DEC 2016: U.S. economy grew at the fastest pace in over 2 years

Submitted by The Blakeley Group, Inc. on December 12th, 2016"An investment in knowledge pays the best interest.”

~ Benjamin Franklin

NOTE: Areas with blue text show the most recent market updates since the November Capital Highlights email.

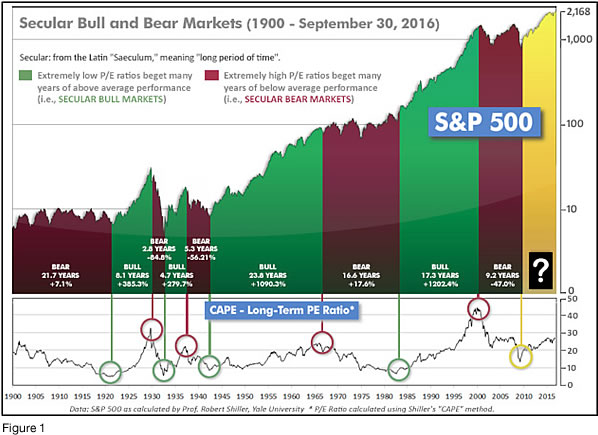

In the "decades" timeframe, the question of whether we are in a continuing Secular Bear Market that began in 2000 or in a new Secular Bull Market has been the subject of hot debate among economists and market watchers since 2013, when the Dow and S&P 500 exceeded their 2000 and 2007 highs. The Bear proponents point out that the long-term PE ratio (called “CAPE”, for Cyclically-Adjusted Price to Earnings ratio), which has done a historically great job of marking tops and bottoms of Secular Bulls and Secular Bears, did not get down to the single-digit range that has marked the end of Bear Markets for a hundred years, but the Bull proponents say that significantly higher new highs are de-facto evidence of a Secular Bull, regardless of the CAPE. Further confusing the question, the CAPE now has risen to levels that have marked the end of Bull Markets except for times of full-blown market manias. See Fig. 1 for the 100-year view of Secular Bulls and Bears.

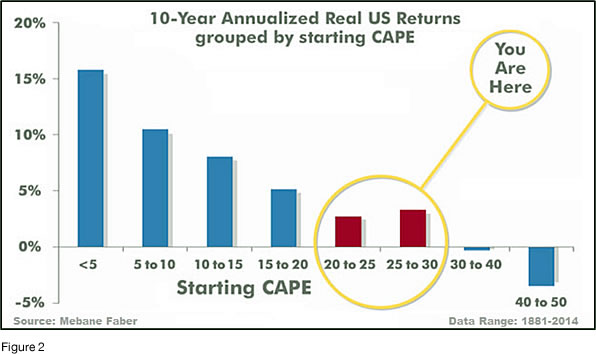

Even if we are in a new Secular Bull Market, market history says future returns are likely to be modest at best. The CAPE is at 27.10, down from the prior week’s 27.40, and only a little lower than the level reached at the pre-crash high in October, 2007. Since 1881, the average annual return for all ten year periods that began with a CAPE around this level have been just 3%/yr (see Fig. 2).

This further means that above-average returns will be much more likely to come from the active management of portfolios than from passive buy-and-hold. Although a mania could come along and cause the CAPE to shoot upward from current levels (such as happened in the late 1920’s and the late 1990’s), in the absence of such a mania, buy-and-hold investors will likely have a long wait until the arrival of returns more typical of a rip-snorting Secular Bull Market.

In the big picture:

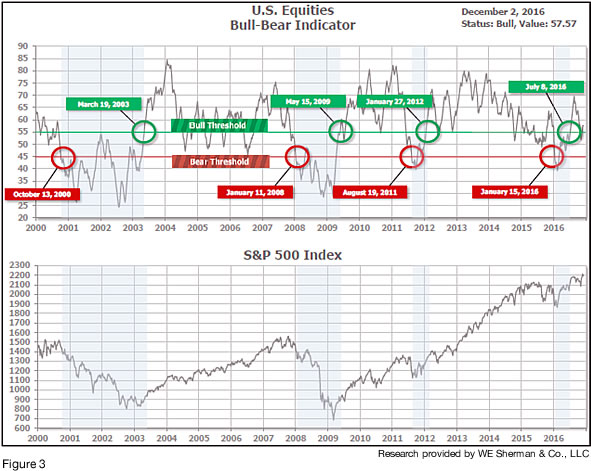

The “big picture” is the months-to-years timeframe – the timeframe in which Cyclical Bulls and Bears operate. The U.S. Bull-Bear Indicator (see Fig. 3) is in Cyclical Bull territory at 57.57, down slightly from the prior week’s 57.20.

In the intermediate picture:

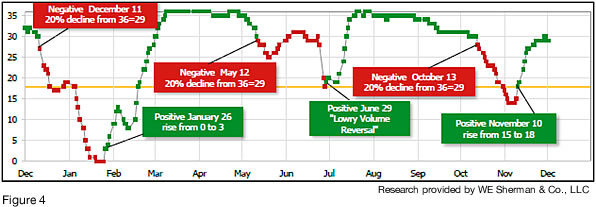

The Intermediate (weeks to months) Indicator (see Fig. 4) turned negative on October 14th. The indicator ended the week at 29, unchanged from the prior week. Separately, the Quarterly Trend Indicator - based on domestic and international stock trend status at the start of each quarter – was positive entering October, indicating positive prospects for equities in the fourth quarter of 2016.

Timeframe summary:

In the Secular (years to decades) timeframe (Figs. 1 & 2), whether we are in a new Secular Bull or still in the Secular Bear, the long-term valuation of the market is simply too high to sustain rip-roaring multi-year returns. The Bull-Bear Indicator (months to years) is positive (Fig. 3), indicating a potential uptrend in the longer timeframe. The Quarterly Trend Indicator (months to quarters) is positive for Q4, and the Intermediate (weeks to months) timeframe (Fig. 4) is negative. Therefore, with two of three indicators positive, the U.S. equity markets are rated as Very Positive.

In the markets:

U.S. stocks broke a string of three consecutive weeks of gains with most indexes turning lower for the week. As has been the case most of the year, the losses were unevenly distributed. The Dow Jones Industrial Average outperformed the other indexes, helped by strong performance in bank, energy, and health care stocks. For the week, the Dow Jones Industrial Average added +18 (+0.1%) points to close at 19,170. The technology-heavy NASDAQ Composite fell over -143 points to 5,255, down -2.65%. Large caps outperformed mid and small caps. The LargeCap S&P 500 index ended down -0.97%, while the MidCap S&P 400 gave up -0.98%, while the SmallCap Russell 2000 dropped the most, at -2.45%.

In international markets, Canada’s TSX ended down slightly, -0.15%. In Europe, the United Kingdom’s FTSE gave up -1.6%. On Europe’s mainland, both France’s CAC 40 and Germany’s DAX were also down, -0.47% and -1.74%, respectively. However, Italy’s Milan FTSE had a second week of gains, rallying +3.46%. In Asia, major markets were mixed. China’s Shanghai Composite fell -0.55%, while Japan’s Nikkei rose +0.24%. Hong Kong’s Hang Seng was also down, pulling back -0.7%. As a whole, developed markets were down -0.1%, while emerging markets gave up -0.4%. As a group, emerging markets (as measured by the MSCI Emerging Markets Index) fell -0.4%, while developed markets (as measured by the MSCI Developed Markets Index) dropped just -0.1%.

Precious metals stabilized a bit after 3 weeks of heavy losses. Gold lost only a ‑$0.60 to end the week at $1,177.80 an ounce, and silver managed a gain of +2.2%, rising +$0.36 to $16.83 an ounce. The industrial metal copper, seen by some as an indicator of global economic health, retreated -1.6% after rallying 4 out of the 5 past weeks. The big commodity news of the week was in energy, where crude oil surged +$5.62 a barrel to $51.68, a weekly gain of +12.2%!

The month of November was great for the U.S., ok for Canada, and not so great for the rest of the world. In the U.S., SmallCaps ripped higher with a +10.99% gain, MidCaps followed at +7.82%, the LargeCap S&P 500 at +3.42%, and the NASDAQ Composite brought up the rear at a still-respectable +2.59%. Canada’s TSX tacked on an additional +2.00% on top of very nice year-to-date gains. But Emerging and Developed international markets didn’t participate in the gains, as the MSCI Emerging Markets Index dropped -4.42% and the MSCI Developed Markets Index lost -1.78%.

In U.S. economic news, initial claims for unemployment rose 17,000 to 268,000 according to the Labor Department. Initial claims have remained below the key 300,000 threshold for 91 straight weeks, the longest stretch since 1970. Consensus forecasts had been for 250,000 claims. The smoothed 4-week moving average of claims, used by analysts to smooth out volatility, rose by 500 to 251,500. Continuing claims, those people who are already collecting unemployment benefits rose 38,000 to 2.08 million.

The U.S. jobless rate hit a 9-year low of 4.6% last month, falling much more than expected as the economy added 178,000 new jobs last month. Gus Faucher, economist at PNC Financial Services Group said “The economy is close to full employment, and the Fed wants to start gradually raising interest rates before the economy reaches full employment and wage pressures accelerate too much and spark much higher inflation.” However, behind the headline number was the fact the unemployment rate dropped because that the civilian labor force shrunk by 226,000, as more people dropped out of the workforce. Many analysts prefer a broader measure of unemployment, known as the U6 rate. That rate fell to 9.3% from 9.5%. This measure includes part time workers looking for a full-time position, and job seekers who have recently given up looking for work.

Payrolls processor ADP reported private employers added 216,000 jobs last month. This was much higher than the consensus forecast of 160,000 jobs. The strong number prompted a response from Mark Zandi, chief economist of Moody’s Analytics who remarked “Mr. Trump is inheriting a strong economy.” In the details of the report, numbers were strong across the board. Small businesses added 37,000 jobs, medium businesses added 89,000, and large businesses added 90,000 workers. But, as has become the norm in this post-recession economy, all the gains were concentrated in the services sector. Goods-producing categories like mining and manufacturing were negative.

In real estate, pending home sales rose slightly in October, indicating that growth in the housing market may be tapering. The National Association of Realtors’ (NAR) index ticked up +0.1% to 110.0, economists had forecast a gain of +0.8%. The index forecasts future sales by tracking real estate transactions in which a contract has been signed, but the deal has not yet closed. Pending sales declined in only one region - the South - where the index fell ‑1.3%. The Northeast, Midwest, and West saw gains of +0.4%, +1.6%, and +0.7%, respectively. Indices for all regions are higher across-the-board compared to the same period last year. According to the NAR, roughly 40% of home sales were at or above list price in October. NAR Chief Economist Lawrence Yun stated, “Low supply has kept prices elevated all year and has put pressure on the budgets of buyers.” In addition, last month’s sales of previously-owned homes were at their highest levels since before the housing crash.

The S&P/Case-Shiller 20-city home price index was up +0.1% in the 3rd quarter, up +5.1% from the year-ago period. As in previous readings, metro areas in western states were the strongest. Seattle, Portland, and Denver all saw strong gains, up +11%, +10.9%, and +8.7% respectively. However, while the year-over-year numbers are strong, the month-to-month numbers have weakened, leading some analysts to suggest that things may be cooling off a bit. San Francisco, one of the fastest rising markets for the past few years, actually declined -0.4% for the month, and Seattle’s home prices were unchanged for the month.

According to the Commerce Department, the U.S. economy grew at the fastest pace in over 2 years in the 3rd quarter as both consumers and government increased their spending and exports surged. The U.S. Gross Domestic Product grew at a +3.2% annual rate in its second reading. The reading was the strongest since the 2nd quarter of 2014 and beat economists’ estimates of +3.1%. Supporting the strong reading was an increase in consumer spending, which accounts for about two-thirds of the economy. Spending rose +2.8% - stronger than the original estimate of +2.1%. In addition, business investments in structures like offices and factory buildings surged +10.1%, almost double the original +5.4% estimate. Corporate profits were also strong, rising +6.6% and after-tax profits surged +7.6% (following a -13.3% plunge over the previous year and a half). Exports of goods are the strongest in three years, while imports were down slightly from the previous quarter.

The Federal Reserve’s latest Beige Book report revealed that there was no sign of any postelection euphoria among the surveyed business contacts. The Beige Book is a culmination of surveys from each Federal Reserve regional bank to its contacts in finance, business, academia, market experts, and other sources. In the report, retails sales remained mixed—sales were higher for apparel and home furnishings, but vehicle sales were down in “most” Fed districts. Wage growth remained “modest, on balance” according to the report, a trend which has been in place most of the year.

Confidence among American consumers jumped to its highest level since 2007, according to the Conference Board. The consumer-confidence index rose to 107.1, an increase of +6.3 points from October. Economists had only expected a reading of 102. Stephen Stanley, chief economist at Amherst Pierpont stated that the data was consistent with a pattern of optimism following elections. “This campaign was so acrimonious that having the election over may have had people feeling better,” he said. The present situation index, which measures how consumers feel about their current conditions, gained +7.3 points to 130.3. The future expectations index also improved, rising +5.7 points to 91.7.

The incomes of Americans rose in October at the fastest rate in 6 months according to the Commerce Department. The positive result should make for a good holiday shopping season economists say. Consumer spending rose +0.3% in October, slightly less than forecasts of +0.5%. Personal incomes rose +0.6%, beating expectations by +0.2%. Richard Moody, chief economist at Regions Financial remarked “Solid income growth sets the stage for continued growth in consumer spending over coming months.” Consumer spending makes up about two-thirds of the nation’s gross domestic product (GDP). That fact makes this reading very significant.

Economic activity in the Chicago-area surged to its highest level in almost two years last month, further evidence that the manufacturing sector may have bottomed. The Chicago Purchasing Managers Index surged +7 points to 57.6, its highest level since January 2015 according to the Institute of Supply Management. Economists had been expecting a reading of 52. Shaily Mittal, senior economist at MNI Indicators stated “The November reading for the Business Barometer marked the sixth month of expansionary business activity in the U.S. Strength in orders, a recovery in oil prices and the stronger dollar have all impacted businesses with varying degrees.” Survey respondents were reportedly optimistic about 2017. The Institute for Supply Management (ISM) said its manufacturing index rose to its highest level in 5 months. The ISM Manufacturing index rose to 53.2, up +1.3 points from October and beating the consensus forecast of 52.5. Readings over 50 indicate more companies are expanding instead of contracting. Rob Martin, an economist at Barclays said, “Overall, this morning’s report supports our view that manufacturing is likely to stabilize after the weakness early in the year.” In addition, ISM’s new orders index rose to 53, up +0.9 point and indexes for production and exports also showed strength. Of the 18 manufacturing industries in the survey, 11 reported growth.

Dallas Fed President Robert Kaplan stated that the Federal Reserve should take a “wait-and-see” stance towards the economic ideas of President-elect Donald Trump because some of the policies under discussion could boost growth, while others may slow the economy. Kaplan was in agreement with the market consensus that the U.S. central bank will raise interest rates at its policy meeting later this month. Analysts note that odds of a rate hike at the next Federal Reserve meeting are around 90%. In addition, Mr. Kaplan said there would likely be more rate hikes over the coming 12 months, but that the path of the hikes would be “somewhat shallower” than prior cycles.

Inflation continues to close in on the Federal Reserve’s 2% target. By the personal-consumption expenditures (PCE) measurement, inflation rose +1.4% over the past year, the highest rate in 2 years. Excluding the often volatile food and energy categories, core PCE grew +1.7% over the past year. This is an increase of +0.4% from this time last year. Earlier this week, the government raised its estimates for wages and salary income in the second and third quarters of this year. Andrew Schneider, economist at BNP Paribas said “This extra household income could explain why consumption growth is holding up in the fourth quarter, despite rising inflation.”

The Canadian economy grew +0.9% in the 3rd quarter rebounding from the 2nd quarter slump due to the Alberta wildfires. Annualized, GDP grew at a rate of 3.5%. StatsCan reported that growth was driven by a +6.1% increase in the energy sector. Exports of goods and services were also strong, rising +2.2% during the 3rd quarter. The quarter was a big turnaround from the second quarter which had contracted by -1.3%. The result exceeded the average estimate of 22 economists surveyed by Bloomberg who had expected an annualized growth rate of +3.38%.

Across the Atlantic in the United Kingdom, according to the Organization for Economic Cooperation and Development the UK will outgrow and outperform the Eurozone over the next decade. The OECD revised its forecast for Britain up to +2% this year, and up +1.2% in 2017. The group believes that the UK will be granted the best possible “most favored nation” status with other EU countries after its EU exit in 2019. The predictions are another blow to the many economists and established institutions who had very vocally and incorrectly predicted that a Brexit vote would cast the UK into an economic abyss.

In France, former Prime Minister Francois Fillon pledged deep economic reforms after winning France’s conservative party presidential nomination. Fillon is an outspoken right-wing candidate who has advocated slashing public sector jobs and deregulating the economy. He has promised to raise the retirement age to 65 and ending early pension rights for many in the state sector. Fillon defeated Alain Juppe in France’s conservative presidential primary with a substantial 66% of the votes.

Italian premier Matteo Renzi has promised to resign if he loses this weekend’s referendum. The referendum seeks to overhaul the country’s legislature, altering the composition of parliament, the way laws are passed, and the balance of power between the country’s central government and its 20 regions. If the referendum fails, the Constitution will stay as it is. Some believe that a ‘No’ win would be a third “anti-establishment revolt” in 2016, following the Brexit vote and election of Donald Trump in the U.S., that could lead to a banking crisis and the exit of Italy from the Eurozone.

Japan’s unemployment rate held steady in October as the availability of jobs improved and household spending fell at a slower rate. Hiroshi Miyazaki, economist at Mitsubishi UFJ Morgan Stanley Securities said, “The labor market has been improving for a while now, and this is starting to lift consumer sentiment.” Japan’s unemployment rate has been falling partly due to a shrinking labor force. The seasonally-adjusted unemployment rate was 3%, in-line with estimates. Data this week showed consumers increased spending on domestic travel and furniture last month. Household spending was down -0.4% in October, but it was less than the estimated ‑0.6%.

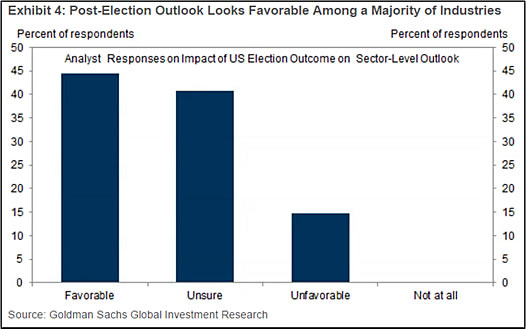

Finally, a team at Goldman Sachs sent out a survey to analysts immediately after the Presidential election, asking what they thought the election of Donald Trump might mean for the industries they covered. Turns out, they were quite optimistic. Avisha Thakkar, leader of the survey team, wrote “While their responses suggest that there is still uncertainty about the sector-level impact, the majority of sectors are anticipating favorable effects.” Respondents stated that expectations of lower tax rates and economic stimulus were the chief reasons for their optimism.

A minority of analysts were not so hopeful. Those that cover sectors such as autos, aerospace, clean energy and agribusiness said they expected the election to weigh negatively on their sectors.

Sources: all index return data from Yahoo Finance; Reuters, Barron’s, Wall St Journal, Bloomberg.com, ft.com, guggenheimpartners.com, ritholtz.com, markit.com, financialpost.com, Eurostat, Statistics Canada, Yahoo! Finance, stocksandnews.com, marketwatch.com, wantchinatimes.com, BBC, 361capital.com, pensionpartners.com, cnbc.com, FactSet; Figs 1-5 source W E Sherman & Co, LLC)

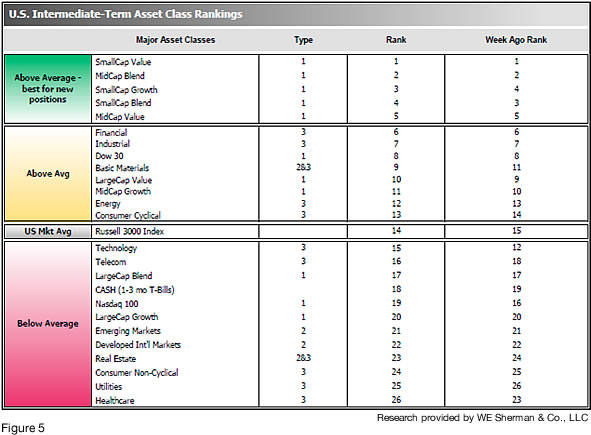

The ranking relationship (shown in Fig. 5) between the defensive SHUT sectors ("S"=Staples [a.k.a. consumer non-cyclical], "H"=Healthcare, "U"=Utilities and "T"=Telecom) and the offensive DIME sectors ("D"=Discretionary [a.k.a. Consumer Cyclical], "I"=Industrial, "M"=Materials, "E"=Energy), is one way to gauge institutional investor sentiment in the market. The average ranking of Defensive SHUT sectors rose to 27.75 from 23.00, while the average ranking of Offensive DIME sectors rose rose to 10.25 from 11.25. The Offensive DIME sectors continue to lead Defensive SHUT sectors. Note: these are “ranks”, not “scores”, so smaller numbers are higher ranks and larger numbers are lower ranks.