February 2023 - Electric Vehicles Sales Spike

Submitted by The Blakeley Group, Inc. on February 13th, 2023The very big picture (a historical perspective):

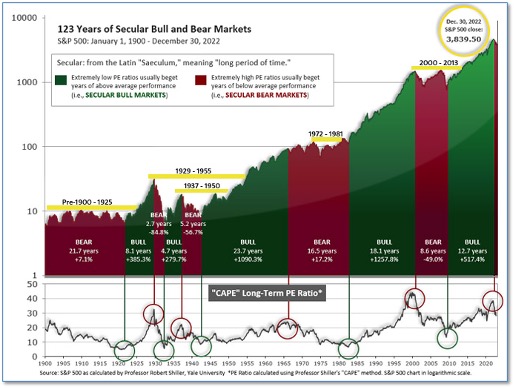

The long-term valuation of the market is commonly measured by the Cyclically Adjusted Price to Earnings ratio, or “CAPE”, which smooths-out shorter-term earnings swings in order to get a longer-term assessment of market valuation. A CAPE level of 30 is considered to be the upper end of the normal range, and the level at which further PE-ratio expansion comes to a halt (meaning that further increases in market prices only occur as a general response to earnings increases, instead of rising “just because”). The market was recently above that level, and has fallen back.

Of course, a “mania” could come along and drive prices higher - much higher, even - and for some years to come. Manias occur when valuation no longer seems to matter, and caution is thrown completely to the wind - as buyers rush in to buy first, and ask questions later. Two manias in the last century - the “Roaring Twenties” of the 1920s, and the “Tech Bubble” of the late 1990s - show that the sky is the limit when common sense is overcome by a blind desire to buy. But, of course, the piper must be paid, and the following decade or two were spent in Secular Bear Markets, giving most or all of the mania-gains back.

The Very Big Picture: 120 Years of Secular Bulls and Bears

Figure 1

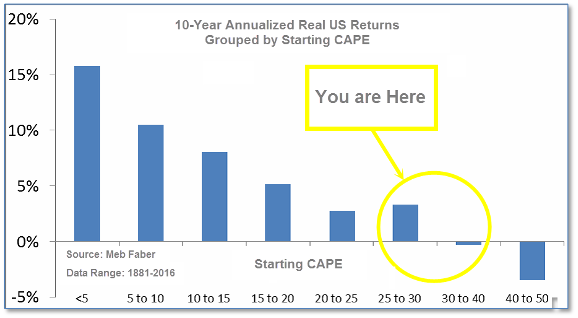

See Fig. 1 for the 100-year view of Secular Bulls and Bears. The CAPE is now at 29.71, down from the prior week’s 30.04. Since 1881, the average annual return for all ten-year periods that began with a CAPE in this range has been slightly positive to slightly negative (see Fig. 2).

The Very Big Picture: Historical CAPE Values

Current reading: 29.71

Figure 2

Note: We do not use CAPE as an official input into our methods. However, if history is any guide - and history is typically ‘some’ kind of guide - it’s always good to simply know where we are on the historic continuum, where that may lead, and what sort of expectations one may wish to hold in order to craft an investment strategy that works in any market ‘season’ … whether the current one, or one that may be ‘coming soon’!

The big picture:

As a reading of our Bull-Bear Indicator for U.S. Equities (comparative measurements over a rolling one-year timeframe), we entered a new Cyclical Bear on March 4, 2022.

The complete picture:

Counting-up of the number of all our indicators that are ‘Up’ for U.S. Equities (see Fig. 3), the current tally is that three of the four are Positive, representing a multitude of timeframes (two that can be solely days/weeks, or months+ at a time; another, a quarter at a time; and lastly, the {typically} years-long reading, that being the Cyclical Bull or Bear status).

In the markets:

U.S. Markets: The major U.S. market indexes ended the week lower amid a relatively light week of economic reports. The Dow Jones Industrial Average pulled back just 57 points to 33,869, a decline of -0.2%. After five consecutive weeks of positive closes, the technology-heavy NASDAQ Composite gave back some of its gains by closing down -2.4%. By market cap, the large cap S&P 500 retreated -1.1%, while the mid cap S&P 400 gave up -2.5% and the small cap Russell 2000 fared the worst of the major indexes, declining -3.4%.

International Markets: Most of the major international markets finished the week down as well. Canada’s TSX pulled back -0.7%, while the United Kingdom’s FTSE 100 ticked down -0.2%. France’s CAC 40 and Germany’s DAX pulled back -1.4% and -1.1%, respectively, while in Asia China’s Shanghai Composite closed down just -0.1%. Japan’s Nikkei managed to finish to the upside for a fifth consecutive week, rising 0.6%. As grouped by Morgan Stanley Capital International, developed markets declined -1.1%. International markets retreated -1.7%.

Commodities: Precious metals finished the week modestly to the downside. Gold ticked down -0.1% to $1874.50 per ounce, while Silver retreated -1.5% to $22.08. West Texas Intermediate crude oil rebounded from last week’s decline rising 8.6% to $79.72 per barrel. The industrial metal copper, viewed by some analysts as a barometer of world economic health due to its wide variety of uses, ended the week down -1%.

U.S. Economic News: At a speech to the Economic Club of Washington, Federal Reserve Chairman Jerome Powell stated he expects “significant declines” in U.S. inflation this year, but he also said the surprisingly strong jobs report for January underscored the need to keep raising rates. “We think we need to do further rate increases,” Powell said. “And we think that we’ll need to hold policy at a restrictive level for a period of time.” Economists say Powell largely stuck to his script that the Fed was making progress in its fight against inflation but there is more work to be done. Bill Adams, economist at Comerica, said “January’s jobs data didn’t really change Chair Powell’s message. The important takeaway is that Powell had a chance to signal a shift to a more aggressive posture and he didn’t take it.” His comments came after a firmer statement put out by the bank after its policy rate hike last week.

Comments made by John Williams, President of the New York Federal Reserve, were a bit more hawkish than Fed Chair Jerome Powell’s. In an interview with the Wall Street Journal, Williams said the central bank needs to maintain “restrictive” interest rates for a few years to make sure high inflation is restored to pre-pandemic levels. Williams said it was appropriate for the Fed to step down to 1/4-quarter point rate hikes after a series of 1/2-point rate increases through most of last year. Williams, a key ally of Fed Chairman Jerome Powell, said the Fed’s current forecast of a peak short-term rate of 5% to 5.25% was still a good goal. The current scenario suggests the Fed would reach its intended target by May with two more rate hikes.

The amount of credit consumers used at the end of last year rose at its smallest pace in more than two years as Americans tightened spending in response to a slowing economy. The Federal Reserve stated consumer credit rose by $11.6 billion in December, less than half of the $26 billion expected by economists. How much credit households use is seen as one indication of the strength of the economy. Consumers tend to borrow more when times are good and cut back when the economy is weak. Revolving credit, mostly credit cards, increased at a 7.3% annual rate in December. That’s the smallest increase in a year and a half. Auto and student loans, known as non-revolving credit, rose at a 1.5% pace. That category of credit is much less volatile, but it’s the smallest increase since the early stages of the pandemic in 2020.

Sentiment among the nation’s consumers rose to their highest level in more than a year, signaling Americans are cautiously optimistic about the U.S. economy as the rate of inflation slows. The University of Michigan reported its survey of consumer sentiment rose 1.5 points to 66.4 this month. It was the third consecutive gain for the index and well above the record low of 50 set last summer. Still, the index sits far below its pre-pandemic high of 101. In the details of the report, the index that measures what consumers think about their current financial situation climbed 4.2 points to 72.6—its highest level in 14 months. Another measure that asked about expectations for the next six months fell slightly to 62.3. Americans still viewed inflation as a threat. They expected the inflation rate in the next year to average about 4.2%. In January, respondents said they expected a 4% inflation rate.

International Economic News: More than three-quarters of Canadian CEO’s surveyed by PwC Global believe that global economic growth will decline over the next 12 months. Furthermore, 25% of these CEOs doubt their businesses will be viable within ten years if they continue on their current path and don’t pursue investments in digital transformations such as automation and deploying cloud, artificial intelligence, and other advanced technologies. Nicolas Marcoux, CEO of PwC Canada, stated that "CEOs have endured a lengthy period of crisis and threats that have impacted last year's optimism. With inflation at levels that have not been seen in decades, macroeconomic volatility, and geopolitical tensions to name a few factors, it's no surprise that CEOs are predicting a decline in global growth over the next 12 months.” PwC polled over 4400 CEO’s in 105 countries in its 26th Annual Global CEO Survey.

Across the Atlantic, the United Kingdom’s benchmark stock index, the FTSE 100, climbed to an all-time high of 7,944 points, boosted by gains from many banks which have seen profits rise as a result of higher interest rates. Despite the gains in the stock market, the U.K.’s domestic economy continues to struggle from cost-of-living pressures. Overall inflation in the United Kingdom is over 10%, and grocery price inflation hit a high of 16.7%. In March, the U.K. government intends to cease compensating a broad household energy bill program that has run throughout the winter. According to Richard Murphy, professor of accounting practice at Sheffield University Management School, without the support of the U.K. government, “many will not be able to make ends meet and will go hungry, cold or even homeless as a result.”

On Europe’s mainland, Bank of France head Francois Villeroy de Galhau said the likelihood of a recession in France could be excluded for 2023. Galhau made the bold announcement on France 2 TV. "This morning, I think I can rule it out," Galhau said. He also reaffirmed he expected inflation to ease off in France, possibly before June. This week, the Bank of France said the French economy was on course to manage slightly positive growth this quarter after growing 0.1% in the previous quarter.

The German economy will stagnate this year, according to the DIHK Chambers of Commerce and Industry. The announcement was a significant upgrade from its previous forecast of a 3% contraction and deep recession. "Instead of a deep recession, we are more likely to see a sideways movement this year and a red zero at the bottom line," DIHK Managing Director Martin Wansleben said. In a survey of 27,000 companies, firms reported a more optimistic outlook for the year. In its last survey, only 8% of respondents were optimistic about the business outlook over the next 12 months. That reading has risen to 16%. However, the number of pessimistic companies expecting business to deteriorate in the same period remains significantly higher at 30%, the survey showed. Across all sectors, three of four companies still view high energy and raw materials prices as a business risk, the survey showed. In the industrial sector, this figure remains very high at 85%.

In an updated forecast, Fitch Ratings expects China’s economy to grow by 5% in 2023—an almost full percentage point improvement from its previous growth prediction. The latest revision is based on “evidence that consumption and activity are recovering faster than initially anticipated” after China’s government removed most of its stringent Covid restrictions. Fitch also pointed to China’s latest purchasing managers’ index (PMI) for manufacturing and services, a measure of business activity, which indicated further growth. China’s official manufacturing PMI reading rose to 50.1 in January from a previous reading of 47, and its services PMI rose to 54.4, the highest level since June 2022.

Japan’s Nikkei news agency reported the Japanese government plans to nominate Kazuo Ueda, an economist and former member of the Bank of Japan's policy board, as the central bank's next governor to succeed Haruhiko Kuroda. Ueda has a Ph.D. in economics from MIT and was classmates with formed Federal Reserve chair Ben Bernanke. Ueda has largely supported the policies of his predecessor Haruhiko Kuroda. In a press interview, Ueda stated he thinks the current BOJ policy is conducted appropriately, and current conditions warrant continuation of its easy monetary policy.

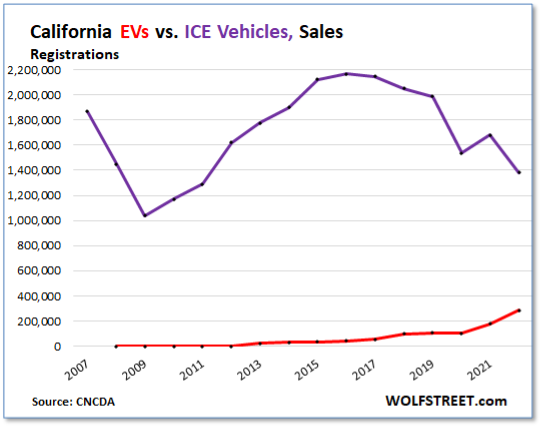

Finally: Electric vehicles (EV) sales in California spiked by over 60% in 2022 to 285,199 new electric vehicles being sold, according to registration data. The overall market share of EVs nearly doubled to 17% of total new vehicle sales. Meanwhile, sales of traditional internal combustion engine (ICE) vehicles fell by 18% to 1.38 million—the lowest since 2011. Even more impressive is that the new federal EV incentives didn’t apply to 2022 sales. (Chart from wolfstreet.com)

(Sources: All index- and returns-data from Yahoo Finance; news from Reuters, Barron’s, Wall St. Journal, Bloomberg.com, ft.com, guggenheimpartners.com, zerohedge.com, ritholtz.com, markit.com, financialpost.com, Eurostat, Statistics Canada, Yahoo! Finance, stocksandnews.com, marketwatch.com, wantchinatimes.com, BBC, 361capital.com, pensionpartners.com, cnbc.com, FactSet.)