JAN 2017: Predictions

Submitted by The Blakeley Group, Inc. on January 6th, 2017"Please email or call 408-459-4911 if you would like to schedule time to call or meet to discuss what The Blakeley Group is working on in 2017.”

~ Dick Blakeley, CFO

NOTE: Areas with blue text show the most recent market updates since the December Capital Highlights email.

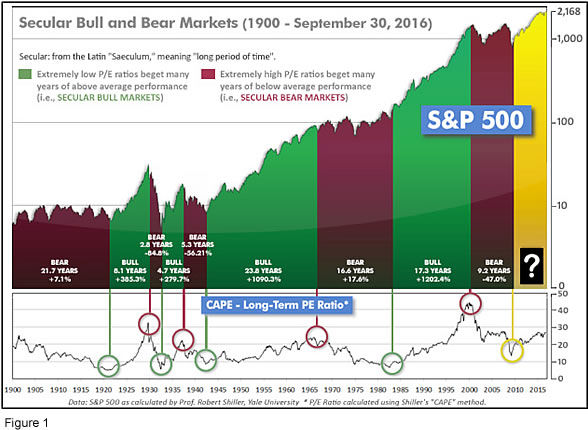

In the "decades" timeframe, the question of whether we are in a continuing Secular Bear Market that began in 2000 or in a new Secular Bull Market has been the subject of hot debate among economists and market watchers since 2013, when the Dow and S&P 500 exceeded their 2000 and 2007 highs. The Bear proponents point out that the long-term PE ratio (called “CAPE”, for Cyclically-Adjusted Price to Earnings ratio), which has done a historically great job of marking tops and bottoms of Secular Bulls and Secular Bears, did not get down to the single-digit range that has marked the end of Bear Markets for a hundred years, but the Bull proponents say that significantly higher new highs are de-facto evidence of a Secular Bull, regardless of the CAPE. Further confusing the question, the CAPE now has risen to levels that have marked the end of Bull Markets except for times of full-blown market manias. See Fig. 1 for the 100-year view of Secular Bulls and Bears.

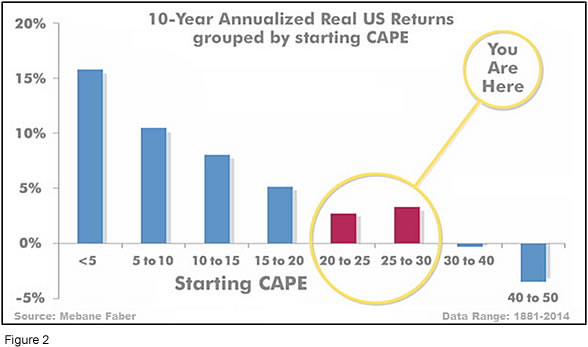

Even if we are in a new Secular Bull Market, market history says future returns are likely to be modest at best. The CAPE is at 27.68, down from the prior week’s 27.99, and only a little lower than the level reached at the pre-crash high in October, 2007. Since 1881, the average annual return for all ten year periods that began with a CAPE around this level have been just 3%/yr (see Fig. 2).

This further means that above-average returns will be much more likely to come from the active management of portfolios than from passive buy-and-hold. Although a mania could come along and cause the CAPE to shoot upward from current levels (such as happened in the late 1920’s and the late 1990’s), in the absence of such a mania, buy-and-hold investors will likely have a long wait until the arrival of returns more typical of a rip-snorting Secular Bull Market.

In the big picture:

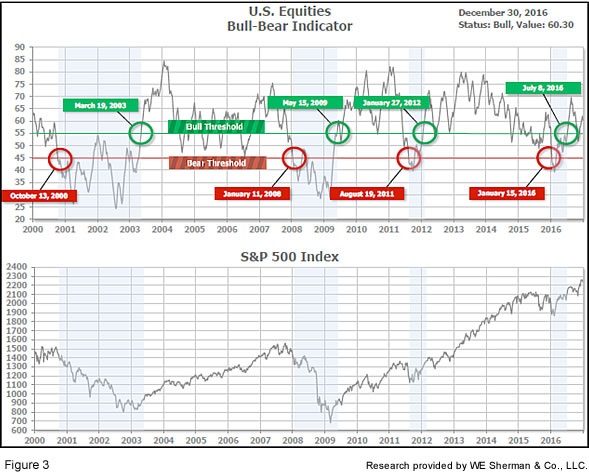

The “big picture” is the months-to-years timeframe – the timeframe in which Cyclical Bulls and Bears operate. The U.S. Bull-Bear Indicator (see Fig. 3) is in Cyclical Bull territory at 60.30, down from the prior week’s 62.01.

In the intermediate picture:

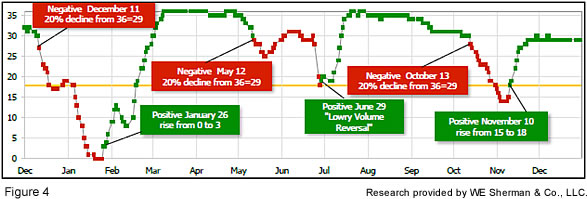

The Intermediate (weeks to months) Indicator (see Fig. 4) turned negative on October 14th. The indicator ended the week at 29, unchanged from the prior week. Separately, the Quarterly Trend Indicator - based on domestic and international stock trend status at the start of each quarter – was positive entering January, indicating positive prospects for equities in the first quarter of 2017.

Timeframe summary:

In the Secular (years to decades) timeframe (Figs. 1 & 2), whether we are in a new Secular Bull or still in the Secular Bear, the long-term valuation of the market is simply too high to sustain rip-roaring multi-year returns. The Bull-Bear Indicator (months to years) is positive (Fig. 3), indicating a potential uptrend in the longer timeframe. The Quarterly Trend Indicator (months to quarters) is positive for Q1, and the Intermediate (weeks to months) timeframe (Fig. 4) is negative. Therefore, with two of three indicators positive, the U.S. equity markets are rated as Very Positive.

In the markets:

Stocks declined in light trading over the holiday shortened week. Having neared the closely watched 20,000 level the previous week, the Dow Jones Industrial Average fell -171 points to record its first weekly loss since early November, down -0.86% to 19,762.6. The tech-heavy NASDAQ Composite had its first down week in 4, falling 1.46% to 5,383. The LargeCap S&P 500 index retreated -1.1%, while MidCaps and SmallCaps fell 0.78% and 1.05%, respectively. Utilities and Transports were both negative, with Transports falling -1.6% and the defensive Utilities ended down only -0.18%.

In international markets, Canada’s TSX gave up a portion of last week’s gains by falling 0.26%, while the majority of European markets rose for the week. The United Kingdom’s FTSE 100 gained +1.06%, along with France’s CAC 40 that added +0.47%. Germany’s DAX notched its fourth straight week of gains by adding +0.27%, but Italy’s Milan FTSE was unable to add a sixth week of gains, retreating 0.57%. In Asia, China’s Shanghai Composite fell 0.21%, while Japan’s Nikkei retreated 1.6% after seven straight weeks of gains. Hong Kong’s Hang Seng rebounded +2% after two weeks of losses. As a group, emerging markets (as measured by the MSCI Emerging Markets Index) rose +2.13%, while developed markets (as measured by the MSCI Developed Markets Index) gained +0.09%.

In commodities, Gold had its first up week after 7 consecutive weeks of losses, rising +$18.10 to $1,151.70 an ounce. Silver also rose for the week, up +1.46% to $15.99 an ounce. In energy, West Texas Intermediate crude oil continued to break out of the last 6 month’s $50 a barrel range, rising $0.70, or 1.32%, to $53.72 a barrel. Overall, the Commodity Research Bureau’s CRB Index was up +1.04% for the week.

The month of December was positive for all U.S. equity indexes. The Dow showed the way, up +3.34%, SmallCaps and MidCaps followed with gains of +2.63% and 2.03%, LargeCap S&P 500 returned +1.82% and the NASDAQ comp trailed the pack with a gain of +1.12%. The MSCI Developed Markets Index did well, too, up +2.7%, but the MSCI Emerging Markets Index trailed with a negative return of -0.26%.

The fourth quarter of 2016 showed a wide disparity in returns among U.S. and international indexes. SmallCaps rocketed +8.43%, narrowly beating out the Dow which returned +7.94%. Not too far behind was the MidCap index, which gained +6.98%. However, the LargeCap S&P 500 lagged behind at +3.25%, and the NASDAQ Composite eked out a minor gain of +1.34% (the narrower NASDAQ 100 was actually negative for the fourth quarter, losing -0.25%). International indexes ran far behind the U.S. for the quarter. The MSCI Developed Markets Index fell -1.35%, and the MSCI Emerging Markets Index dropped -5.46%. Gold was the largest casualty of the quarter, losing almost -13% - largely a victim of the strengthening post-election dollar.

2016 again showed the futility of predictions – particularly in investing and politics. Virtually no one predicted the election of President-elect Trump, and absolutely no one predicted the market’s post-election response. Investors who acted on actual data did fine, but those acting on the vast majority of predictions did poorly. In the U.S., SmallCaps led the way with a gain of +19.48%, followed closely by MidCaps at +18.73%. The Dow was also in double digits, rising +13.42%. The LargeCap S&P 500, with a gain of +9.54%, returned half that of SmallCaps. Bringing up the rear for 2016 was the NASDAQ Composite with a rise of “only” +7.5%. International markets were mixed for 2016. The MSCI Emerging Markets Index gained +9.9%, but the MSCI Developed Markets Index lost 0.7%. Major international markets were bracketed at the upper end by the U.K., which gained +14.4%, and at the lower end by China’s Shanghai market, which lost -12.3%. The U.S. has been much stronger than non-U.S. markets for the past 5 years; for example, the broad FTSE Global All-Cap ex-US Index has still not yet exceeded its peak of 2007, in contrast to the U.S. which has forged ahead to numerous new highs in that period.

In U.S. economic news, the number of Americans who applied for unemployment benefits last week fell back to the extremely low levels that have been the norm for much of the year. Initial claims for unemployment fell last week by 10,000 to 265,000. Initial claims have remained below the key 300,000 level for 95 straight weeks, the longest streak in 46 years. With the unemployment rate below 5%, businesses have reported having a difficult time finding skilled workers. The less-volatile 4-week moving average of claims fell 750 to 263,000.

Demand in the housing market continues to be the strongest in years, according to the latest S&P Case-Shiller national home price index reading. U.S. home prices hit a new peak in October, up +5.6% from a year earlier and setting another new high from the previous month. In addition, all 20 cities in the Case-Shiller 20-city home price index saw annual home price increases, and 15 out of the 20 also posted month-over-month increases. Seattle, Portland, and Denver posted the largest year-over-year price gains, with Seattle and Portland rising over +10%, and Denver up +8%. David Blitzer, managing director and chairman of the Index Committee at S&P Dow Jones Indices warned that the current pace of growth can’t continue forever writing, “Home prices and the economy are both enjoying robust numbers. However, mortgage interest rates rose in November and are expected to rise further as home prices continue to out-pace gains in wages and personal income." The home price index tracks prices on a rolling three-month average. October’s reading represents the three-month average of August, September, and October prices.

The National Association of Realtors’ (NAR) Pending Home Sales Index fell 2.5% in November to a seasonally-adjusted 107.3. The index measures homes under contract that have not yet closed. Despite the fall, the NAR noted that the reading still marked the index’s 31st straight month above its baseline reading of 100. The baseline reading is the rate at which homes went to contract in the year 2001, the first year in which the index was published and itself a good year for U.S. housing. Therefore, the current reading is seen as “exceptional” by the NAR, despite the drop. By region, pending home sales were mixed. The Northeast region was up +5.7% from the prior year, while the Midwest region declined -2.4%, and the South and West regions were each down 1%.

Confidence among American consumers surged in December to 113.7, reported the Conference Board - the highest level since 2001. Lynn Franco, the Conference Board’s director of economic indicators, attributed the strong reading to a “post-election surge in optimism for the economy”, citing strong jobs and income prospects, all-time highs in the stock market, and a new President and administration. The present situation index, which measures Americans’ current confidence, fell almost -6 points to 126.1, but that’s still near its highest level in 9 years. A measure of expectations over the next six months rose over +10 points to its highest level since 2003. Stephen Stanley, chief economist at Amherst Pierpont Securities said, “The election of Donald Trump has raised household expectations for the economy to a very high level. It remains to be seen whether Trump can deliver, but the ground would certainly appear to be ripe for a pickup in consumer spending based on this confidence data.”

In the Windy City, manufacturing activity fell more than expected in December, retreating from last month’s highest reading since January of 2015. The Institute for Supply Management (ISM) said its index decreased 3 points to a seasonally-adjusted 54.6 this month. Analysts had expected only a 0.6 point drop. In the details of the report three out of the five components decreased. New orders led the decline, losing 6.7 points to 56.5, while employment and supplier deliveries components remained positive. Economist Jamie Satchi reported, “Most firms are upbeat going into 2017 and believe new and better things are to come under the new administration.”

The U.S. trade deficit increased +5.5% last month to a seasonally adjusted annual $65.3 billion, according to the Commerce Department. A stronger U.S. dollar could weigh on U.S. exporters, as the dollar has surged +5% since Trump’s victory. Imports rose +1.2% to $187 billion, while exports were up +1% to $121.7 billion. This difference between imports and exports is known as the “trade gap”. Economists suggest that Trump’s proposals will lead to wider budget deficits which may trigger higher inflation and interest rate increases by the Federal Reserve.

In Canada, the U.K.’s Centre for Economics and Business Research had some bad news for Canadians. In a new report, the group stated Canada’s economic growth is set to flatline at 2% or less per year over the next 15 years, leading the country to lose ground in the ranking of the world’s economies. The forecasts call for Canadian GDP growth of just +1.8%/yr. from 2016-2020, then +2%/yr. growth from 2021 to 2030. The group is concerned with Canada’s public sector deficit which has risen to 2.5% of GDP, and its gross debt as a percentage of GDP of 92%.

Across the Atlantic, Britain’s corporate finance chiefs are more optimistic about the future than at any point over the past 18 months, according to a survey of chief finance officers by Deloitte. Overall companies remain cautious about launching big new investments, but their appetite for hiring is rebounding. Ian Stewart, Deloitte’s chief economist stated, “The economy has accelerated in the second half of the year and is stronger than people expected even before the referendum, so I think the resilience of the economy has boosted that measure of confidence.” Deloitte’s optimism index, which measures the proportion of CFO’s who are more optimistic than they were three months ago turned positive for the first time since the middle of last year.

On Europe’s mainland, German industry leaders warned in 2017, to “expect the unexpected”. The leaders of the German Industry Association (BDI), the Chamber of Commerce (DIHK) and the Employers’ Association all expressed fears about uncertainties, especially surrounding elections in Germany and France, and protectionist trends in other countries. In addition, BDI President Ulrich Grillo stated "The level of global uncertainty has increased as has the unpredictability. Unfortunately I fear that won't change very much in 2017."

In Italy, the world’s oldest and very troubled bank Monte dei Paschi di Siena (BMPS) said that the European Central Bank (ECB) has called for it to receive a bailout of $9.2 billion. The BMPS’ reported need for recapitalization was over 3 billion euro more than previously thought necessary. BMPS cited letters from the ECB to the Italian Ministry of Finance and Economy indicating that the results of 2016 stress tests showed the capital needs of BMPS at €8.8 billion. The ECB also noted that the bank's liquidity had deteriorated between November 30th and December 21st. According to the Italian economic newspaper Il Sole 24 Ore, the Italian government will need to invest some six billion euros in the lender and the rest would be raised through the forced conversion of bonds into equity. "With these figures, the bank will in effect be nationalised, given that the state will own more than 67 percent," the newspaper calculated.

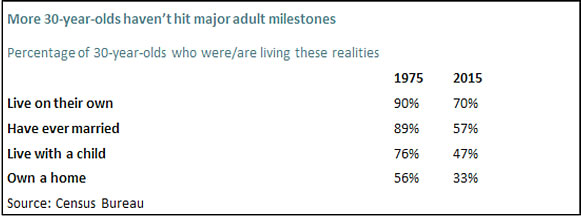

China’s state news agency Xinhua reported China will meet its growth target of +6.5 to +7% this year, adding that the country’s stable growth will be reassuring to a “weak and vulnerable” global economy. Xinhua noted that unlike other countries, China has the flexibility to defend against sharp economic decline as it restructures its economy toward consumption and services. Chinese officials are confident in the country’s economy, says Xinhua, saying the positive trends of this year will continue into next year.In Japan, the stagnant economy may finally be showing some tangible signs of life. Factory output data released by Japan’s trade ministry shows signs of economic recovery. Industrial production grew by +1.5% this month over November. That followed a +0.6% gain in September and a flat reading in October. In addition retail sales increased, while inventories dropped for three straight months. The data supports the Bank of Japan’s view that growing global demand will support a steady improvement in the economy. Takeshi Minami, chief economist at Norinchukin Research Institute stated, “While domestic demand still lacks strength, a pick-up in exports is driving up production. Output will likely continue recovering moderately ahead.” Finally, a major part of American belief is that each generation should do a bit better than the preceding one. The Census Bureau released data this past week showing that on several measures, millennials are well behind the preceding generation. The Census Bureau compared today’s 30-year-olds with 30-year-olds of 1975, revealing that millennials are less likely to have reached many of the milestones of adulthood than their 1975 counterparts. In 1975, 75% of 30-year-olds had married, had a child, were not enrolled in school, and had lived on their own. In 2015, just 33% could make that claim. In addition, a survey by Washington D.C.-based think tank Pew Research Center showed that living with parents is now “the most common young adult living arrangement for the first time on record” and that millennials are less likely to be married by the time they are 34 than any previous generation. One possible major cause for the delay in reaching these milestones may be student loan payments. In a survey from bankrate.com, more than 56% of millennials said they have delayed a major life event because of their student loan debt. The following chart, from marketwatch.com, details these “milestone” discrepancies.

(sources: all index return data from Yahoo Finance; Reuters, Barron’s, Wall St Journal, Bloomberg.com, ft.com, guggenheimpartners.com, ritholtz.com, markit.com, financialpost.com, Eurostat, Statistics Canada, Yahoo! Finance, stocksandnews.com, marketwatch.com, wantchinatimes.com, BBC, 361capital.com, pensionpartners.com, cnbc.com, FactSet; Figs 1-5 source W E Sherman & Co, LLC)

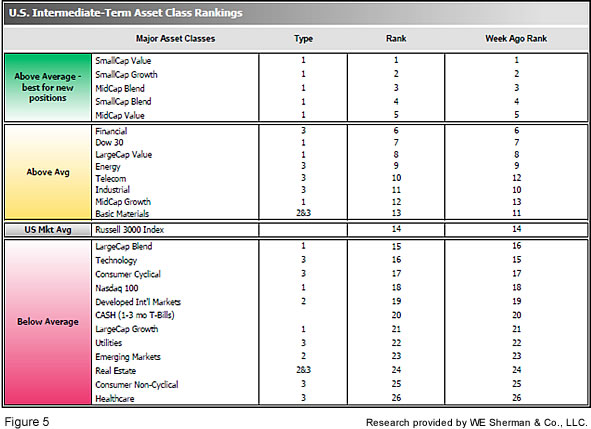

The ranking relationship (shown in Fig. 5) between the defensive SHUT sectors ("S"=Staples [a.k.a. consumer non-cyclical], "H"=Healthcare, "U"=Utilities and "T"=Telecom) and the offensive DIME sectors ("D"=Discretionary [a.k.a. Consumer Cyclical], "I"=Industrial, "M"=Materials, "E"=Energy), is one way to gauge institutional investor sentiment in the market. The average ranking of Defensive SHUT sectors rose to 20.75 from 21.25, while the average ranking of Offensive DIME sectors slipped to 12.50 from 11.75. The Offensive DIME sectors continue to lead Defensive SHUT sectors. Note: these are “ranks”, not “scores”, so smaller numbers are higher ranks and larger numbers are lower ranks.