JAN 2021 Record Highs Despite One of the Most Tumultuous Weeks in the Nation’s History

Submitted by The Blakeley Group, Inc. on January 27th, 2021The very big picture (a historical perspective):

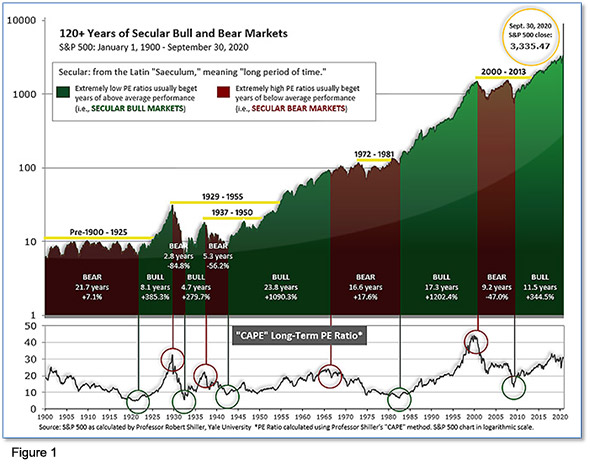

The long-term valuation of the market is commonly measured by the Cyclically Adjusted Price to Earnings ratio, or “CAPE”, which smooths-out shorter-term earnings swings in order to get a longer-term assessment of market valuation. A CAPE level of 30 is considered to be the upper end of the normal range, and the level at which further PE-ratio expansion comes to a halt (meaning that further increases in market prices only occur as a general response to earnings increases, instead of rising “just because”). The market was recently at that level.

Of course, a “mania” could come along and drive prices higher - much higher, even - and for some years to come. Manias occur when valuation no longer seems to matter, and caution is thrown completely to the wind - as buyers rush in to buy first, and ask questions later. Two manias in the last century - the “Roaring Twenties” of the 1920s, and the “Tech Bubble” of the late 1990s - show that the sky is the limit when common sense is overcome by a blind desire to buy. But, of course, the piper must be paid, and the following decade or two were spent in Secular Bear Markets, giving most or all of the mania-gains back.

The Very Big Picture: 120 Years of Secular Bulls and Bears.

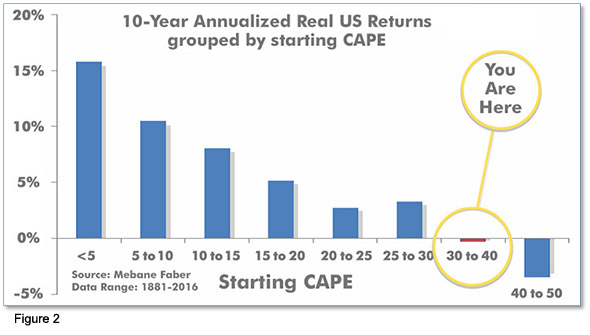

See Fig. 1 for the 100-year view of Secular Bulls and Bears. The CAPE is now at 30.68, up from the prior week’s 31.47. Since 1881, the average annual return for all ten-year periods that began with a CAPE in the 20-35 range have been slightly-positive to slightly-negative (see Fig. 2).

Note: We do not use CAPE as an official input into our methods. However, if history is any guide - and history is typically ‘some’ kind of guide - it’s always good to simply know where we are on the historic continuum, where that may lead, and what sort of expectations one may wish to hold in order to craft an investment strategy that works in any market ‘season’ … whether current one, or one that may be ‘coming soon’!

The Very Big Picture: Historical CAPE Values.

Current reading: 34.77

The big picture:

As a reading of our Bull-Bear Indicator for U.S. Equities (comparative measurements over a rolling one-year timeframe), we remain in Cyclical Bull territory.

The complete picture:

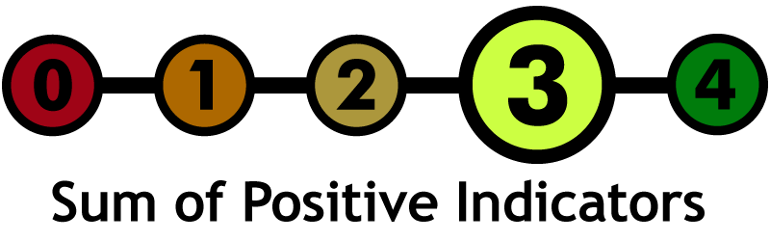

Counting-up of the number of all our indicators that are ‘Up’ for U.S. Equities (see Fig. 3), the current tally is that three of four are Positive, representing a multitude of timeframes (two that can be solely days/weeks, or months+ at a time; another, a quarter at a time; and lastly, the {typically} years-long reading, that being the Cyclical Bull or Bear status).

The Current ‘Complete Picture’: The Sum of Positive Indicators.

In the markets:

U.S. Markets: The major U.S. indexes continued their march to record highs despite one of the most politically tumultuous weeks in the nation’s history. Small caps outperformed large-caps by a wide margin, and energy stocks led the gains within the S&P 500 after Saudi Arabia made a surprise announcement that it was unilaterally cutting oil production by 1 million barrels per day. The Dow Jones Industrial Average added 491 points, or 1.6%, ending the week at 31,098. The technology-heavy NASDAQ Composite gained 2.4% closing at 13,202. By market cap, the large cap S&P 500 rose 1.8%, while the mid cap S&P 400 and small cap Russell 2000 surged 4.8% and 5.9%, respectively.

International Markets: Like the U.S., international markets were a sea of green at the start of the new year. Canada’s TSX rose 3.5%, while the United Kingdom’s FTSE 100 surged 6.4% in its first week of actual real Brexit. On Europe’s mainland, France’s CAC 40 and Germany’s DAX added 2.8% and 2.4%, respectively. In Asia, China’s Shanghai Composite rose 2.8% and Japan’s Nikkei added 2.5%. As grouped by Morgan Stanley Capital International, developed markets rose 3.8% while emerging markets rallied 5.9%.

Commodities: Gold retreated -3.2% last week to $1835.40 an ounce, while Silver fell a steeper -6.7% to $24.64. Oil continued to recover and is now up 9 out of the last 10 weeks. West Texas Intermediate crude rose 7.7% to $52.24 per barrel. The industrial metal copper, which is viewed by some analysts as a barometer of world economic health due to its wide variety of uses, gained 4.4%.

U.S. Economic News: The number of Americans filing for first-time unemployment benefits fell slightly in the first week of the new year, but overall unemployment remained exceedingly high. The Labor Department reported initial jobless claims fell by 3,000 to 787,000 last week. Economists had forecast claims to total 815,000. After falling to a pandemic low of 711,000 in early November, new jobless claims moved higher again after a record surge in coronavirus cases in December. Continuing claims, which counts the number of people already collecting benefits, declined by 126,000 to 5.07 million—a new pandemic low. That number is reported with a one-week delay.

The U.S. lost jobs for the first time in eight months as a resurgence in coronavirus cases at the end of the year forced businesses to resort to more layoffs. The Bureau of Labor Statistics reported employment in the government and private sector declined by 140,000. In the report, most of the layoffs were concentrated in the restaurant and hospitality sectors that rely largely on crowds of customers. Bars and restaurants shed over 370,000 jobs while jobs in recreation such as theme parks and casinos also declined by 92,000. On a positive note, hiring rose by 161,000 in white-collar professional occupations and 51,000 in construction. The official unemployment rate remained unchanged at 6.7%. Analysts were mixed following the report. Senior Economist Sal Guatieri at BMO Capital Markets called the report a “major setback for the labor market”, while Chief Economist Chris Low at FHN Financial noted, “This is a pause in the recovery, not a full-on stall.”

The vast services side of the U.S. economy accelerated in December as companies grew more optimistic with the continued rollout of the coronavirus vaccine. The Institute for Supply Management (ISM) reported its survey of senior executives at non-manufacturing companies rose 1.3 points to a three-month high of 57.2. Readings above 50 indicate that businesses are expanding. In the report, 14 of the 18 service industries tracked by ISM expanded the same as in November. New orders and production both rose and remained near a pandemic high, but employment fell, turning negative for the first time since August. Anthony Nieves, ISM chairman stated, “Various local- and state-level COVID-19 shutdowns continue to negatively impact companies and industries.”

As with Services, Manufacturers shrugged off the resurgence in coronavirus cases late last year and reported their fastest growth since the pandemic began. The Institute for Supply Management (ISM) reported its manufacturing index rose 3.2 points to 60.7 in December—its highest level in almost two and half years. Economists had forecast a reading of just 57. Manufacturing activity has expanded for seven consecutive months since the economy reopened last spring. In the report, new orders climbed 2.8 points to 67.9, while production increased 4 points to 64.8. Notably, the sub index that tracks employment rose 3.1 points to 51.5, moving into positive territory for the second time in three months. Sixteen of the 18 industries tracked by ISM expanded in December, unchanged from the prior month. Amazingly, most companies said sales now exceed pre-crisis levels and they expect even better revenue gains in 2021.

U.S. factory goods orders rose for a seventh consecutive month in November, the Commerce Department reported. Orders for manufactured goods rose 1% in November following a 1.3% gain the prior month. Economists had expected just a 0.8% gain. In the details, orders for long-lasting durable goods rose 1%, while orders for non-durable goods were up 1.1%. Excluding aircraft, orders for non-defense capital goods rose a revised 0.5%--up a tick from the prior estimate.

Only a “couple” of the 17 top Federal Reserve officials pushed for the central bank to expand its purchases of longer-term bonds during their meeting in December, minutes from that meeting showed. The Fed has been buying $40 billion of Treasuries per month since June, with the purchases coming across the yield curve. Ahead of the meeting many economists argued that concentrating the purchases on the long-end of the curve would add more stimuli to the economy. Fed officials “generally judged that the asset purchase program as structured was providing very significant policy accommodation,” according to the minutes. “Some” Fed officials left open the possibility of weighing purchases of Treasuries toward the longer end if necessary, the minutes said. Furthermore, the Fed stated it would continue its asset purchases “until substantial further progress has been made toward reaching the Committee’s maximum employment and price stability goals.” However, there is no mention of what specific numerical criteria or thresholds constitute “substantial progress”.

International Economic News: For the first time since May, Canada’s economy entered contraction according to data from Canada’s Ivey School of Business. Ivey’s Purchasing Managers’ Index (IPMI) fell 6 points to 46.7 in November. Readings below 50 indicate a decrease in activity. The IPMI measures the month-to-month variation in economic activity as indicated by a panel of purchasing managers in the public and private sectors across Canada. The employment gauge fell to 45.8 from 48.1 in November, while supplier deliveries slipped to 30.1—its lowest reading since April. The country is in the middle of a second wave of the coronavirus pandemic, with some provinces increasing economic restrictions in recent weeks to help contain the virus.

Across the Atlantic, U.S. investment bank Goldman Sachs cut its GDP forecast for the United Kingdom citing the nation’s new national lockdown. "Given the return to nationwide lockdown in the UK, we now expect a 1.5% contraction in real GDP in Q1, putting the UK economy into a double-dip recession," economists at the bank said in a note. This will be the first time the UK economy will have experienced a double dip since the mid-1970s. With the economy shrinking again, the Bank of England will likely pick up the pace of its asset-purchase plan to keep borrowing rate low and shore up the financial system, but will probably not resort to negative interest rates unless the post-lockdown recovery is weaker than forecast, Goldman said.

On Europe’s mainland, French Prime Minister Jean Castex said France's border restrictions with Britain will remain in place "until further notice". "It is out of the question that we lower our guard," Castex said as the country confirmed two clusters of the mutant UK coronavirus variant. France closed its border with Britain on December 20 after the emergence of a highly contagious new strain of the disease in the UK. Only certain categories of people, including French citizens and truck drivers, are allowed through the border, providing they have a negative PCR test from the last 72 hours. French Health Minister Olivier Véran said Thursday that all laboratories had been mobilized to track new variants of the coronavirus in France.

Germany reported a string of strong economic reports this week, suggesting the Eurozone’s largest economy avoided a double-dip downturn in the final quarter of 2020. Manufacturing orders, industrial production, retail sales, employment and exports data for November and December released this week were all better than expected, indicating the economy was resilient at the end of last year. Economists had feared that the upsurge of Covid-19 would trigger a double-dip downturn across large parts of Europe in the final quarter of 2020, after the historic recession in the first half of the year. Stefan Schilbe, chief economist for Germany at HSBC, said the latest economic data “provides another sign that the restrictions implemented on 2 November to contain the further spread of Covid-19 did not have a material effect on the industrial recovery”.

The International Monetary Fund said China urgently needed to take steps to contain the risks to its financial stability. The Washington-based IMF stated China’s virus relief measures that are “potentially distortionary” should be phased out. Debt levels have climbed during the pandemic, especially in the private sector, the fund said, while credit quality likely deteriorated due to looser rules for dealing with bad loans. Specifically, the report stated, repayment holidays for borrowers and relaxed rules on how to treat non-performing loans “run the risk of increasing moral hazard and undoing recent progress in strengthening bank transparency and governance.”

Japan’s economy is expected to make its sharpest rebound in decades this year as the impact of the COVID-19 pandemic eases. The world’s third largest economy is projected to grow 3.4% in the next year according to the average forecast of 35 economists polled by the Japan Center for Economic Research. If the estimate is borne out, it would be a dramatic recovery from the economy’s worst contraction to its highest growth since fiscal 1995, when comparative date became available. Furthermore, a Kyodo News survey of more than 100 of the largest firms in Japan showed 72% expect the economy to expand at a moderate pace in 2021.

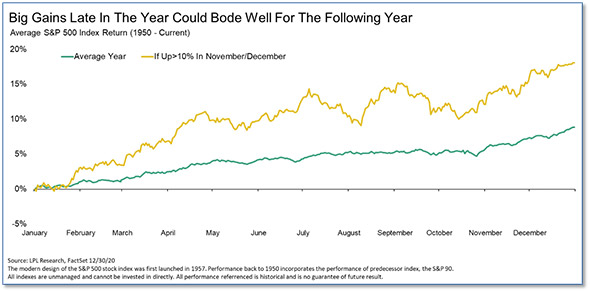

Finally: Is a strong year-end rally a portent for returns in the new year that follows? Ryan Detrick, Chief Market Strategist at LPL Financial, says the results of his study of the question could have “bulls smiling” in 2021. Detrick said a 10% or greater gain in the final two months of the year, which since World War II has occurred 5 times prior to this year, has led to a higher S&P 500 the following year each and every time. Detrick concluded his study with “Once again, strong returns are the playbook historically,” The chart below (the gold line) shows what a year typically looks like after a 10% or more prior-year November/December rally, compared to an “average” S&P 500 return (the green line). (Chart from LPL Financial)

(Sources: All index- and returns-data from Yahoo Finance; news from Reuters, Barron’s, Wall St. Journal, Bloomberg.com, ft.com, guggenheimpartners.com, zerohedge.com, ritholtz.com, markit.com, financialpost.com, Eurostat, Statistics Canada, Yahoo! Finance, stocksandnews.com, marketwatch.com, wantchinatimes.com, BBC, 361capital.com, pensionpartners.com, cnbc.com, CNBC, FactSet.)