August 2015 Special Edition: China’s Economic Slowdown

Submitted by The Blakeley Group, Inc. on August 24th, 2015NOTE: Areas with blue text show the most recent market updates since the August 6th Capital Highlights email.

The very big picture:

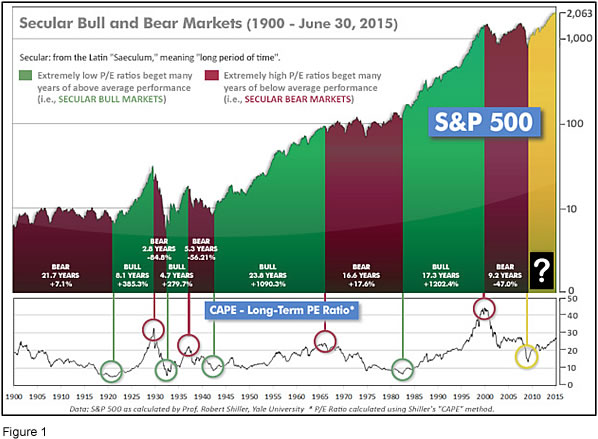

In the “decades” timeframe, the question of whether we are in a continuing Secular Bear Market that began in 2000 or in a new Secular Bull Market has been the subject of hot debate among economists and market watchers since 2013, when the Dow and S&P 500 exceeded their 2000 and 2007 highs. The Bear proponents point out that the long-term PE ratio (called “CAPE”, for Cyclically-Adjusted Price to Earnings ratio), which has done a historically great job of marking tops and bottoms of Secular Bulls and Secular Bears, did not get down to the single-digit range that has marked the end of Bear Markets for a hundred years, but the Bull proponents say that significantly higher new highs are de-facto evidence of a Secular Bull, regardless of the CAPE. Further confusing the question, the CAPE now has risen to levels that have marked the end of Bull Markets except for times of full-blown market manias. See Fig. 1 for the 100-year view of Secular Bulls and Bears.

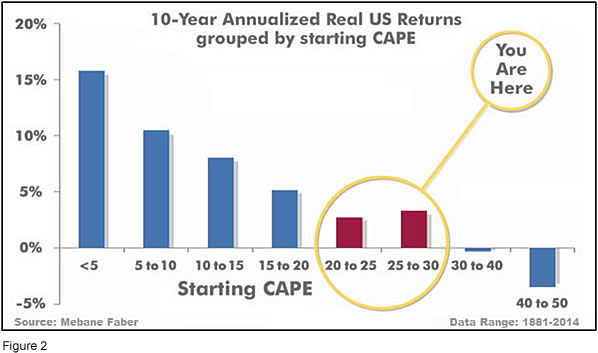

Even if we are in a new Secular Bull Market, market history says future returns are likely to be modest at best. The CAPE is at 25.0, down from the prior week’s 26.5, and approximately at the level reached at the pre-crash high in October, 2007. In fact, since 1881, the average annual returns for all ten year periods that began with a CAPE at this level have been just 3%/yr (see Fig. 2). (Note: all P/E references are to the Shiller P/E values, sometimes called PE10 or CAPE, which are calculated so as to remove shorter-term fluctuations; see robertshiller.com for details).

This further means that above-average returns will be much more likely to come from the active management of portfolios than from passive buy-and-hold. Although a mania could come along and cause the CAPE to shoot upward from current levels (such as happened in the late 1920’s and the late 1990’s), in the absence of such a mania, buy-and-hold investors will likely have a long wait until the arrival of returns more typical of a rip-snorting Secular Bull Market.

In the big picture:

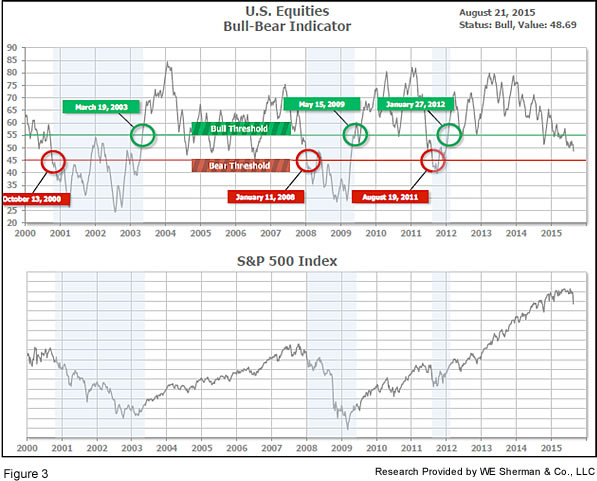

The “big picture” is the months-to-years timeframe – the timeframe in which Cyclical Bulls and Bears operate. The US Bull-Bear Indicator (see Fig. 3) is at 48.69, down substantially from the prior week’s 51.47, and continues in Cyclical Bull territory. The current Cyclical Bull has taken the US and some of Europe to new all-time highs, but many of the world’s major indices have yet to top 2007’s levels – particularly in the Emerging Markets area.

In the intermediate picture:

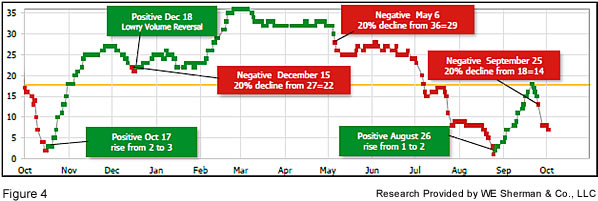

The intermediate (weeks to months) indicator (see Fig. 4) is Positive and ended the week at 5, down from the prior week’s 8. Separately, the quarter-by-quarter indicator – based on domestic and international stock trend status at the start of each quarter – gave a positive indication on the first day of July for the prospects for the fourth quarter of 2015.

Timeframe summary:

In the Secular (years to decades) timeframe (Figs. 1 & 2), whether we are in a new Secular Bull or still in the Secular Bear, the long-term valuation of the market is simply too high to sustain rip-roaring multi-year returns. In the Cyclical (months to years) timeframe (Fig. 3), all major equity markets are in Cyclical Bull territory. In the Intermediate (weeks to months) timeframe (Fig. 4), US equity markets are again rated as Positive. The quarter-by-quarter indicator gave a positive signal for the 3rd quarter: US equities were in an uptrend at the start of Q3 2015, sufficient to signal a higher likelihood of an up quarter than a down quarter.

In the markets:

Major indexes around the world experienced their largest weekly declines since 2011 as concerns grew that China’s economic slowdown would weigh heavily on global growth and commodity prices. A plunge in some emerging market currencies also raised fears of a global round of competitive devaluations. Nations devaluing their currencies against each other could cut deeper into the profits and competitiveness of U.S. multinational companies. All of the major benchmarks are now negative year to date. The Dow Jones Industrial Average and SmallCap Russell 2000 have both declined over 10% from their peaks, putting them into what is commonly considered “correction” territory.

For the week, the Dow Jones Industrial Average lost a whopping 1017 points to close at 16459. The tech heavy Nasdaq lost the psychologically-important 5000 level, losing 342 points to 4706. The S&P 500 LargeCap index declined -5.77% for the week and the small cap Russell 2000 gave up -4.61%. It is noteworthy that the SmallCap Russell 2000 lost less than the LargeCap S&P 500, since the higher-volatility SmallCaps normally lead to the downside during market declines, perhaps due to the perception that SmallCaps have less dependency on China and other international trouble spots than their larger brethren. Canada’s TSX shed -5.63%, down for the third week in a row.

A broad sweep of international markets also showed weakness. Developed International gave up -6.38%, Emerging Markets plunged over -7.8%. Northern European markets were not immune: the United Kingdom’s FTSE dropped -5.54%; Germany’s DAX Composite plunged -7.83%; France’s CAC 40 likewise dropped -6.57%. In Asia, China’s Shanghai Composite index got the booby prize for the worst performing major market, collapsing ‑11.54%, while Japan’s Nikkei dropped -5.28%.

In commodities, an ounce of Gold jumped +4.2% to $1159.90 an ounce. Silver’s rise was more tepid, a gain of only $0.10 to $15.32 an ounce. Crude oil had its tenth straight week of declines, giving up over -4.48% for the week. A barrel of crude oil is hovering just above $40 at $40.29 a barrel, and now is back to levels last seen in the depths of the Great Recession in 2009.

In US economic news, the housing market was the source of the majority of the good news reported during the week. Home builder sentiment continued to improve as the National Association of Home Builders index rose to 61 from 60—the highest since 2005. Future sales outlook weakened slightly but remained strong at 70, while the “current conditions” index remained unchanged at 66. Housing starts neared an 8-year high, now running at a pace of 1.206 million units/yr in July, nicely beating expectations. This pace has not been seen since just before the Great Recession began. The National Association of Realtors reported that new and existing home sales jumped +2% in July to a pace of 5.59 million, beating expectations. It was the highest since February 2007, and was +10.3% higher than a year ago. The median price was +5.6% higher versus a year ago in July.

The Consumer Price Index (CPI) rose just +0.1% in July, missing expectations of a +0.2% gain. For the year, the index stands just 0.2% higher. Core inflation, which strips out food and energy, also rose just 0.1% during the month, but is up 1.8% versus a year ago, much nearer to the Federal Reserve’s 2% target.

Manufacturing in the United States slowed in August as Markit’s flash Purchasing Managers Index (PMI) showed the slowest improvement in business conditions in nearly 2 years, falling nearly a point to 52.9. Output growth drove the decline, but production volumes were also weak. According to the survey a stronger dollar was weighing on exports, and China’s weaker yuan is expected to further worsen the situation.

In minutes released of the July 28-29 Federal Reserve’s Open Market Committee session, Federal Reserve officials said last that while conditions for raising interest rates were approaching, they saw more room for labor market improvement and need more confidence that inflation is moving toward their goal. Most meeting participants “judged that the conditions for policy firming had not yet been achieved, but they noted that conditions were approaching that point.” However, St. Louis Fed President James Bullard told MNI News that he will argue for a September rate hike at the central bank’s upcoming meeting. Bullard said he isn’t concerned that inflation and wages remained below Fed targets, but does fear financial bubbles as the Fed keeps interest rates at record lows.

In Canada, core inflation in the central bank’s measure was at a rate of 2.4% in July, matching expectations. The Bank of Canada targets inflation at 1% to 3%. Separately, retail sales rose +0.6% during June and were up +1.4% versus a year ago.

Good trade numbers headlined Eurozone economic news during the week. Exports rose +12% in June versus this time last year, thanks to a weaker Euro. Imports were also up by +7%. The trade balance increased to €21.9 billion from €21.3 billion. Trade with member countries was up +10% versus year ago, indicating stronger economic activity. Markit’s composite PMI for the Eurozone rose +0.2 point to 54.1, one of the strongest readings in the last two years. Overall, new business ran at the fastest pace since May. Output accelerated in Germany and confidence increased in France.

In China, fears of a “hard landing” may become a reality. The Markit manufacturing PMI index dropped to a 77-month low of 47.1 in August. The manufacturing output index declined to 46.6, a 45-month low. Nearly all categories decreased at faster rates than prior months.

Brazil’s economic news has gone from bad to worse. Economic activity declined more than expected in June. The central bank’s economic activity seasonally adjusted index fell over half a percent. Analysts expect the economy to contract -2% in 2015. Unlike counterparts elsewhere round the world, the Brazilian central bank is not stimulating the economy with cheaper money – instead, it is keeping the Brazilian benchmark interest rate at 14.25% to combat inflation. This is every central banker’s nightmare scenario – stagflation.

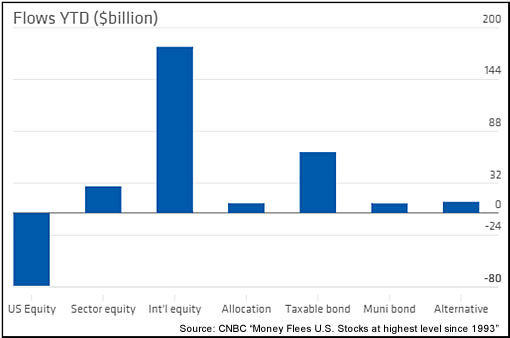

Finally, we highlight the flight of investor money from U.S. stock funds, which some say is actually more of a “stampede”. According to a recent CNBC article, this year $78.7 billion has left domestic equity-focused funds according to fund researcher Morningstar. Domestic equity funds gave up $20.4 billion in July alone, and over $158 billion in the past 12 months – a higher outflow than in the Great Recession of 2008-2009. Analysts are unable to point out the exact cause as, up until this past week, the market hasn’t performed all that poorly.

Analysts speculate that investors believe the United States is nearing the end of its six and half year bull market, and that globally, internationals are cheaper on a fundamental level. It is believed that investors think that Japan and Europe are at different points of their economic cycles and that they are still actively stimulating their economies. International equity funds have indeed garnered much of that outflow, depicted in the graph below:

(sources: Reuters, Barron’s, Wall St Journal, Bloomberg.com, ft.com, guggenheimpartners.com, ritholtz.com, markit.com, financialpost.com, Eurostat, Statistics Canada, Yahoo! Finance, stocksandnews.com, marketwatch.com, wantchinatimes.com, BBC, 361capital.com, pensionpartners.com, cnbc.com; Figs 3-5 source W E Sherman & Co, LLC)

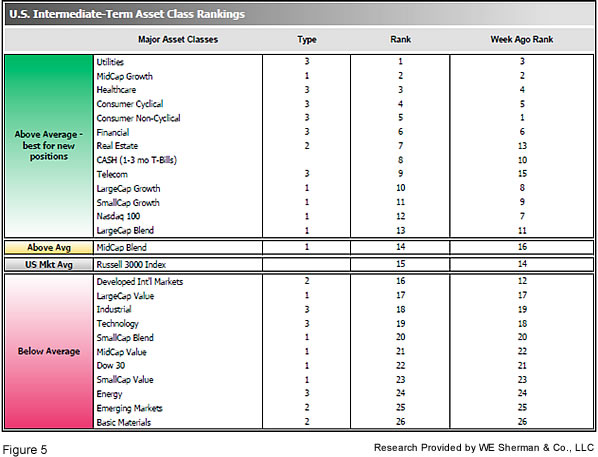

The ranking relationship (shown in Fig. 5) between the defensive SHUT sectors (“S”=Staples [a.k.a. consumer non-cyclical], “H”=Healthcare, “U”=Utilities and “T”=Telecom) and the offensive DIME sectors (“D”=Discretionary [a.k.a. Consumer Cyclical], “I”=Industrial, “M”=Materials, “E”=Energy), is one way to gauge institutional investor sentiment in the market.

The average ranking of Defensive SHUT sectors rose again to 4.5 from the prior week’s 5.5, while the average ranking of Offensive DIME sectors rose slightly to 18.0 from the prior week’s 18.5. The Defensive SHUT sectors have maintained their lead in rankings over the Offensive DIME sectors. Note: these are “ranks”, not “scores”, so smaller numbers are higher ranks and larger numbers are lower ranks.

Summary:

The US has led the worldwide recovery, and continues to be among the strongest of global markets. However, the over-arching Secular Bear Market may remain in place globally even as new highs are reached in the US.

Because the world may still be in a Secular Bear, we have no expectations of runs of multiple double-digit consecutive years, and we expect poor market conditions to be a frequent occurrence. Nonetheless, we remain completely open to any eventuality that the market brings, and our strategies, tactics and tools will help us to successfully navigate whatever happens.