Foiling the Financial Fraudsters

Submitted by The Blakeley Group, Inc. on September 1st, 2024

When it comes to financial scams, it’s easy to assume that the only victims are the ones we hear about so often in the media—the “little old ladies” who are tricked by nefarious call center workers in distant lands urging them to send what little money they have.

But the fact is, financial fraudsters are working overtime to target those of us with significant assets. Even worse: They’re having far more success at parting us from our wealth than you might imagine.

The upshot: Just because you’re “good with money” or careful in who you deal with when it comes to finances doesn’t mean you won’t be pursued by financial scammers—nor does it guarantee you’ll avoid their traps.

With that in mind, consider some of the key ways you may be targeted—and what you can do to avoid these scams, as well as how to best respond if you eventually get scammed.

You’re a target

It should hardly be surprising that the affluent represent a target-rich environment for financial crooks. After all (to borrow a quote from famed bank robber Willie Sutton), “that’s where the money is.” Consider just how focused these criminals may be on you and your wealth:

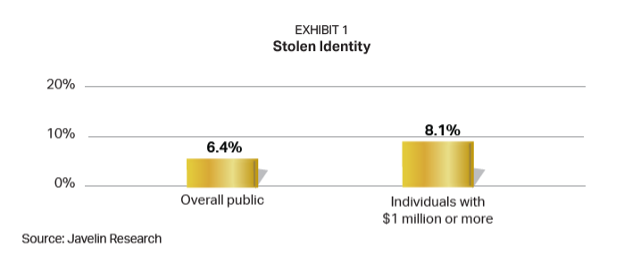

- Cybercriminals stole the identities of 6.4% of the public overall but 8.1% of individuals with $1 million or more, according to Javelin Research.

- The affluent are 43% more likely to experience identity theft, according to research done by Experian and the Department of Justice.

- More than a quarter of ultra-high-net-worth families, family offices and family businesses (with an average wealth of $1.1 billion) have been the target of a cyberattack, according to Campden Research.

- In the past several years, numerous high-profile examples of fraud and alleged fraud targeting the affluent have come to light (such as Anna Sorokin, Sam Bankman-Fried, Billy McFarland and Elizabeth Holmes).

Additionally, you may be more susceptible to their efforts than you realize or care to admit. One of our biggest biases is overconfidence in our abilities. People who are high achievers in one area can have a tendency to overestimate their skill level in a different area. That can lead to, for example, assuming that because you manage a successful business or division, you are equally adept at identifying great investments or top professionals to manage your investing. Consider the many rich and respected individuals who famously fell for Bernie Madoff’s Ponzi scheme.

Ultimately, being smart or wealthy doesn’t necessarily make you an expert at spotting scams or shielding yourself from them. One study of British high-net-worth investors found that those whose net worth was more than £3 million were twice as likely to report being a fraud victim as were those with a net worth of £250,000-£500,000.

Be on guard

The good news is that you can take steps to better protect yourself from financial scams and fraud. A good first step is to get a handle on the many ways the crooks are trying to get at you and your money—and the damage those efforts may cause.

In broad terms, many scams typically start with the fraudster’s pitch to you, which is designed to evoke strong emotions such as fear or greed. The criminal then uses various persuasion tactics to get you to take action—for example, by making you feel obligated to follow through on a commitment you made, or making you feel rushed to act because of the scarcity of the “opportunity.” Alternatively, thieves using technology might literally steal your information without your ever having a single known interaction with them.

More specifically, the actual methods used—both high-tech and low-tech—include the following (with the caveat that financial fraudsters seem to be continually adapting and tweaking their strategies):

1. Phishing and ransomware attacks

These may be the two categories with which you’re most familiar. A type of online scam, phishing occurs when scammers impersonate a legitimate company using legitimate-looking emails or texts. You, acting under the assumption that the communication and the links in it are trustworthy, inadvertently share sensitive data with the crooks. Ransomware is a type of malicious software that encrypts your files in a way that makes them inaccessible to you, then demands a ransom for the “key” to get them back.

Ransomware has commonly targeted big businesses and large organizations, which of course have mission-critical technology and deep pockets. That said, small businesses are now the targets of 82% of ransomware attacks—likely because they’re seen as easier prey with less adequate security measures.

2. Wire transfer fraud

This occurs when criminals fool you into wiring money to them. Often they do so by presenting themselves (via an email or a text) as a trusted individual or organization, such as a family member, a business partner or even a charity. One well-publicized example: Real estate investor and “Shark Tank” judge Barbara Corcoran was scammed out of nearly $400,000 after criminals pretending to be Corcoran’s assistant emailed Corcoran’s bookkeeper to wire funds to pay for a nonexistent investment property.

3. Account takeovers

This is a type of identity theft in which scammers get unauthorized access to an online account—for example, by setting up a legit-sounding public Wi-Fi network and using it to capture usernames, passwords and payment information.

4. Card-not-present fraud

Using stolen credit card data to buy items online (or by phone or mail) has become increasingly common, along with the rise in both online shopping and working remotely.

5. Tax scams

There are numerous tax-related scams that leave taxpayers owing excessive amounts of money. One scam that directly targets people with a high net worth involves getting excessively high valuations for their art in order to get bigger income tax deductions.

Avoid getting scammed

Armed with insights into how scammers might come at you and your wealth, you can start taking steps to avoid them or shut them down when they try to strike. Some ideas to consider:

1. Check your “basics.”

Secure your home network, use strong passwords and multifactor identification, and install anti-malware and other internet-security programs. Such plain-vanilla safeguards should form the foundation of your efforts.

2. Slow down and use caution.

Many financial criminals demand that potential victims act quickly, creating a false sense of urgency to their pitch. That means one key move is to resist the urge to take immediate action, giving you time to dig deeper. Communicate this expectation to your financial professionals, too—advisors, insurance specialists, bookkeepers and so on. Tell them to double-check any financial transaction requests—especially ones marked urgent—with you directly (by calling you to confirm, for example).

3. Verify requests independently.

Say you get an unsolicited email (or text or call) from your financial institution, the IRS, tech support, etc. demanding that you take action immediately. Rather than click on the link provided to you, call or email the person or company directly to determine whether the communication is legitimate. If it’s a phone call, hang up and look up the callback number.

4. Root out impersonators.

Would-be online fraudsters often create fake accounts on social media that they use to gather intel they can use against you. Alert the companies if you see that someone has set up a profile claiming to be you, don’t accept friend requests until you verify them as legit, and don’t respond to requests from complete strangers.

5. Separate your personal life from your business life.

Entrepreneurs should consider using different email addresses for family communications and business communications. This can help prevent a hack in one area of your life from spilling over into the other—and help you avoid some of the scams outlined above.

6. Check in on your finances.

Review your financial statements for odd or unfamiliar transactions or any unauthorized activity. The same goes for credit reports and other statements that involve your wealth. This won’t prevent you from getting scammed—but it can help you identify possible fraud and shut it down as soon as possible.

7. Ask for help if you need it (or even think you might).

Even when people get scammed or worry they may be stepping into a fraudulent situation, they often don’t tell anyone or reach out for advice or help. They fear that admitting they’ve been duped will make them look stupid or weak—particularly if they’re known for being financially savvy or intelligent in other ways. Don’t fall into that trap: If you think you’re getting taken or are on that path, enlist the help of the authorities, trusted advisors or others to review the situation and offer potential next steps.

8. Consider hiring experts.

Fraud prevention firms catering to the affluent can build bespoke strategies designed to wall you off from financial fraud. Other services can monitor social media for scam accounts or posts that could threaten your wealth.

Conclusion

Note how many of the tactics to avoid getting scammed involve personal behaviors rather than high-end technology. Using both together can be more impactful, but it’s important to remember that keeping financial criminals at bay can depend greatly on the actions you take—and don’t take—when interacting with the world around you.