Do You Know Your High-Net-Worth Personality?

Submitted by The Blakeley Group, Inc. on April 22nd, 2022Key Takeaways:

- There are nine distinct high-net-worth personality types.

- Many affluent investors are Family Stewards who want to take care of loved ones.

- It’s important to work with advisors and others who understand and respect the type of investor you are

If you’re like most successful people we know, you’re probably seeking truly valuable financial advice that’s designed around maximizing your ability to achieve your most important objectives. That’s likely the case whether you’re an entrepreneur or an employee, or you’ve inherited significant wealth.

One often overlooked way to help make that happen is to work with professionals who are able to connect with you and relate to you. You want to surround yourself with experts who know you well enough to really “get” what you want your money to accomplish, and why.

In fact, we’ve found over the years that a personal connection between advisors and their clients is as important to financial success as traits such as advisors’ competence and resources. That doesn’t mean you have to be best friends with your advisor, of course. But there should be some sort of affinity there.

To get advice that works, it’s incumbent on you to understand your own high-net-worth (HNW) personality so you can select and work with advisors who are an ideal match.

What is an HNW personality, anyway?

HNW psychology is all about understanding what the affluent want from the professionals they work with, as well as the “how” and “why” behind their attitudes and decisions about their money. Developed in the late 1990s, HNW psychology has been verified through the study of thousands of wealthy investors ever since. It’s also been adopted by elite, forward-thinking financial advisors and other professionals.

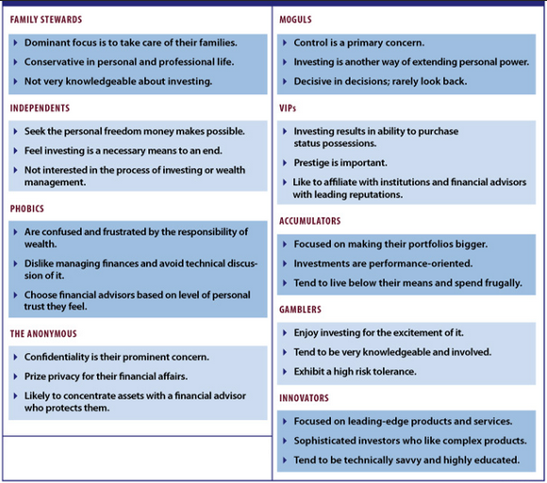

The results of this work in HNW psychology have helped researchers identify nine HNW personality types (see Exhibit 1). Chances are, you fall into one of these nine categories:

Exhibit 1

At a Glance: The Nine High-Net-Worth Personalities

- The Family Steward. Family Stewards’ chief financial and investment concern is taking good care of their loved ones. Their goals usually center on issues like paying for children’s tuition or passing on wealth to heirs. Family Stewards are often conservative financially, and want financial advisors who make them feel that their goal of caring for family is protected.

- The Independent. This type of affluent investor wants the freedom that financial security ensures—freedom to do what they want, when they want to do it. To them, wealth is a means to a desired end. They want to work with financial advisors who can give advice that will allow them to attain—and maintain—financial freedom and flexibility.

- The Investment Phobic. Phobics don’t like investing, don’t understand it and don’t want to learn. They prefer to delegate investment duties to a financial advisor they trust and who demonstrates reliability and dedication.

- The Anonymous. These are extremely private investors who value confidentiality and don’t want to disclose their financial information to anyone. They tend to work with only one or two advisors whom they trust deeply because of those advisors’ focus on privacy.

- The Mogul. Moguls seek power, influence and control, and they tend to view investing as yet another arena where they can exercise those things.

- The VIP. VIPs value prestige, and usually want their investments to help them buy possessions and social respect. VIPs prefer to work with “marquee” firms that are prestigious and well known among their peers.

- The Accumulator. These investors save more than they spend, live below their means and don’t show outward signs of affluence. They may have millions of dollars, but might wear only sale-priced clothes from discount stores. Their goal is capital appreciation, pure and simple. The more money they have, the better and more comfortable they feel.

- The Gambler. To Gamblers, investing is all about the excitement and drama—and, of course, performance results. They are most likely to believe that they can consistently beat the market, and want to work with financial advisors who will aggressively try to do so.

- The Innovator. Innovators like new investment products, strategies, services and trading methods. They want advisors who are technically savvy and up to speed in their knowledge of and approach to investing—and who will offer them the newest and often most complex solutions.

Note: There’s nothing inherently good or bad about any of the personality types. Each one simply reflects someone’s core beliefs and ideals about money and wealth.

Why It Matters

If you choose to work with an advisor, it’s important to partner with one who shares your particular HNW personality—or who at least knows how to work well with your type.

It’s not just because it’s nice to work with someone who thinks similarly to you. We believe that working with an advisor who doesn’t understand or appreciate your core values could potentially cost you financially.

Example: Say you’re a Mogul personality type who is seeking outsized returns and willing to take substantial risk to maximize the probability of obtaining your goal. You’ll probably be poorly served and disappointed by an advisor who favors conservative investments. Likewise, if you’re a Phobic and your advisor constantly wants to talk about the investment process and the gyrations of the markets, you’ll find yourself having an unsuccessful—and unenjoyable—investment experience.

The upshot: Your wealth needs to be positioned to support what you care about most in life. And you need to be able to trust the advice you’re getting, as well as the source of that advice. If your advisor doesn’t “play well in the sandbox” with someone like you, you’ll receive none of those benefits—which, in turn, could mean you won’t grow and protect your wealth according to your wishes and beliefs.

Identify your personality

Which type fits you closest? You may find there is some overlap, but chances are one category describes your personality best most of the time. We tend to see that most people are Family Stewards—they do what they do in order to help give their spouses, children and grandchildren more opportunities in life.

If you’re not sure or want to conduct a reality check on your assumption, write down some answers to these four questions:

- What would you like your investments to achieve? If you’re a Family Steward, your answers will revolve around what you would like your money to do for your family, ranging from funding the college education of a child or grandchild to taking care of an elderly parent to estate planning that ensures a harmonious division of assets for your children. You’ll want an advisor who focuses in those areas and has an in-depth understanding of families and family dynamics.

If, by contrast, you’re an Independent, your answers will probably include goals like buying your dream house or sailing around the world. In other words, you will place the highest value on using money to buy personal autonomy and freedom to do exactly what you want to do in life—and your advisor will need to understand and account for those drivers when serving you.

- When you think about money, what concerns, needs or feelings come to mind? If you write down a phrase like “I want my money to grow as quickly and safely as possible” or “I want to have $5 million by the time I’m 60,” you can be pretty confident you are an Accumulator looking mainly to acquire more assets. Accumulators are not particularly concerned about what they can do with their money; they are driven to accumulate it. That might mean you should seek out an advisor who pursues strong growth and/or one who takes steps to ensure that your wealth will be protected over time.

If you associate feelings of power, importance and control with money, you are most likely a Mogul. You see having more money as having more ability to influence people—ranging from family members to business contacts to community leaders—and events to your advantage.

If you really enjoy being recognized and acknowledged, and enjoy prestigious surroundings and possessions, you are likely a VIP. That means you are interested in what money can do for you mostly in terms of gaining material possessions: a wonderful new house, fabulous trips, a new boat. VIPs tend to invest for what money can buy and the lifestyle it can confer.

- How involved do you like to be in the investing process? The question is extremely effective in determining whether you are a Phobic, Gambler or Innovator. If you feel investing is uncomfortable, a burden or even a bit scary, you are probably a classic Phobic—and you’ll probably want an advisor who doesn’t throw a lot of detailed information about investing at you. But if you love learning all you can about financial markets and investments and feel a strong need to take a hands-on approach to managing your wealth—either to get a thrill or to pursue wealth management as an intellectual challenge—you may be a Gambler or Innovator. If so, you’ll be best served by an advisor who wants to “get in the trenches” with you when it comes to investing decisions and seeking out cutting-edge solutions and insights.

- How important to you is confidentiality of your financial affairs? Just about everyone cares about confidentiality, of course. But if you are deeply concerned about this issue and feel almost secretive about your financial affairs, consider yourself an Anonymous personality type. You’ll want an advisor who has systems in place to ensure the security and confidentiality of your financial data—and who explicitly details those measures to you.

Conclusion

Armed with a good idea of your high-net-worth personality type, you can assess whether the advice you are getting today reflects that type. It’s another key step in helping to position yourself to achieve an elite wealth management experience.