February 2016: January was Rough for Stock Markets Worldwide

Submitted by The Blakeley Group, Inc. on February 3rd, 2016"Ïncome taxes has made more liars than golfers."

~Will Rogers

April 1924

NOTE: Areas with blue text show the most recent market updates since the January Capital Highlights email.

The very big picture:

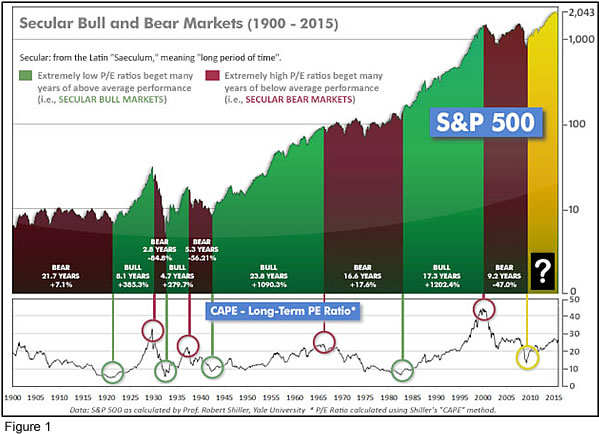

In the “decades” timeframe, the question of whether we are in a continuing Secular Bear Market that began in 2000 or in a new Secular Bull Market has been the subject of hot debate among economists and market watchers since 2013, when the Dow and S&P 500 exceeded their 2000 and 2007 highs. The Bear proponents point out that the long-term PE ratio (called “CAPE”, for Cyclically-Adjusted Price to Earnings ratio), which has done a historically great job of marking tops and bottoms of Secular Bulls and Secular Bears, did not get down to the single-digit range that has marked the end of Bear Markets for a hundred years, but the Bull proponents say that significantly higher new highs are de-facto evidence of a Secular Bull, regardless of the CAPE. Further confusing the question, the CAPE now has risen to levels that have marked the end of Bull Markets except for times of full-blown market manias. See Fig. 1 for the 100-year view of Secular Bulls and Bears.

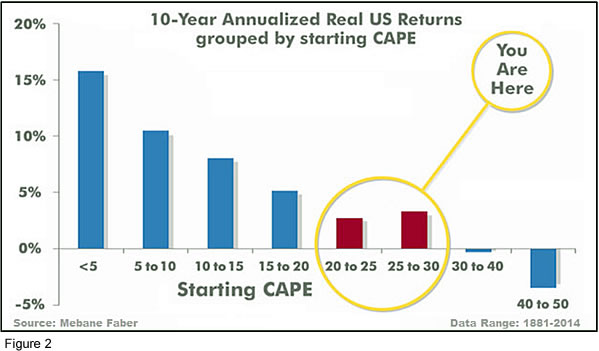

Even if we are in a new Secular Bull Market, market history says future returns are likely to be modest at best. The CAPE is at 24.56, up from the prior week’s 24.16, after having earlier reached the level also reached at the pre-crash high in October, 2007. Since 1881, the average annual returns for all ten year periods that began with a CAPE around this level have been just 3%/yr (see Fig. 2).

This further means that above-average returns will be much more likely to come from the active management of portfolios than from passive buy-and-hold. Although a mania could come along and cause the CAPE to shoot upward from current levels (such as happened in the late 1920’s and the late 1990’s), in the absence of such a mania, buy-and-hold investors will likely have a long wait until the arrival of returns more typical of a rip-snorting Secular Bull Market.

In the big picture:

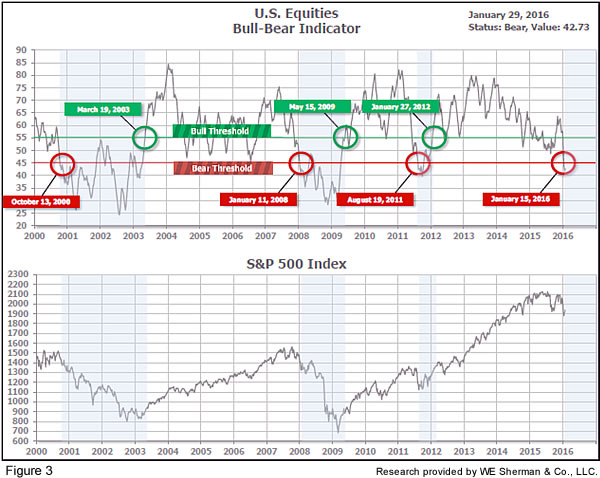

The “big picture” is the months-to-years timeframe – the timeframe in which Cyclical Bulls and Bears operate. The US Bull-Bear Indicator (see Fig. 3) turned negative on January 15th, and remains in Cyclical Bear territory at 42.73, up from the prior week’s 41.79.

In the intermediate picture:

The intermediate (weeks to months) indicator (see Fig. 4) turned positive on January 26th. The indicator ended the week at 6, up smartly from the prior week’s 0. Separately, the quarter-by-quarter indicator – based on domestic and international stock trend status at the start of each quarter – gave a negative indication on the first day of January for the prospects for the first quarter of 2016.

Timeframe summary:

In the Secular (years to decades) timeframe (Figs. 1 & 2), whether we are in a new Secular Bull or still in the Secular Bear, the long-term valuation of the market is simply too high to sustain rip-roaring multi-year returns. The Bull-Bear Indicator (months to years) is negative (Fig. 3), indicating a new Cyclical Bear has arrived. The Quarterly Trend Indicator (months to quarters) is negative, and the Intermediate (weeks to months) timeframe (Fig. 4) is positive. Therefore, with two of the three indicators negative, the U.S. equity markets are rated as Mostly Negative.

In the markets:

The U.S. stock market capped a volatile week with a +396 point rally on Friday. Analysts attributed the rally to a few strong earnings reports, expectations of slower rate hikes by the Fed, and – most of all – the adoption of negative interest rates by the Bank of Japan. For the week, the Dow Jones Industrial Average rose +2.3%, up +372 points to 16,466. The NASDAQ Composite was the laggard of the major indexes, gaining just half a percent and ending the week at 4,614. The LargeCap S&P 500 rose +1.75%, the MidCap S&P 400 added +2.3%, and the SmallCap Russell 2000 gained +1.4%.

In international markets, Canada’s TSX rebounded +3.49%, helped by the rise in prices for oil and gold. In Europe, the United Kingdom’s FTSE rose +3.1%, France’s CAC 40 gained +1.85%, and Germany’s DAX added +0.34%. In Asia, Japan’s Nikkei ended the week up +3.3%, and Hong Kong’s Hang Seng index rose +3.1%. But China was unable to halt its decline and fell for a 5th straight week, down an additional -6.14%.

In commodities, a barrel of West Texas Intermediate crude oil surged +4.3% to $33.62. In precious metals, an ounce of silver rose +1.68% to $14.26, and gold tacked on +$20.20 to end the week at $1,118.40 an ounce.

The month of January was a rough one for stock markets worldwide. The SmallCap Russell 2000 was the worst-performing US index in January, down -8.85%, followed closely by the NASDAQ Composite, down -7.86%. The best-performing US index was the S&P 500, at “just” -5.07% (the worst month for the S&P 500 since last August, and the worst January since 2009). After a disappointing (-11.1%) performance in 2015, Canada was the least-damaged major world market in January, at a relatively benign -1.44% for the Toronto TSX Composite. Developed International and Emerging International were in the same ballpark as the US for January, returning -5.03% and ‑5.52% respectively.

In U.S. economic news, Initial claims for jobless benefits fell 16,000 to 278,000 last week according to the Labor Department. This was a relief to economists who worried that after new claims touched a 7-month high earlier this month a softening in the labor market might have begun, but the lower claims number is new evidence that the labor market is still relatively upbeat despite a slowing overall U.S. economy.

In U.S. housing, S&P/Case-Shiller reported that U.S. home price gains accelerated in November, slightly beating expectations. The index, based on a sample of 20 major metro areas, saw a +5.8% annual gain—the highest since July 2014. Portland, Denver, and San Francisco continue to lead with double-digit gains. National Association of Realtors chief economist Lawrence Yun noted in a press release that “While sustained job creation is spurring more activity, the ability to find available homes in affordable price ranges is difficult for buyers in many job creating areas.”

Demand for long-lasting “durable” goods declined sharply in December, signaling a downturn in business investment in 2015 that worsened in the final months of the year. The Commerce Department said orders for durable goods fell a seasonally-adjusted -5.1% last month, the biggest decline in a year and a half. Economists had been expecting only a -1.5% decline. Of particular concern is the orders number for core capital-goods, which remove aircraft and defense. That metric declined -4.3% in December and is down -7.5% for the year. This was the first annual decline in 3 years.

A dismal start to the year in the markets hasn’t impacted the U.S. consumer. The Consumer Confidence Index beat estimates by 2 points coming in at 98.1 this month according to the Conference Board. The number is closely watched by analysts due to the U.S. consumer driving 70% of the economy. Less than a quarter of respondents said jobs were hard to get, but those saying they were “plentiful” fell slightly.

Crude oil’s 70% plunge since June of 2014 has hurt the Lone Star state in a big way. The Dallas Federal Reserve’s general business activity index declined to -34.6 in January, plunging further into negative territory following December’s -21.6 reading. The reading is the most negative since April of 2009. The production index, which had been the last bastion of strength despite weak orders, finally capitulated into negative territory dropping 23 points to -10.2. New orders and unfilled orders fell deeper into contraction. The Texas employment index also turned negative for the first time in 3 months.

On Wednesday the Federal Reserve kept its key interest rate unchanged and signaled that it’s taking a time-out before resuming its effort to normalize interest rate policy. The lack of movement was widely expected. Fed watchers noted that one key phrase had been removed from the post-meeting statement that was present in the December minutes. The phrase “The committee…is reasonably confident that inflation will rise, over the medium term, to its 2 percent objective.” was replaced with inflation is “expected to remain low in the near term” but still rise to the 2% in the medium term. Though the change is subtle, it implies that the Fed is retreating from the implied projection of 4 quarter-point rate hikes in 2016.

In Japan, the Bank of Japan shocked markets around the world by taking the aggressive step of cutting interest rates below zero on Friday. The policy essentially means that banks will have to pay for the privilege of “parking” money at the central bank, and in theory this should motivate the banks to lend more. The move represents a last resort for the country that has struggled with weak growth for a quarter-century. This move was also widely interpreted as being a damper on the pace at which the U.S. Fed increases interest rates, since now the European Central Bank and the Bank of Japan have gone the opposite direction as the U.S. in their respective interest rate policies.

In China, capital outflows surged $158.7 billion in December to an estimated $1 trillion for all of 2015. The large scale of the outflows is a sign of the battle being waged among policymakers trying to manage the yuan amid slower economic growth and falling Chinese stock markets. The entire year’s estimated trillion-dollar total is greater than 7 times the prior year’s $134.3 billion, according to Bloomberg Intelligence data. December’s outflows increased by almost $50 billion over November after China’s central bank stated that it would refocus the yuan’s moves against a wider basket of currencies than just the dollar.

Finally, one long-standing indicator of stock market health is the amount of money borrowed by investors and speculators for stock purchases – called “margin debt”. The amount of outstanding margin debt reached a peak last April and has declined steadily ever since. Originally devised in the 1970’s by market analyst Norman Fosback, the margin debt indicator has a good record of identifying Bull and Bear markets when compared to its own 12-month moving average. The identification is even more accurate when the margin debt breach is more than a one-month aberration. Unhappily for the Bulls, margin debt has now remained below its 12-month moving average for 5 consecutive months.

(sources: all index return data from Yahoo Finance; Reuters, Barron’s, Wall St Journal, Bloomberg.com, ft.com, guggenheimpartners.com, ritholtz.com, markit.com, financialpost.com, Eurostat, Statistics Canada, Yahoo! Finance, stocksandnews.com, marketwatch.com, wantchinatimes.com, BBC, 361capital.com, pensionpartners.com, cnbc.com, FactSet; Figs 1-5 source W E Sherman & Co, LLC)

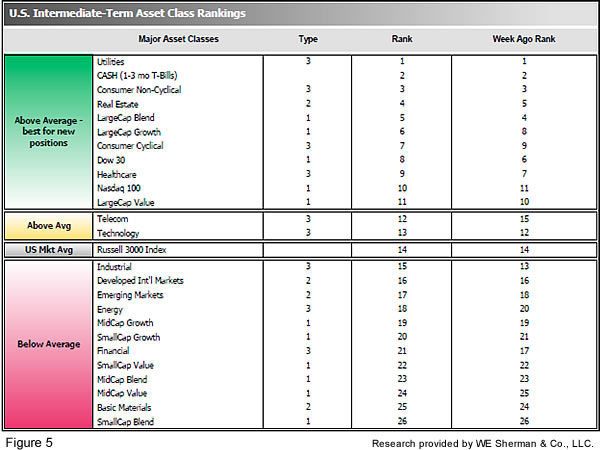

The ranking relationship (shown in Fig. 5) between the defensive SHUT sectors (“S”=Staples [a.k.a. consumer non-cyclical], “H”=Healthcare, “U”=Utilities and “T”=Telecom) and the offensive DIME sectors (“D”=Discretionary [a.k.a. Consumer Cyclical], “I”=Industrial, “M”=Materials, “E”=Energy), is one way to gauge institutional investor sentiment in the market. The average ranking of Defensive SHUT sectors rose slightly to 6.3 from the prior week’s 6.5, while the average ranking of Offensive DIME sectors also rose slightly to 16.3 from the prior week’s 16.5. The Defensive SHUT sectors have maintained their lead over the Offensive DIME sectors. Note: these are “ranks”, not “scores”, so smaller numbers are higher ranks and larger numbers are lower ranks.

Summary:

The US has led the worldwide recovery, and continues to be among the strongest of global markets. However, the over-arching Secular Bear Market may remain in place globally even through new highs were reached in the US earlier this year. Because the world may still be in a Secular Bear, we have no expectations of runs of multiple double-digit consecutive years, and we expect poor market conditions to be a frequent occurrence. Nonetheless, we remain completely open to any eventuality that the market brings, and our strategies, tactics and tools will help us to successfully navigate whatever happens.

Check out the latest article in the Resource area of our website:

“Hacking and Identity Theft: A Simple Step to Better Protect Yourself