama’s White House Press Secretary Jay Carney proved that he should not be in the stock prediction business when he proclaimed in March 2014 that investors should “not invest in Russian equities right now.”

Note that the returns would not be easily available to a U.S. investor, as they are expressed in each country’s own currency.

(sources: all index return data from Yahoo Finance; Reuters, Barron’s, Wall St Journal, Bloomberg.com, ft.com, guggenheimpartners.com, ritholtz.com, markit.com, financialpost.com, Eurostat, Statistics Canada, Yahoo! Finance, stocksandnews.com, marketwatch.com, wantchinatimes.com, BBC, 361capital.com, pensionpartners.com, cnbc.com, FactSet; Figs 1-5 source W E Sherman & Co, LLC)

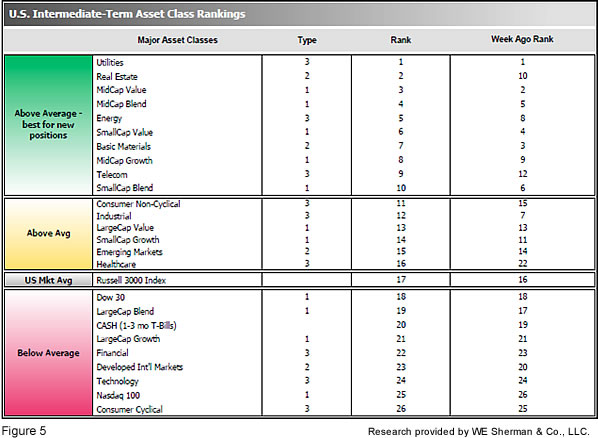

The ranking relationship (shown in Fig. 5) between the defensive SHUT sectors ("S"=Staples [a.k.a. consumer non-cyclical], "H"=Healthcare, "U"=Utilities and "T"=Telecom) and the offensive DIME sectors ("D"=Discretionary [a.k.a. Consumer Cyclical], "I"=Industrial, "M"=Materials, "E"=Energy), is one way to gauge institutional investor sentiment in the market. The average ranking of Defensive SHUT sectors rose to 9.3, up smartly from the prior week’s 12.5, while the average ranking of Offensive DIME sectors fell to 12.5 from the prior week’s 10.8. The Defensive SHUT sectors retook the lead over Offensive DIME sectors as sentiment seemingly gyrates with each headline. Note: these are “ranks”, not “scores”, so smaller numbers are higher ranks and larger numbers are lower ranks.

Check out the latest article in the Resource area of our website:

"Hacking and Identity Theft: A Simple Step to Better Protect Yourself"

by Dick Blakeley