August 2016: The U.S. Major Indexes Finished the Week Mixed

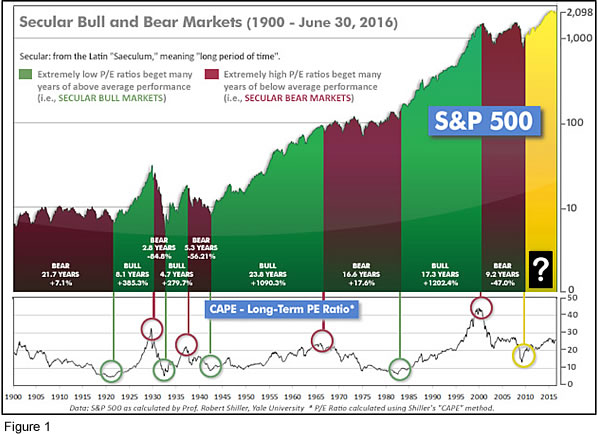

Submitted by The Blakeley Group, Inc. on August 4th, 2016The very big picture: In the "decades" timeframe, the question of whether we are in a continuing Secular Bear Market that began in 2000 or in a new Secular Bull Market has been the subject of hot debate among economists and market watchers since 2013, when the Dow and S&P 500 exceeded their 2000 and 2007 highs. The Bear proponents point out that the long-term PE ratio (called “CAPE”, for Cyclically-Adjusted Price to Earnings ratio), which has done a historically great job of marking tops and bottoms of Secular Bulls and Secular Bears, did not get down to the single-digit range that has marked the end of Bear Markets for a hundred years, but the Bull proponents say that significantly higher new highs are de-facto evidence of a Secular Bull, regardless of the CAPE. Further confusing the question, the CAPE now has risen to levels that have marked the end of Bull Markets except for times of full-blown market manias. See Fig. 1 for the 100-year view of Secular Bulls and Bears.

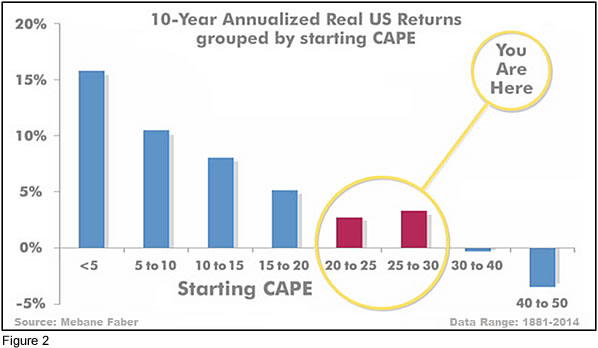

Even if we are in a new Secular Bull Market, market history says future returns are likely to be modest at best. The CAPE is at 26.95, nearly unchanged from the prior week’s 26.96, after having earlier reached the level also reached at the pre-crash high in October, 2007. Since 1881, the average annual return for all ten year periods that began with a CAPE around this level have been just 3%/yr (see Fig. 2).

This further means that above-average returns will be much more likely to come from the active management of portfolios than from passive buy-and-hold. Although a mania could come along and cause the CAPE to shoot upward from current levels (such as happened in the late 1920’s and the late 1990’s), in the absence of such a mania, buy-and-hold investors will likely have a long wait until the arrival of returns more typical of a rip-snorting Secular Bull Market.

In the big picture:

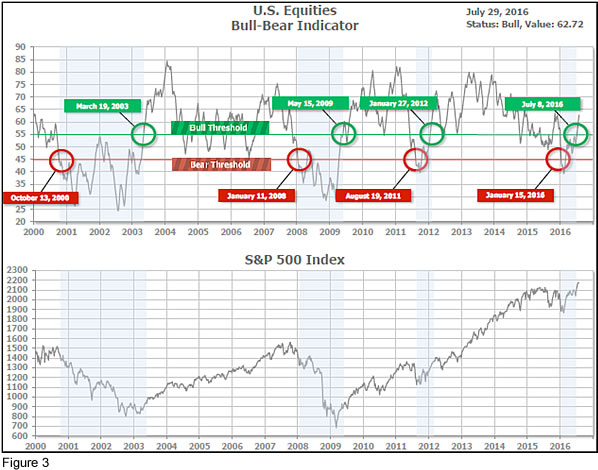

The “big picture” is the months-to-years timeframe – the timeframe in which Cyclical Bulls and Bears operate. The U.S. Bull-Bear Indicator (see Fig. 3) is in Cyclical Bull territory at 62.72, up from the prior week’s 60.39.

In the intermediate picture:

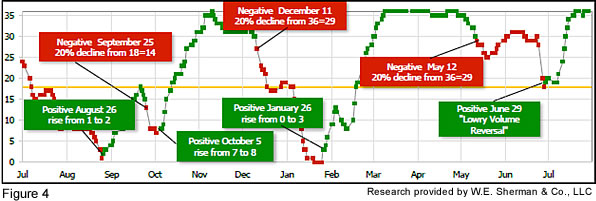

The Intermediate (weeks to months) Indicator (see Fig. 4) turned positive on June 29th. The indicator ended the week at 36 (the maximum value), unchanged from the prior week. Separately, the Quarterly Trend Indicator - based on domestic and international stock trend status at the start of each quarter - gave a positive indication on the first day of July for the prospects for the third quarter of 2016.

Timeframe summary:

In the Secular (years to decades) timeframe (Figs. 1 & 2), whether we are in a new Secular Bull or still in the Secular Bear, the long-term valuation of the market is simply too high to sustain rip-roaring multi-year returns. The Bull-Bear Indicator (months to years) is positive (Fig. 3), indicating a potential uptrend in the longer timeframe. The Quarterly Trend Indicator (months to quarters) is positive for Q3, and the Intermediate (weeks to months) timeframe (Fig. 4) is also positive. Therefore, with all three indicators positive, the U.S. equity markets are rated as Very Positive.

In the markets:

The U.S. major indexes finished the week mixed. The large cap indexes were flat to modestly lower, while the NASDAQ and smaller-cap indexes notched a fifth consecutive week of gains. The Dow Jones Industrial Average declined ‑138 points to 18,432, down -0.75%, while the NASDAQ composite rose +1.22% to end the week at 5,162. The LargeCap S&P 500 index was down fractionally, -0.07%, while MidCaps and SmallCaps rose +0.46% and +0.58% respectively. The S&P MidCap 400 moved further into record territory, and is the best performer year to date. The NASDAQ was the biggest gainer of the week, helped by strong earnings reports from Google (aka “Alphabet”) and Amazon.

In international markets, Canada’s TSX and the United Kingdom’s FTSE declined only slightly, down -0.12% and ‑0.09%, respectively. On Europe’s mainland, France’s CAC 40 rose +1.34% and Germany’s DAX was even stronger at +1.87%. Asian markets were down across the board, but not greatly. China’s Shanghai stock exchange was off -1.11%, Hong Kong’s Hang Seng index fell -0.33%, and Japan’s Nikkei declined -0.35%.

In commodities, precious metals regained some luster as Gold rose +$34.50 an ounce to $1,357.90, up +2.61%. Silver joined gold in the plus column, rising +$0.66 to $20.35, up +3.34%. Oil, though, had a difficult week, declining -$2.59 to $41.60 for a barrel of West Texas Intermediate crude oil, down -5.86%.

July was a very good month for all major markets domestically and foreign. Oil was among the very few minuses, losing -14.38% for the month. The NASDAQ Composite led the parade of US gainers at +6.60%, followed by the SmallCap Russell 2000 at +5.90%. The LargeCap S&P 500 was no slouch, at +3.56%, likewise the Dow at +3.68%. Developed International markets as a group gained +3.98% (EFA), behind Emerging International’s very good +5.38% (EEM).

In U.S. economic news, the number of Americans filing for unemployment benefits rose slightly to a seasonally-adjusted 266,000 last week, according to the Labor Department. Economists had forecast a rise of 260,000. Claims have remained below 300,000, the threshold associated with a healthy labor market, for 73 consecutive weeks. The smoothed 4-week average of claims, considered a better measure as it irons out week-to-week volatility, fell 1,000 to 265,500—the lowest level since April.

The Case-Shiller National Home Price index for May declined to 5.2% from 5.4%, missing consensus forecasts by 0.1%. On an annual basis, home prices remained at a +5% rate of growth. Analysts suggest that low long-term interest rates will continue to support the housing market, but there is some evidence that prices may be reaching levels that average homebuyers will find out of reach. Portland continued to see the biggest annual increase, up +12.5%. Seattle and Denver rounded out the top three, up +10.7% and +9.5%, respectively. David Blitzer, managing director of the index committee at S&P Dow Jones Indices, noted that regional patterns are shifting. The Pacific Northwest is now booming, and has overtaken the previously strongest areas of Los Angeles, San Diego and San Francisco.

New-home sales rose to a seven year high, signaling continued robust demand in the housing market. June new-home sales rose by +3.5% to a seasonally adjusted annual rate of 592,000, according to the Commerce Department. It was the strongest reading since February 2008 and beat forecasts by 32,000. The median price jumped to $306,700 last month, 6% higher than this time last year. Supply fell to a 4.9 month supply of homes at the current sales pace. Lawrence Yun, the chief economist of the National Association of Realtors, warned than an inadequate supply of homes for sale is frustrating prospective buyers. Regionally, sales weakened slightly in the Northeast and South, but surged by more than +10% in the West and Midwest.

The Conference Board reported that consumer confidence was little changed this month, coming in at 97.3, down ‑0.1 point. Economists had expected the index to fall further, to 95.5. Lynn Franco, director of economic indicators at the Conference Board stated “consumers were slightly more positive about current business and labor market conditions, suggesting the economy will continue to expand at a moderate pace.”

Like the Conference Board report, consumers’ attitudes weakened slightly according to the University of Michigan’s Consumer Sentiment survey. The index hit 90, slightly lower than expectations and down ‑3.5 from June’s final reading. The monthly survey of 500 consumers measures attitudes toward topics like personal finances, inflation, unemployment, government policies and interest rates. Richard Curtin, the survey’s chief economist, cited increasing concern among upper income households about economic prospects and lingering worries about Britain’s decision to leave the European Union.

Activity in the U.S. service sector declined slightly, according to an early read of the services portion of July’s Purchasing Managers Index (PMI) of 50.9, down -0.5 from June. Expectations had been for a reading of 51.2. While the services sector rose at a weaker pace, the composite services + manufacturing index improved to 51.5, up +0.3 point, indicating a modest pickup in the rate of output growth.

Durable goods orders fell -4% in June, the steepest drop in almost 2 years and the second straight month of negative readings. Analysts had expected a -1.7% decline. Durable goods are those which are expected to last 3 years or longer and serve as a good barometer for large capital expenditures and therefore the overall health of the U.S. economy. Even after removing the volatile transportation component, durable goods orders still fell ‑0.5%.

U.S. GDP grew at a disappointing 1.2% annualized rate in the second quarter, according to the Commerce Department—far below economists’ expectations. Economic growth is now tracking at a 1% rate of growth in 2016, the weakest since 2011. Since the end of the recession, the average annual growth rate has been 2.1%, the weakest pace of any expansion since 1949. Gregory Daco, economist at Oxford Economics stated “Consumer spending growth was the sole element of good news…weakness in business investment is an important and lingering growth constraint.” Business investment fell -2.2%, its third consecutive quarterly decline.

On Wednesday, the Federal Reserve left interest rates on hold as expected, but did state that a September Fed Funds rate increase could still be on the table. According to the statement, near-term economic risks to the economy have diminished and the committee will continue to closely monitor inflation indicators and global and economic developments. “Information received since the Fed policy committee in June indicates that the labor market strengthened and that economic activity has been expanding at a moderate rate,” the Fed reported. Kansas City Fed President Esther George, who was in favor of an immediate rate hike, was the lone dissenter.

In international economic news, Canada’s GDP shrank by -0.6% in May, the worst monthly GDP figure since March 2009. Wildfires in Alberta and a slowdown in manufacturing contributed to the decline, according to Statistics Canada. Non-conventional oil and gas extraction declined by -22% due to the Fort McMurray fires. Output from the western oilsands fields is now at its lowest level since May 2011.

In the United Kingdom, government bond yields fell to new lows as expectations increased that the Bank of England will cut interest rates at its monetary policy meeting on August 4 and possibly restart quantitative easing. On Friday, the yield on the benchmark 10-year U.K. government bond was 0.74% while the 10-year note in the U.S. is about double that, at 1.45%.

European Union bank stocks rose at the end of the week in anticipation of the forthcoming results from stress tests for 51 lenders across the European Union. The European Banking Authority will publish the results this weekend. Across the Eurozone, second quarter GDP slowed to 1.2%, down -1% according to EU statistics agency Eurostat. However, the pace of growth was 0.3% higher when compared to the first quarter.

French economic growth unexpectedly ground to a halt, recording no growth in the second quarter according to Insee, the French national statistics agency. Finance Minister Michel Sapin understatedly said “second-quarter growth is disappointing given the forecasts.” French household spending recorded no growth in the second quarter and investing fell 0.4%.

The German DAX was the latest index to recoup all of its losses since the Brexit vote. German unemployment continued to decline—an indication that Europe’s largest economy is showing resilience despite the Brexit vote. The number of people out of work declined 7,000 to 2.682 million according to the Federal Labor Agency in Nuremburg. The jobless rate remained at a record low 4.2%.

In Japan, all eyes were on the Bank of Japan, but the results were less than anticipated. The BOJ decided to ease its monetary policy by expanding its purchases of securities, increasing its purchases to 6 trillion yen from 3.3 trillion per year. Interest rates and its monetary base were unchanged.

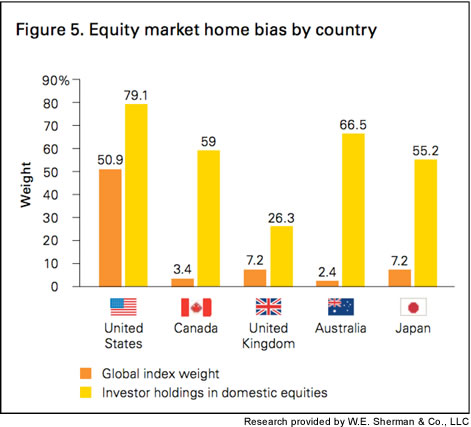

Finally, mutual fund giant Vanguard recently released a report entitled The Global Case for Strategic Asset Allocation and an Examination of Home Bias. Home bias is the tendency of a nation’s investors to invest the majority of their assets in their own nation’s equities regardless of how much or how little their own home nation represents as a % of total global assets. In the report, summarized in the chart below, Vanguard notes that U.S. stocks make up 50.9% of global market capitalization, but U.S. investors have an average of 79.1% of their equity holdings in American stocks - an apparent “overweighting” of American equities relative to the rest of the world. But Americans are nowhere near the most imbalanced. Canadians, for example, are much more imbalanced, having over 59% of their assets invested in Canada while Canada comprises only 3.4% of global market cap, and Australians are the worst by this measure, having over 66.5% of their assets invested in Australia, which is only 2.4% of global market cap!

(sources: all index return data from Yahoo Finance; Reuters, Barron’s, Wall St Journal, Bloomberg.com, ft.com, guggenheimpartners.com, ritholtz.com, markit.com, financialpost.com, Eurostat, Statistics Can

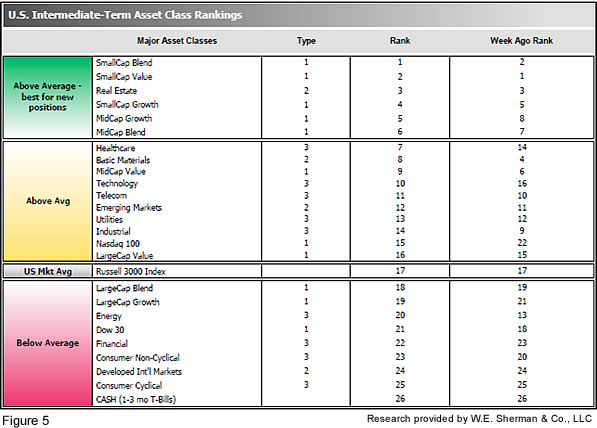

ada, Yahoo! Finance, stocksandnews.com, marketwatch.com, wantchinatimes.com, BBC, 361capital.com, pensionpartners.com, cnbc.com, FactSet; Figs 1-5 source W E Sherman & Co, LLC) XX The ranking relationship (shown in Fig. 5) between the defensive SHUT sectors ("S"=Staples [a.k.a. consumer non-cyclical], "H"=Healthcare, "U"=Utilities and "T"=Telecom) and the offensive DIME sectors ("D"=Discretionary [a.k.a. Consumer Cyclical], "I"=Industrial, "M"=Materials, "E"=Energy), is one way to gauge institutional investor sentiment in the market. The average ranking of Defensive SHUT sectors rose to 13.5, up from the prior week’s 14, while the average ranking of Offensive DIME sectors fell to 16.8 from the prior week’s 12.8. The Offensive DIME sectors have lost their lead over the Defensive SHUT sectors. Note: these are “ranks”, not “scores”, so smaller numbers are higher ranks and larger numbers are lower ranks. (sources: all index return data from Yahoo Finance; Reuters, Barron’s, Wall St Journal, Bloomberg.com, ft.com, guggenheimpartners.com, ritholtz.com, markit.com, financialpost.com, Eurostat, Statistics Canada, Yahoo! Finance, stocksandnews.com, marketwatch.com, wantchinatimes.com, BBC, 361capital.com, pensionpartners.com, cnbc.com, FactSet; Figs 1-5 source W E Sherman & Co, LLC) The ranking relationship (shown in Fig. 5) between the defensive SHUT sectors ("S"=Staples [a.k.a. consumer non-cyclical], "H"=Healthcare, "U"=Utilities and "T"=Telecom) and the offensive DIME sectors ("D"=Discretionary [a.k.a. Consumer Cyclical], "I"=Industrial, "M"=Materials, "E"=Energy), is one way to gauge institutional investor sentiment in the market. The average ranking of Defensive SHUT sectors rose to 13.5, up from the prior week’s 14, while the average ranking of Offensive DIME sectors fell to 16.8 from the prior week’s 12.8. The Offensive DIME sectors have lost their lead over the Defensive SHUT sectors. Note: these are “ranks”, not “scores”, so smaller numbers are higher ranks and larger numbers are lower ranks.