FEB 2017: Job Growth Details

Submitted by The Blakeley Group, Inc. on February 10th, 2017We are happy to have a new member joining The Blakeley Group. Reana Brady has joined the group assisting Dick and helping support the rest of the team. Please feel free to call or email Reana at 408-459-4911 or info@theblakeleygroup.com. She can help handle most requests and arrange time for calls in my calendar.

NOTE: Areas with blue text show the most recent market updates since the January Capital Highlights email.

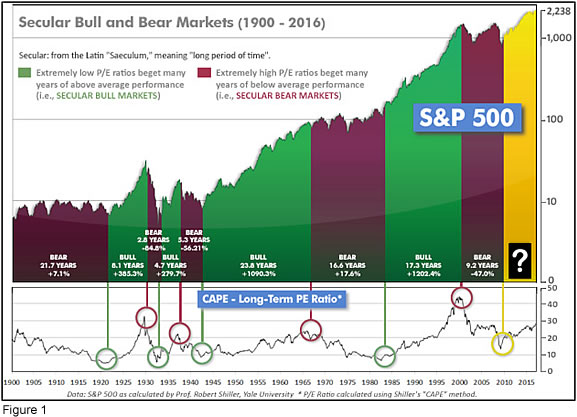

In the "decades" timeframe, the question of whether we are in a continuing Secular Bear Market that began in 2000 or in a new Secular Bull Market has been the subject of hot debate among economists and market watchers since 2013, when the Dow and S&P 500 exceeded their 2000 and 2007 highs. The Bear proponents point out that the long-term PE ratio (called “CAPE”, for Cyclically-Adjusted Price to Earnings ratio), which has done a historically great job of marking tops and bottoms of Secular Bulls and Secular Bears, did not get down to the single-digit range that has marked the end of Bear Markets for a hundred years, but the Bull proponents say that significantly higher new highs are de-facto evidence of a Secular Bull, regardless of the CAPE. Further confusing the question, the CAPE now has risen to levels that have marked the end of Bull Markets except for times of full-blown market manias. See Fig. 1 for the 100-year view of Secular Bulls and Bears.

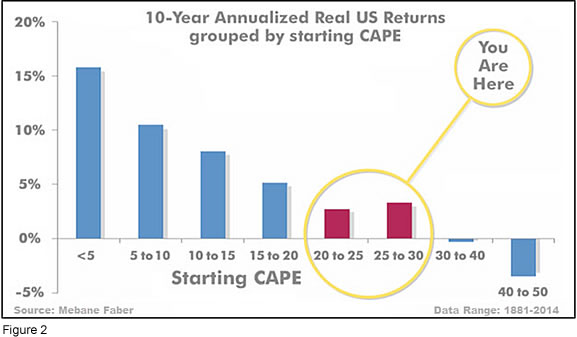

Even if we are in a new Secular Bull Market, market history says future returns are likely to be modest at best. The CAPE is at 28.47, up modestly from the prior week’s 28.44, and only a little lower than the level reached at the pre-crash high in October, 2007. Since 1881, the average annual return for all ten year periods that began with a CAPE around this level have been just 3%/yr (see Fig. 2).

This further means that above-average returns will be much more likely to come from the active management of portfolios than from passive buy-and-hold. Although a mania could come along and cause the CAPE to shoot upward from current levels (such as happened in the late 1920’s and the late 1990’s), in the absence of such a mania, buy-and-hold investors will likely have a long wait until the arrival of returns more typical of a rip-snorting Secular Bull Market.

In the big picture:

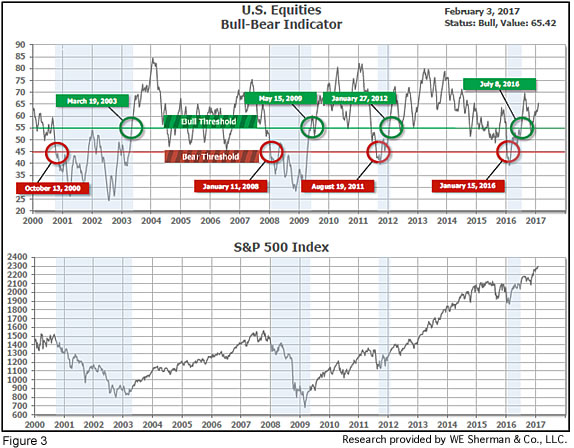

The “big picture” is the months-to-years timeframe – the timeframe in which Cyclical Bulls and Bears operate. The U.S. Bull-Bear Indicator (see Fig. 3) is in Cyclical Bull territory at 65.42, up from the prior week’s 63.63.

In the intermediate picture:

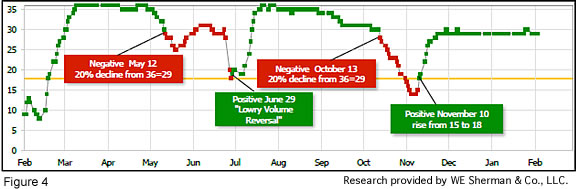

The Intermediate (weeks to months) Indicator (see Fig. 4) turned positive on November 10th. The indicator ended the week at 29, down 1 from the prior week's 30. Separately, the Intermediate-term Quarterly Trend Indicator - based on domestic and international stock trend status at the start of each quarter – was positive entering January, indicating positive prospects for equities in the first quarter of 2017.

Timeframe summary:

In the Secular (years to decades) timeframe (Figs. 1 & 2), whether we are in a new Secular Bull or still in the Secular Bear, the long-term valuation of the market is simply too high to sustain rip-roaring multi-year returns. The Bull-Bear Indicator (months to years) is positive (Fig. 3), indicating a potential uptrend in the longer timeframe. The Quarterly Trend Indicator (months to quarters) is positive for Q1, and the Intermediate (weeks to months) timeframe (Fig. 4) is negative. Therefore, with two of three indicators positive, the U.S. equity markets are rated as Very Positive.

In the markets:

U.S. stocks ended the week essentially flat as a powerful rally on Friday compensated for a poor start to the week. Smaller capitalization stocks outperformed the larger capitalization stocks, but all of the major benchmarks remained below recent highs. The Dow Jones Industrial Average retreated -22 points, but regained the closely-watched 20,000 level to end the week at 20,071, down -0.11%. The tech-heavy NASDAQ rose fractionally, up +0.11% to close at 5,666. By market cap, the LargeCap S&P 500 rose +0.12%, but it was the MidCap S&P 400 and SmallCap Russell 2000 that saw the biggest gains, rising +0.59% and +0.52%, respectively.

In international markets, Canada’s TSX retreated -0.64% after four weeks of gains. Across the Atlantic, the United Kingdom’s FTSE was flat, up just +0.05%. On Europe’s mainland, France’s CAC 40 fell a third straight week, down ‑0.3%, along with Germany’s DAX which retreated a larger -1.38%. Italy was negative for a fourth straight week, down -1.1%. Asian major markets were all in the red. China’s Shanghai Stock Exchange ended down -0.6%, while Japan’s Nikkei retraced last week’s gain by falling -2.82%. Hong Kong’s Hang Seng finished the week down -0.99%. Despite European and Asian losses, developed markets (as measured by the MSCI Developed Markets Index) rose +0.28%, while emerging markets (as measured by the MSCI Emerging Markets Index) gained +0.75%.

In commodities, gold rose +2.73% or $32.40 to end the week at $1,220.80 an ounce. Gold has risen five out of the last six weeks. Silver was also up +2%, closing at $17.48 an ounce. Energy continued to be range bound. Oil gained +1.24%, closing at $53.83 a barrel for West Texas Intermediate crude. The industrial metal copper, viewed by some as a barometer of worldwide economic health, retreated from last week’s gain by falling -2.73%.

In U.S. economic news, job growth in the private-sector picked up in January as employers added 246,000 jobs—far above expectations according to payroll processor ADP. It was the fastest pace of job growth since June. Manufacturing got an unexpected boost, adding 15,000 jobs. In the details of the report, small private-sector businesses added 62,000 jobs in January, medium-sized added 102,000, and large businesses added 83,000. Of those, 201,000 were in the service sector, compared to 46,000 in goods production.

In line with the ADP report, the Labor Department reported that the number of Americans who applied for unemployment benefits at the end of January fell by 14,000 to 246,000. New claims have been under the 300,000 level for 100 straight weeks--an event not seen since the early 1970’s. In addition, the economy has created more than 2 million jobs for the sixth straight year. Analysts note that the month only includes 10 days of the new Trump administration, and that it remains to be seen whether his policies spur further hiring. The less-volatile smoothed four-week average of initial claims rose by 2,250 to 248,000. Continuing claims, those people already receiving benefits, declined by 39,000 to 2.06 million in the week ended January 21. Those claims are reported with a one-week delay.

The monthly Non-Farm Payrolls (NFP) report showed the U.S. created 227,000 new jobs in January, which was the largest gain in four months. Retailers, financial companies, restaurants, and construction firms led the industries seeing the most job gains. The unemployment rate in the NFP rose slightly in large part because more people began looking for work again. Jim Baird, chief investment officer at Plante Moran Financial Advisors summed it up simply stating, “The jobs market just keeps on rolling.” President Trump has vowed to make jobs the central focus of his White House with a three prong strategy of tax cuts, reduced regulations, and infrastructure spending.

A gauge of pending home sales jumped in December, a sign of continued strength in the nation’s housing market despite headwinds. The National Association of Realtors (NAR) National Pending Sales Index rose +1.6% to 109. The reading exceeded analysts’ expectations for a +0.6% rise. The index is used to forecast future sales by tracking real estate transactions in which a contract has been signed, but not yet closed. Regionally, the data was mixed. In the Northeast and Midwest, the index was down -1.6% and -0.8%, respectively. In the South and West, the index rose +2.4% and +5%. In its release, the NAR noted that supply continues to be a concern, and that tighter inventory will continue to push prices higher even as borrowing costs continue to rise.

Home prices accelerated in November, according to the S&P/CoreLogic Case-Shiller home price index. The 20-city index rose +5.3% for the 3-month period ending in November, compared to the same period the year before—an increase of +0.2% from October’s reading. For the year, the national price index rose +5.6%, up +0.1% from October. Among the 20 metro areas comprising the index, Seattle, Denver, and Portland continued to see the strongest price gains. Of note, San Francisco, which had been one of the highest price metros in the country, may finally have reached a saturation point. San Francisco was one of only two cities in the 20-city index to show a monthly decline.

Construction spending fell -0.2% in December after a strong year of growth, according to the Commerce Department. Construction spending for all of 2016 totaled $1.16 trillion, up +4.5% from 2015. Private construction spending rose +0.2%, while public spending fell -1.7%. Residential construction was particularly strong with a +0.5% gain for the month and an overall increase of +5.2% for last year over 2015. Ian Shepherdson, chief economist for Pantheon Macroeconomics noted that architectural billings, viewed as a leading indicator for future projects have surged, and therefore expects a solid 2017.

American consumers spent more on big ticket items like automobiles in December, finishing the final month of the year on an optimistic note. The Commerce Department reported consumer spending increased +0.5% last month, the biggest increase for that month since 2009. Consumer spending is closely watched by analysts because it is responsible for over two-thirds of U.S. economic growth. Overall, consumer spending rose +3.8% last year, following a +3.5% advance in 2015. However, the increase in spending was partly due to the increase in inflation. Americans had to spend more to fill their gas tanks as the price of oil rebounded last year following 2015’s plunge. The Personal Consumption Expenditures (PCE) inflation index climbed +1.6% last year, the fastest 12-month gain since the fall of 2014. The Federal Reserve watches the PCE index closely as its preferred inflation gauge. The Federal Reserve has an inflation target of 2%, with readings above that likely to spur the central bank to raise U.S. interest rates.

Confidence among consumers retreated modestly from the optimism following the election falling to a reading of 111.8 in January, following the 15-year high of 113.3 set in December, according to the Conference Board. Economists had expected a reading of 113. Lynn Franco, Director of Economic Indicators at the Conference Board said in its release, “The decline in confidence was driven solely by a less optimistic outlook for business conditions, jobs, and especially consumers' income prospects. Consumers' assessment of current conditions, on the other hand, improved in January. Despite the retreat in confidence, consumers remain confident that the economy will continue to expand in the coming months." The survey is a closely followed barometer of consumers’ attitudes regarding business conditions, short-term outlooks, personal finances, and jobs.

Manufacturers in the United States reported the strongest growth in more than two years according to the Institute for Supply Management’s (ISM) manufacturing index. ISM said its manufacturing index climbed to 56% last month marking its fifth straight gain, and easily surpassing economists’ forecasts. In addition, it’s at its highest level since the end of 2014. In the details, the new orders and employment components hit their highest levels in 2 years. ISM’s readings are in agreement with IHS Markit’s Purchasing Managers Index manufacturing survey which also showed the strongest readings in nearly two years. Stephen Stanley, chief economist at Amherst Pierpont Securities released a note stating, “This is the healthiest that the manufacturing sector has looked in quite some time.” The index is compiled from a survey of executives who order raw materials and other supplies for their companies.

In the services sector, ISM reported that growth remains strong but came in below forecast last month. The ISM non-manufacturing index fell -0.1 point to 56.5. The components that measure activity, new orders, and inventories declined, while those for employment and deliveries edged up. Readings above 50 indicate expansion.

On Wednesday, the Federal Reserve kept interest rates unchanged and said the economy was still on just a moderate growth path despite the surge in confidence among consumers and businesses following the election. As was widely expected, the Fed voted to leave the federal funds rate at the 0.5-0.75% rate. The Fed’s policy committee vote was unanimous. In its statement, the Fed noted “measures of consumer and business sentiment have improved of late” but said business investment remains “soft.” In December, the Fed indicated it anticipated three interest rate increases this year, but analysts had not expected any movement this early in the new administration’s presidency. By the next meeting in mid-March, more details should be known about Republican plans for taxation and infrastructure spending, and whether the new administration will be able to deliver the level of growth currently expected.

In international news, Canada’s economy rebounded in November as strength in manufacturing, resource extraction, and construction outweighed weakness in real estate. Statistics Canada reported that real gross domestic product rose +0.4% in November, more than compensating for October’s -0.2% drop. Economists noted that November’s growth was broad-based and topped their forecasts by +0.1%. In the report, goods-producing sectors grew +0.9%, while services rose +0.2%. Key sectors such as manufacturing and oil and gas extraction each rose +1.4%. Real estate services dropped -0.2%, which the government statistical agency attributed to new stricter government mortgage-lending rules. Paul Ashworth, chief North American economist at Capital Economics noted, “Overall, the drag on the Canadian economy from the oil price slump has finally faded, but the decline in real estate is a sign that the nascent housing downturn represents a new drag on economic growth.”

In the United Kingdom, members of Britain’s House of Commons advanced a bill this week bringing a full Brexit closer to being a reality. The so-called European Union Bill authorizes Prime Minister Theresa May to begin formal Brexit discussions with the EU. The bill passed by an overwhelming 498 to 114 vote. The bill will now proceed to the UK’s House of Lords. The bill was necessitated by a British Supreme Court ruling last month, which mandated that the decision to leave the EU was a decision for Parliament to make, not the Prime Minister. Even with the bill’s overwhelming support in the House of Commons, analysts note that the Brexit process will be neither quick nor easy.

On Europe’s mainland, the French national statistics office Insee reported that Gross Domestic Product rose +0.4% in the fourth quarter of last year, matching the median estimate. Inflation accelerated +1.6% in January, the most since November 2012. France’s performance was matched by solid growth in Germany and Spain as well. With inflation rising across the region, it will almost assuredly lead to discussion about the ECB’s $2.4 trillion bond-buying program. Michael Martinez, economist at Societe Generale SA in London stated, “The euro zone is getting good nominal growth and rising inflation, a scenario in which pressure on the ECB is going to increase. There are fewer and fewer people who will understand the need to continue doing quantitative easing.”

In Germany, the think tank Ifo Institute reported that Germany broke its previous trade surplus record last year and has overtaken China as the world’s richest exporter. Germany made almost $300 billion more from selling goods and services to other countries than it spent on imports last year, giving it a higher trade surplus than China. China had the second highest trade surplus at $245 billion. According to the institute, exports of goods such as cars and chemicals had a significant impact on Germany’s surplus. The Ifo report also estimated the United States had the largest trade deficit in the world, spending $478 billion more on imports than it earned on exports.

In Asia, solid data from China’s industrial heartland points to a promising start to the new year, following weakness in 2016. China’s official manufacturing Purchasing Managers’ Index (PMI) showed the industrial sector continued to expand in January, although down slightly from December. China’s PMI reading for January slipped ‑0.1 point to 51.3, but still exceeded market expectations. A PMI above 50 indicates expansion. Capital Economics’ China economist Julian Evans-Pritchard said the data suggests China’s recent recovery appears to remain largely intact for now. Of note, the services sector in China accounted for more than half of China’s GDP in 2016, the fifth successive year it has surpassed the economic output of industries such as manufacturing and construction. China’s official non-manufacturing PMI improved +0.1 point to 54.6.

The Bank of Japan upgraded its growth forecasts for the current fiscal year, but kept its policy stance unchanged in a move that was widely expected in its latest policy review. The central bank raised its gross domestic product (GDP) forecast to 1.4% for the current year, up +0.4% from its previous estimate. For fiscal 2017, it raised its economic growth forecast to 1.5%, a rise of +0.2%. In its statement, the BOJ said that the improvement in growth outlook correlates with the recovery of Japanese exports. Analysts at research firm DBS released a note supporting the growth upgrades, writing “Japan's exports and manufacturing have showed clear signs of recovery compared to a quarter ago, thanks to the improvement in the global economy, rebound in commodity prices and depreciation of the yen.”

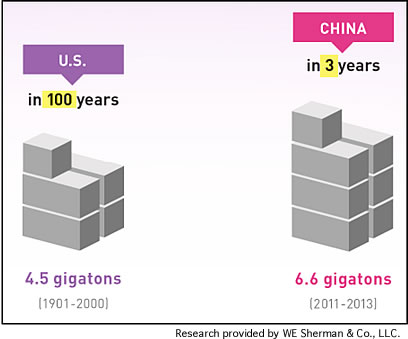

Finally, multi-billionaire Microsoft founder Bill Gates recently wrote on his GatesBlog, “This might be the most mind-blowing fact I learned this year”, followed by a graphic of Chinese cement usage over the last 3 years. In short, China has used more cement in the last 3 years than the United States has used in the last 100 years! China’s 6.6 gigatons of cement, consumed in 3 years, dwarfs the U.S.’ 4.5 gigatons, consumed in 100 years. Here’s the amazing graphic provided by Mr. Gates.

(sources: all index return data from Yahoo Finance; Reuters, Barron’s, Wall St Journal, Bloomberg.com, ft.com, guggenheimpartners.com, ritholtz.com, markit.com, financialpost.com, Eurostat, Statistics Canada, Yahoo! Finance, stocksandnews.com, marketwatch.com, wantchinatimes.com, BBC, 361capital.com, pensionpartners.com, cnbc.com, FactSet; Figs 1-5 source W E Sherman & Co, LLC)

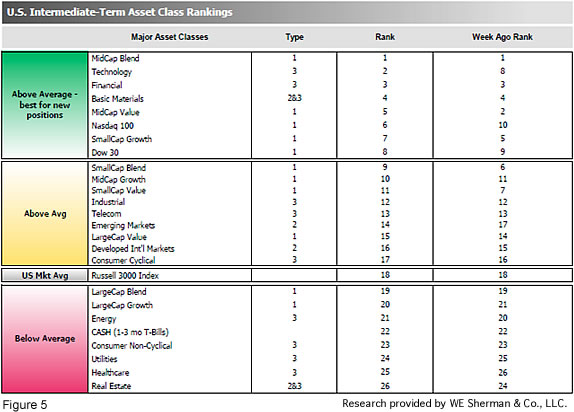

The ranking relationship (shown in Fig. 5) between the defensive SHUT sectors ("S"=Staples [a.k.a. consumer non-cyclical], "H"=Healthcare, "U"=Utilities and "T"=Telecom) and the offensive DIME sectors ("D"=Discretionary [a.k.a. Consumer Cyclical], "I"=Industrial, "M"=Materials, "E"=Energy), is one way to gauge institutional investor sentiment in the market. The average ranking of Defensive SHUT sectors rose to 21.25 from 21.50, while the average ranking of Offensive DIME sectors slipped to 13.50 from 13.00. The Offensive DIME sectors continue to lead Defensive SHUT sectors. Note: these are “ranks”, not “scores”, so smaller numbers are higher ranks and larger numbers are lower ranks.